NWPX Infrastructure (NWPX) Delivers 23.9% Profit Growth, Challenging Cautious Market Narratives

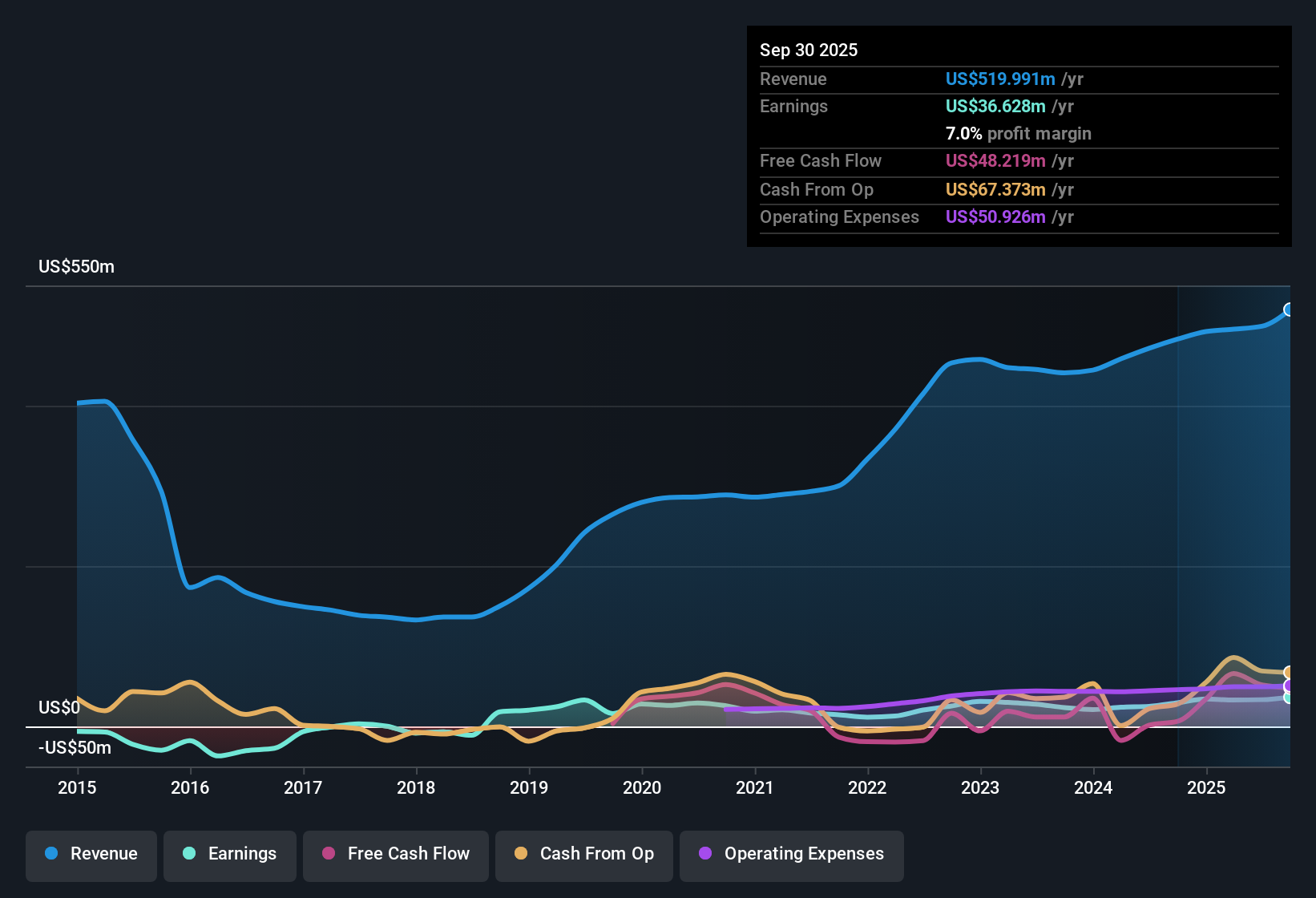

NWPX Infrastructure (NWPX) posted robust numbers this quarter, with earnings climbing 23.9% year-over-year and net profit margins rising to 7% from 6.1%. This growth capstone comes as the company extends its five-year streak of 13.8% annual earnings growth, all while trading at a notably lower price-to-earnings ratio of 14.9x compared to the US Construction industry average of 35.4x. With shares at $56.47, well below the estimated fair value of $73.57, investors now balance attractive valuation signals against a cautious outlook for declining earnings and slow revenue growth ahead.

See our full analysis for NWPX Infrastructure.With the latest earnings figures in hand, it is time to see how they align with the key market narratives. Some expectations might be confirmed, while others could be up for a rethink.

See what the community is saying about NWPX Infrastructure

Margins Steady as Backlog Climbs

- NWPX Infrastructure’s backlog surged by 20% sequentially to $348 million, reinforcing a solid base of future revenue despite analysts forecasting a slowdown to 1.6% annual revenue growth.

- The consensus narrative notes that while the company’s robust order pipeline and resilient demand in its Water Transmission Systems and Precast segments underscore long-term support for margins, analysts expect net profit margins to shrink from 6.7% today to 6.0% over three years.

- This tension between a healthy backlog and forecasted margin pressure highlights the risk of squeezing profits even as underlying demand looks resilient.

- Analysts caution that strong current results may not be fully sustainable if headwinds such as rising capital costs and shifts toward substitute materials begin to weigh on future bids and profitability.

Share Repurchases Offset Soft Earnings Outlook

- Analysts expect the number of shares outstanding to decline by 2.67% per year for the next three years, providing some EPS support as absolute earnings are forecast to fall by 1.1% yearly.

- According to the consensus narrative, ongoing buybacks and a healthy balance sheet help blunt the impact of soft near-term growth by supporting per-share metrics and keeping shareholder returns more stable than headline earnings might suggest.

- Still, bears warn that this cushion may only partially offset the effect of flattish top-line momentum and potential municipal funding volatility on the company’s long-term EPS trend.

- The narrative highlights that while repurchases are positive, overreliance could limit flexibility if macro or industry headwinds intensify.

Valuation Gap Versus Peers Widens

- Shares trade at 14.9x earnings, notably below the US Construction industry average of 35.4x and the peer average of 31.9x, with the current price of $56.47 also sitting well below the DCF fair value estimate of $73.57.

- The consensus narrative points out this substantial discount could reflect investor unease with slow growth prospects. However, analysts are split, with a price target of 59.67 representing only modest upside from the current level, despite the wide gap to fair value.

- This suggests the market may be factoring in longer-term risks around government funding, substitute materials, and earnings contraction more heavily than analysts.

- Bullish investors will watch closely to see if NWPX’s disciplined capital allocation and strong execution start to close the gap relative to sector peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for NWPX Infrastructure on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these results? You can build your own data-driven story and share your view in just a few minutes. Do it your way

A great starting point for your NWPX Infrastructure research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

NWPX Infrastructure faces headwinds from forecasted earnings declines and slow top-line momentum, with analysts expecting only limited upside due to weak growth.

If you’re looking for more reliable expansion, focus on companies maintaining consistent results through market cycles by starting with our stable growth stocks screener (2111 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com