TAL Education Group (NYSE:TAL) Margin Gains Challenge High-Valuation Concerns

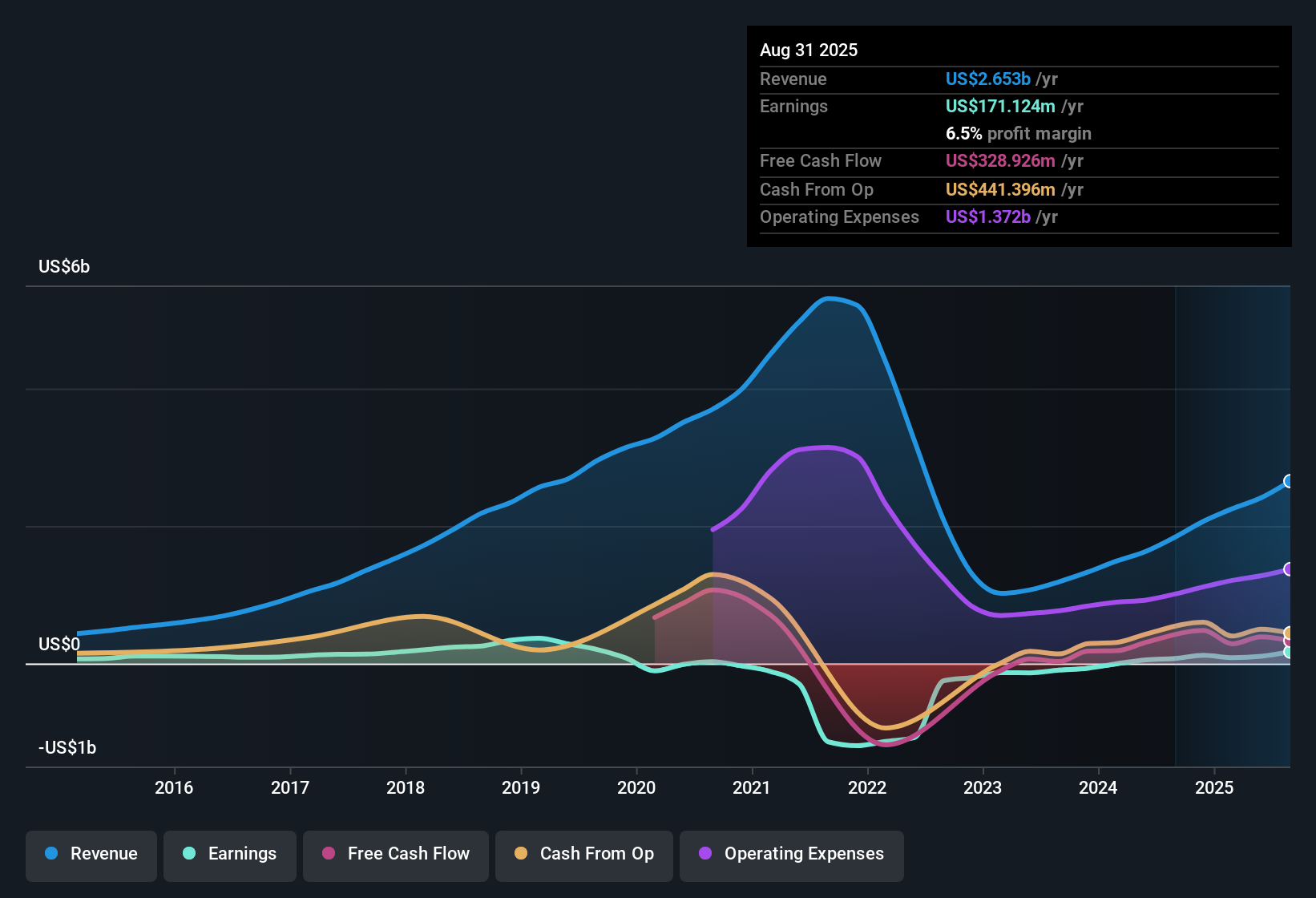

TAL Education Group (NYSE:TAL) delivered net profit margins of 6.5%, up from 3.9% a year ago, while annual earnings growth soared to 136.4%, far surpassing its five-year average of 47.9% per year. Analysts now expect earnings to grow at 24% annually and revenues at 17.2% per year, both comfortably ahead of US market averages of 15.9% for earnings and 10.3% for revenues. With margins improving and profit momentum outpacing the broader market, TAL appears to be firmly establishing itself as a high-quality earnings story.

See our full analysis for TAL Education Group.Next up, we will see how these headline results compare with the key narratives surrounding TAL, and where investor stories might shift in response.

See what the community is saying about TAL Education Group

DCF Fair Value Shows Major Gap

- TAL’s DCF fair value is $31.44 per share, significantly above the current share price of $12.26. Most analysts assign a consensus price target of $13.96, reflecting skepticism about whether current growth rates and profitability can be sustained long enough to justify such a premium valuation.

- According to the analysts' consensus view,

- The projected increase in annual revenues to $4.5 billion and earnings of $395.9 million by 2028 would imply a future PE ratio of 24.7x, still well above the US Consumer Services industry average of 18.6x. Consensus remains cautious about re-rating upside until delivery and market conditions improve, even in light of strong reported margins.

- Despite trading well below DCF fair value, the industry and peer set multiples continue to limit immediate price upgrades. This highlights the importance of monitoring for volatility if the optimistic scenario does not materialize.

Amplified Growth, But Margin Pressure Ahead

- The EDGAR summary shows analysts expect TAL’s revenue to rise 17.2% annually and profit margins to climb from 4.3% today to 8.9% in three years. The learning device segment is currently operating at a non-GAAP loss and still faces heavy marketing spend, highlighting near-term profitability challenges despite the overall growth picture.

- Consensus narrative notes that

- Diversification into online enrichment, STEAM, and AI-powered products is intended to increase resilience and customer retention. However, growing competition and continued high cost investment in devices are likely to pressure margins and earnings, regardless of broader topline momentum.

- TAL’s increased brand spending and channel expansion could boost its market share over the longer run, which means operating leverage may eventually support wider margins. This outcome depends on whether high levels of investment begin to pay off.

Valuation Premium Versus Peers and Sector

- TAL trades at a price-to-earnings ratio of 43.6x, well above its industry average of 18.4x and peer group average of 20.2x. This signals that the market continues to price in significant growth and margin improvement ahead despite recent profitability gains.

- According to analysts' consensus,

- The wide valuation spread may be justified if TAL hits its growth targets, but any earnings or revenue disappointment will place the current valuation at risk, especially as sector multiples remain much lower.

- The key issue is that while TAL trades at a deep discount to its DCF fair value, such a large premium to industry averages requires near-flawless execution to support future price appreciation.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for TAL Education Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Not interpreting the results the same way? Add your perspective and shape your personal narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding TAL Education Group.

See What Else Is Out There

Despite robust revenue growth, TAL’s premium valuation leaves little room for error. This exposes investors to downside if earnings momentum falters or margins remain pressured.

If you want more confidence in future returns, use stable growth stocks screener (2103 results) to focus on companies with reliable earnings and consistent top-line expansion through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com