TAL Education Group (NYSE:TAL): Evaluating Valuation After Strong Q2 Growth and $600 Million Buyback Program

TAL Education Group (NYSE:TAL) just released earnings for its fiscal second quarter, announcing revenue and net income growth, with results powered by enrichment learning programs and new AI-based devices. Operating income more than doubled from last year.

See our latest analysis for TAL Education Group.

TAL Education Group’s strong quarter comes alongside a recently completed $134.7 million buyback, signaling real confidence from management. Yet after the upbeat revenue report, the share price pulled back 5% in a day and is down 2.7% this week. The year-to-date share price return remains a healthy 25%. With a 3-year total shareholder return of 125%, the stock’s long-term momentum shows staying power. Recent volatility is a reminder that valuations and expectations are in flux.

If this shift in momentum has you curious about what else is moving, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares pulling back despite stellar quarterly growth and a major buyback, investors are left weighing whether TAL is now trading at a relative discount or if the current price already reflects expectations for future outperformance.

Most Popular Narrative: 12.1% Undervalued

TAL Education Group’s most widely followed valuation narrative points to a fair value moderately above the recent market close, suggesting current levels may present an opportunity. The gap between the fair value and traded price is creating debate on whether this discount is sustainable as expectations shift.

Diversification into online enrichment, STEAM, and AI-driven learning devices alongside disciplined expansion of offline centers lessens regulatory risk concentration and creates multiple growth engines. This underpins more resilient and broad-based revenue streams.

What is powering this upside? The narrative’s pricing hinges on bold forecasts for future revenue streams and margins, blending disruptive tech bets with traditional learning. Curious about the big assumption that sets this estimate apart? Peel back the layers to uncover which driver is fueling the fair value math and see what has analysts split.

Result: Fair Value of $13.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, momentum could falter if K-12 growth slows or if the learning device segment continues to lose money, which could pressure earnings and investor optimism.

Find out about the key risks to this TAL Education Group narrative.

Another View: Are Valuations Getting Ahead of Fundamentals?

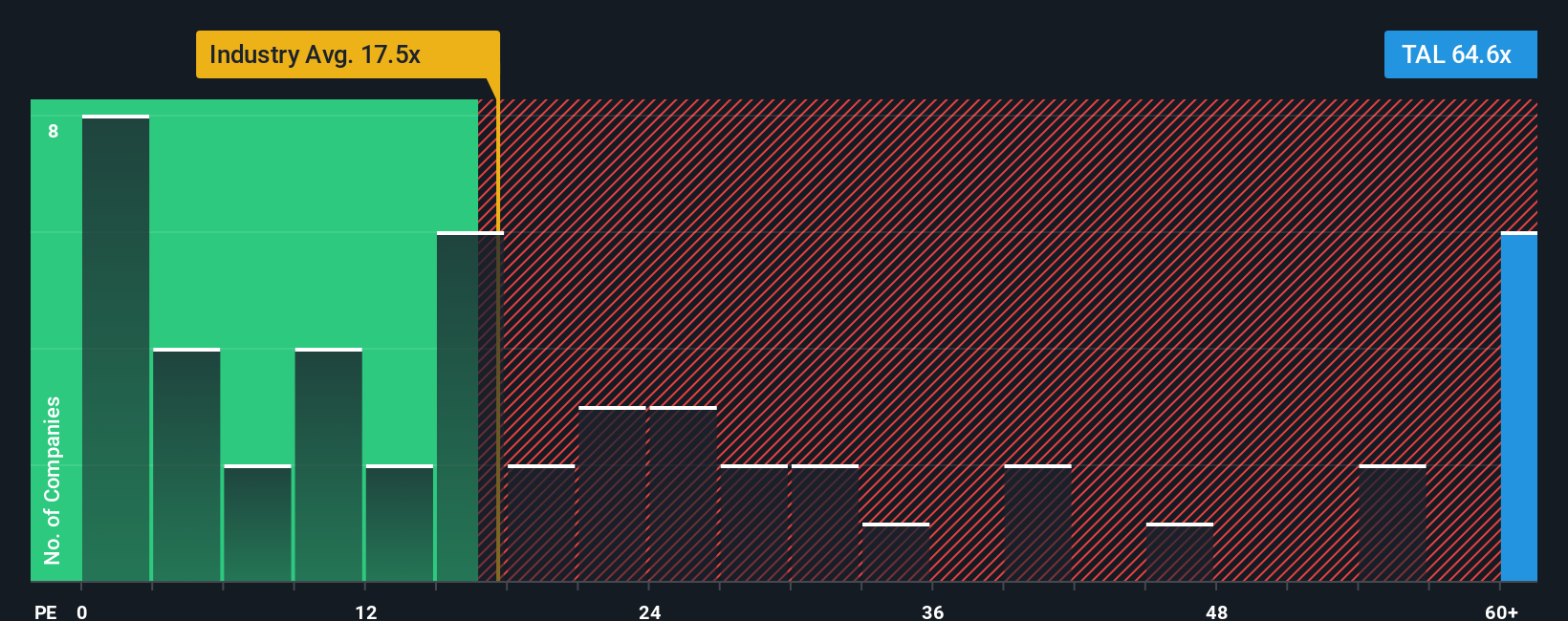

While analysts see upside in TAL’s fair value, a look at its price-to-earnings ratio offers another perspective. The stock trades at 43.6 times earnings, well above the US Consumer Services industry average of 18.8x and a fair ratio of 28.6x. This wide gap hints at valuation risk if expectations slip. Is this premium justified, or are buyers betting too much on future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TAL Education Group Narrative

If you see the story differently or want to test your own assumptions, you can dig into the data and craft your perspective in just minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding TAL Education Group.

Looking for More Investment Ideas?

Smart investors never limit their vision to a single stock. Unlock your potential and act now to stay ahead with new opportunities that could redefine your portfolio.

- Uncover high potential growth by starting with these 26 AI penny stocks, which put artificial intelligence at the core of their strategy and are redefining entire industries.

- Capture reliable passive income by checking out these 22 dividend stocks with yields > 3%, which boast attractive yields that can boost returns even when markets fluctuate.

- Ride the next tech breakthrough by taking a closer look at these 28 quantum computing stocks, which pursue advancements in quantum computing and next-level performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com