Record Gross Profit Amid Margin Gains Could Be a Game Changer for PC Connection (CNXN)

- On October 29, 2025, PC Connection reported third-quarter results showing sales of US$709.07 million and diluted earnings per share of US$0.97, both coming in below analyst expectations, alongside record gross profit and margin expansion driven by growth in cloud software, cybersecurity, and services.

- Management highlighted a strong customer backlog, increased momentum in advanced technologies like AI, and ongoing efforts to pursue tuck-in acquisitions, signaling a focus on higher-value growth areas amid recent public sector headwinds.

- We'll examine how the company’s record gross profit and focus on higher-margin solutions could reshape the investment narrative going forward.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

PC Connection Investment Narrative Recap

To be a shareholder in PC Connection, an investor needs confidence that the company's pivot toward higher-margin solutions, cloud, cybersecurity, and services, will offset weaker hardware sales and any volatility from public sector contracts. The latest quarterly results showed record gross profit even as revenue and EPS missed expectations; this points to margin expansion as a key short-term catalyst, but the ongoing unpredictability of public sector spending remains the primary risk. The overall impact of the news is moderate, as the gross margin story largely remains intact despite near-term sales headwinds.

Among recent announcements, the company's continued share buyback, repurchasing 83,693 shares for US$5.12 million last quarter, stands out. While this supports shareholder value and signals confidence in future prospects, it does not materially shift the company's exposure to the biggest risk: public sector funding cycles and their effect on revenue consistency.

However, it’s equally important for investors to be aware that amid strong gross profit growth, lingering government budget delays could still…

Read the full narrative on PC Connection (it's free!)

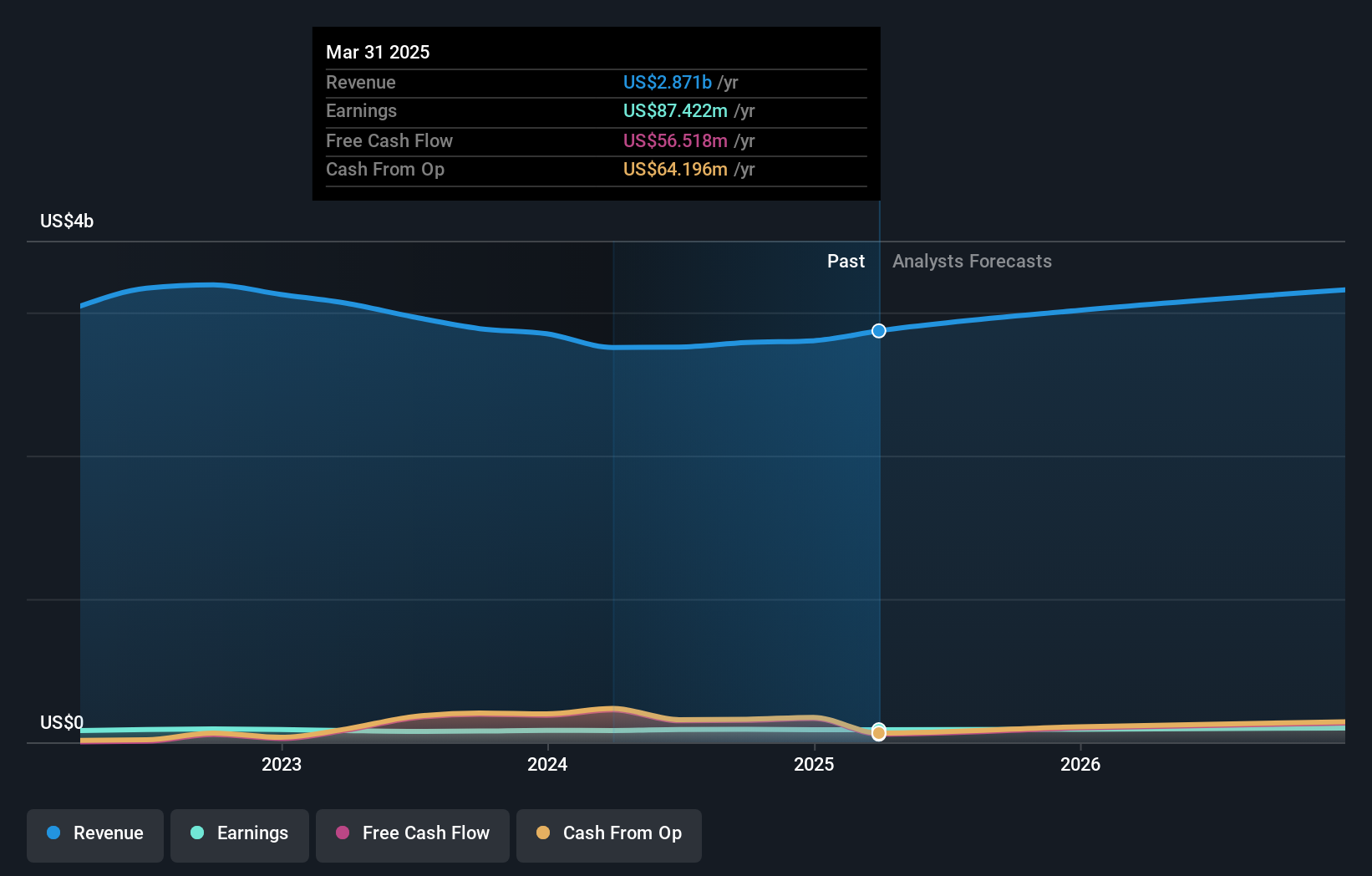

PC Connection's outlook projects $3.4 billion in revenue and $116.0 million in earnings by 2028. This implies 5.4% annual revenue growth and a $30 million increase in earnings from the current $86.0 million.

Uncover how PC Connection's forecasts yield a $76.00 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided three separate fair value estimates for PC Connection, ranging from US$65.56 to US$91.96 per share. While many see upside potential, the recent earnings miss highlights just how closely performance is tied to shifts in customer mix and public sector demand, reminding you to consider both opportunity and risk when comparing valuations.

Explore 3 other fair value estimates on PC Connection - why the stock might be worth as much as 51% more than the current price!

Build Your Own PC Connection Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PC Connection research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free PC Connection research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PC Connection's overall financial health at a glance.

No Opportunity In PC Connection?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com