Will Alliance Resource Partners' (ARLP) 2025 Sales Guidance and Profit Growth Shift Its Investment Narrative?

- Alliance Resource Partners recently updated its full-year sales guidance for 2025, projecting total sales tons between 32.50 million and 33.25 million, and reported third-quarter results with revenue of US$571.37 million and net income of US$95.1 million.

- While revenue declined compared to a year ago, the company's net income improved, highlighting a combination of lower sales figures and enhanced profitability.

- We'll explore how Alliance's updated sales forecast and improved third-quarter earnings could reshape the company's overall investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Alliance Resource Partners Investment Narrative Recap

To be a shareholder in Alliance Resource Partners, investors need to believe in stable or resilient coal demand backed by a supportive U.S. policy outlook, while also accepting exposure to commodity price pressures and regulatory risk. The recent update to sales guidance and solidified third-quarter earnings do not materially alter the company’s major short-term catalyst, domestic coal demand stabilization, nor do they reduce its biggest risk, which remains significant downside if coal pricing or U.S. energy policy shifts quickly.

Of the recent announcements, the updated full-year 2025 sales guidance is most relevant, as it aims to reassure investors about volume stability even as average prices decline. While production volumes rose year-over-year in the third quarter, uneven pricing and ongoing reliance on existing contracts continue to define the near-term outlook for revenue and profitability.

By contrast, investors should be aware that any meaningful change in U.S. coal policy or faster-than-expected coal plant retirements could…

Read the full narrative on Alliance Resource Partners (it's free!)

Alliance Resource Partners is projected to reach $2.4 billion in revenue and $389.8 million in earnings by 2028. This outcome assumes a 1.2% annual revenue growth rate and a $156.5 million increase in earnings from the current $233.3 million.

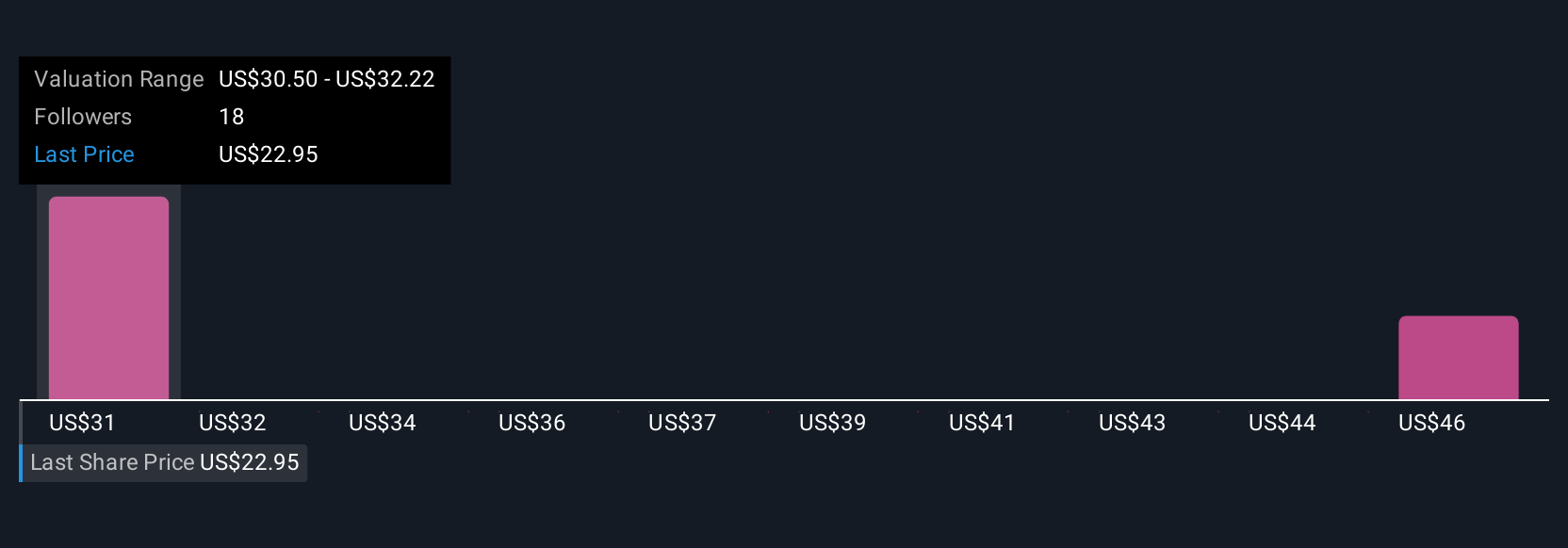

Uncover how Alliance Resource Partners' forecasts yield a $30.50 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Alliance’s fair value anywhere from US$30.50 up to US$93.40, signaling major differences in outlook. With wide-ranging views on revenue stability despite ongoing pressure on coal prices, you can compare several possible scenarios for the stock here.

Explore 2 other fair value estimates on Alliance Resource Partners - why the stock might be worth over 3x more than the current price!

Build Your Own Alliance Resource Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alliance Resource Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Alliance Resource Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alliance Resource Partners' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com