Genie Energy (GNE): Profit Growth Surges, Challenges Concerns over High Valuation and Margin Stability

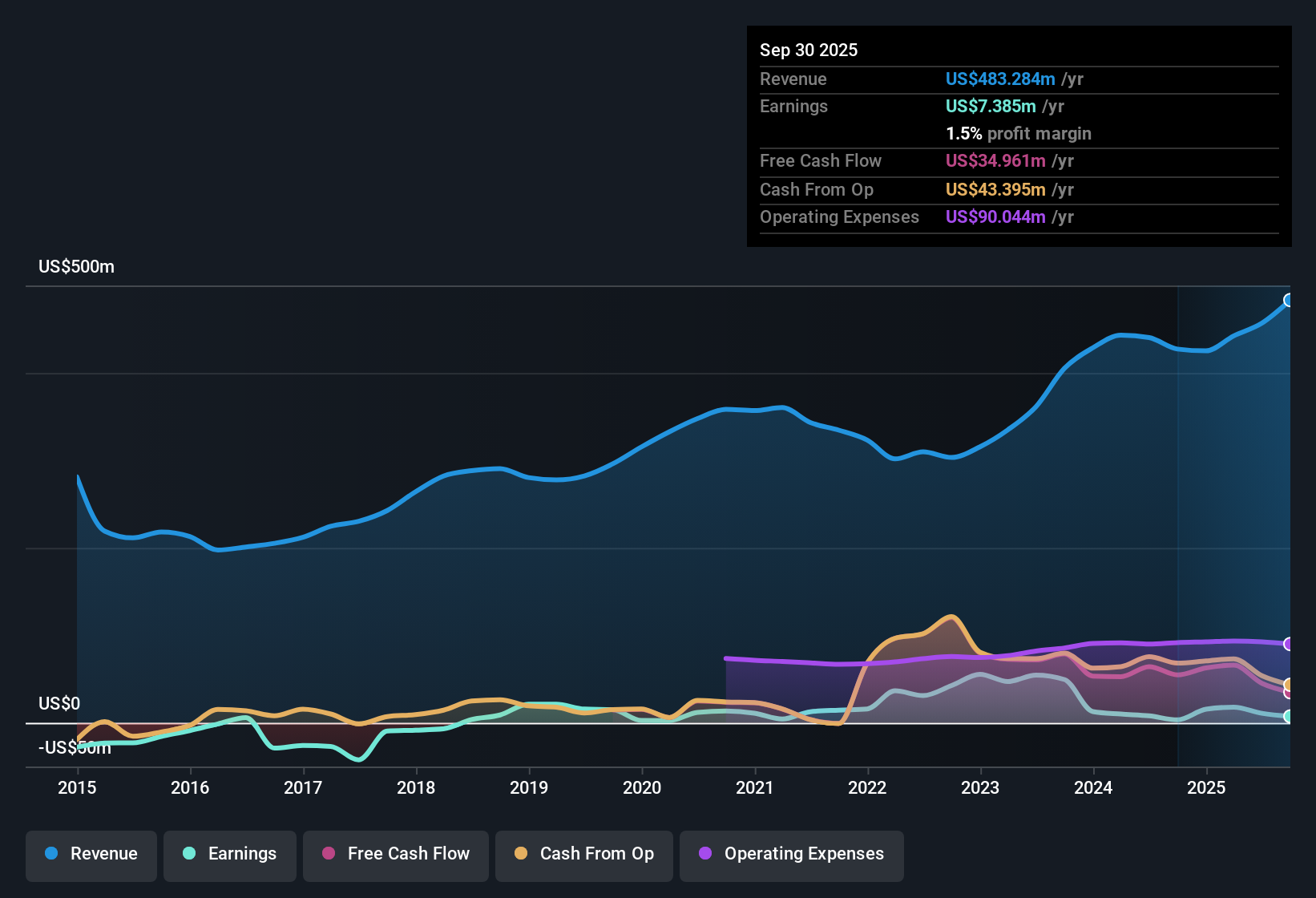

Genie Energy (GNE) just posted headline-grabbing growth, with earnings expected to surge 37% per year, which is more than double the US market average of 16.1%. Profit growth over the past year accelerated sharply, jumping 118.9% after several years of declines. Net profit margins also improved from 0.8% to 1.5%. Even with shares trading at $14.8 below an estimated fair value of $58.2, the price-to-earnings ratio sits high at 53.5x against the industry average. This puts future profitability and valuation under the spotlight for investors.

See our full analysis for Genie Energy.Next up, we’ll see how these results compare to the latest narratives and sentiment tracking around Genie Energy, highlighting where the data fits or challenges the prevailing stories.

See what the community is saying about Genie Energy

Profit Margins Climb as Operational Efficiency Improves

- Net profit margin rose from 0.8% to 1.5% over the past year, highlighting management’s focus on cost controls and better pricing discipline even as the industry faces ongoing volatility.

- Analysts' consensus view points to further margin expansion, with operational improvements and decreased SG&A spending seen as structural drivers for future gains.

- Consensus narrative notes that normalized commodity pricing and resilient customer retention are expected to support margins and provide a buffer against industry headwinds.

- This recovery in profitability challenges past worries around earnings stability that followed years of margin compression.

- Looking ahead, see how analysts weigh improved margins against market risks in the full consensus narrative. 📊 Read the full Genie Energy Consensus Narrative.

Topline Growth Lags Industry, But Diversification Expands

- While Genie Energy’s revenue growth is forecast at 6.1% per year, which is slower than the US market average of 10.5%, the company is actively expanding its distributed solar and advisory services to open up new markets and diversify earnings streams.

- Consensus view sees growth opportunities in electrification and decentralization, but highlights that regulatory hurdles and market concentration may temper the pace.

- Revenue diversity via solar and advisory segments offers protection and upside as industry trends shift in favor of distributed, resilient energy solutions.

- Nonetheless, changes in federal tax incentives and structural disadvantages could limit future expansion if Genie cannot adapt as quickly as peers.

Valuation Remains Elevated Despite Discount to DCF Fair Value

- At a share price of $14.8, Genie trades below its DCF fair value of $58.20. However, the price-to-earnings ratio of 53.5x far exceeds both the industry average of 21.5x and the US utilities peer group at 15.5x.

- Consensus narrative emphasizes that for the analyst price target of $18.00 by 2028 to be justified, Genie must deliver higher earnings and improved margins while closing the gap between lofty valuation multiples and sector benchmarks.

- To meet these expectations, analysts assume the PE ratio will compress to 19.9x as earnings grow, suggesting the need for sustained outperformance to support the stock’s premium.

- The current valuation tests investor conviction in Genie’s roadmap, especially as near-term upside is positive but already reflected in ambitious multiples.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Genie Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique angle on the latest figures? Share your insights and shape your own narrative in just a few minutes. Do it your way

A great starting point for your Genie Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Genie Energy’s premium valuation and lagging top-line growth suggest the company may struggle to justify its lofty multiples, especially when compared to peers that achieve steadier expansion.

If you’re looking for more reliable gains, focus on stable growth stocks screener (2094 results) to find companies that demonstrate consistent revenue and earnings growth through changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com