Is Now the Right Time to Reassess Erie Indemnity After a 30% Drop in 2025?

- Wondering if Erie Indemnity is still a worthy pick or whether the recent headlines signal a new opportunity? You are definitely not alone, especially if the stock's recent moves have caught your attention.

- The share price has taken a sharp turn lately, dropping 13.5% over the past week and now down 30.3% year-to-date. This brings one-year returns to -28%, despite a solid gain over the past five years.

- Recent news has cast the entire insurance sector into the spotlight, with investors debating how changing regulations and claims trends may impact future profits. For Erie Indemnity, the concern around market-wide risk has clearly played into the sharp price correction, but the company’s long-term fundamentals and track record keep it front of mind for many followers.

- Right now, Erie Indemnity scores 0 out of 6 on our undervaluation checks, so there's more to the story than just a declining price. Let's break down how traditional valuation methods measure up for ERIE and why a smarter, more holistic approach might reveal the real opportunity. Stay tuned for that at the end of the article.

Erie Indemnity scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Erie Indemnity Excess Returns Analysis

The Excess Returns valuation model examines how much the company earns over and above the cost of its equity, focusing on returns generated by invested capital, not just bottom-line profits. For Erie Indemnity, this approach highlights whether management is generating meaningful value for shareholders beyond what a risk-free investment would produce.

Looking at the numbers, Erie Indemnity has a Book Value of $44.16 per share and a Stable EPS of $9.26 per share, with the stable earnings figure reflecting the median return on equity from the past five years. The Cost of Equity stands at $2.24 per share, meaning that each year, the company needs to earn this amount just to compensate shareholders for their investment risk. Erie’s Excess Return, which is what it delivers beyond that minimum hurdle, is calculated at $7.03 per share, supported by an impressive average Return on Equity of 28.06%. The long-term Stable Book Value is $33.01 per share.

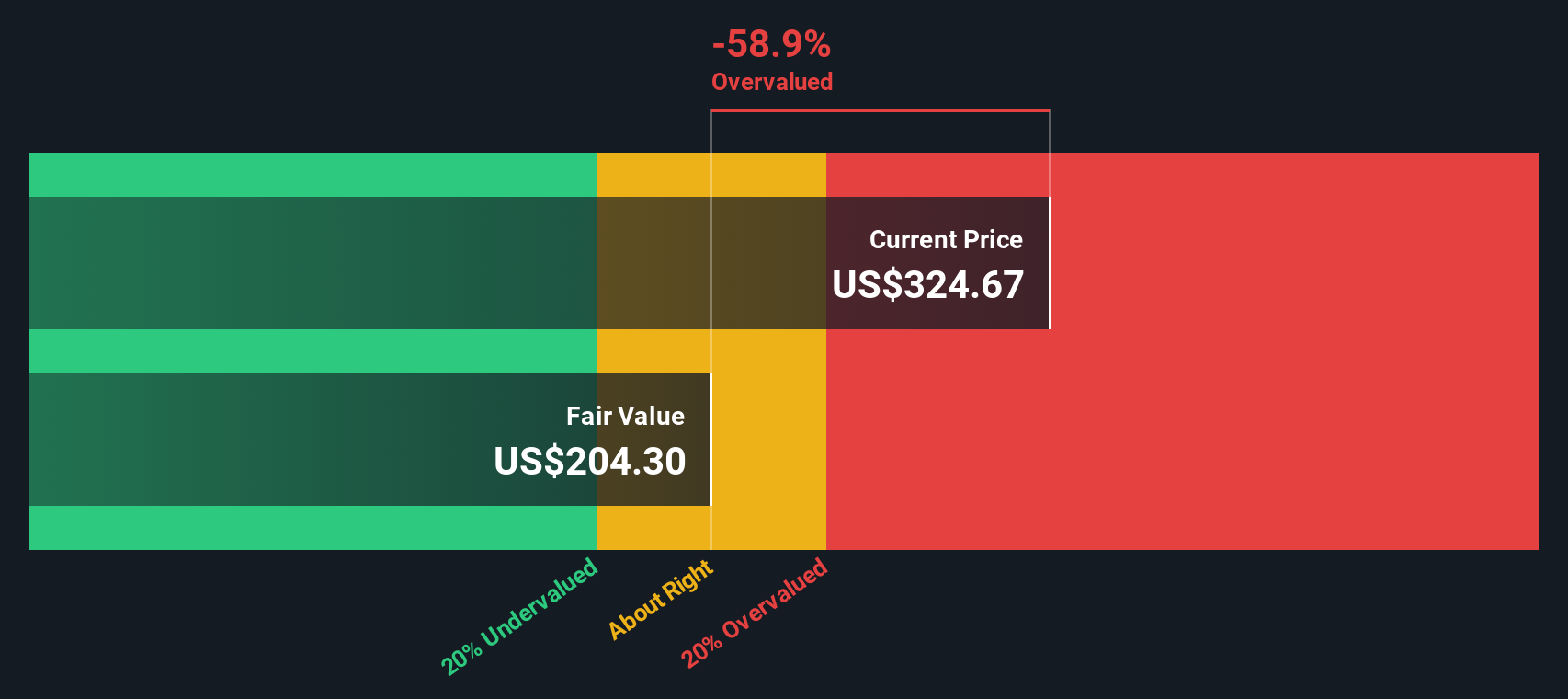

Based on this model, Erie Indemnity’s resulting intrinsic value comes in at a 27.9% premium to its fair value. This signals the stock is notably overvalued compared to its underlying fundamentals. While the company’s ability to generate high returns is commendable, current prices appear to anticipate more than what excess returns justify today.

Result: OVERVALUED

Our Excess Returns analysis suggests Erie Indemnity may be overvalued by 27.9%. Discover 839 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Erie Indemnity Price vs Earnings

For a consistently profitable company like Erie Indemnity, the Price-to-Earnings (PE) ratio is a widely used and effective valuation tool. The PE ratio provides investors with a quick sense of how much they are paying for each dollar of current earnings, making it especially useful for firms with stable and predictable profit streams.

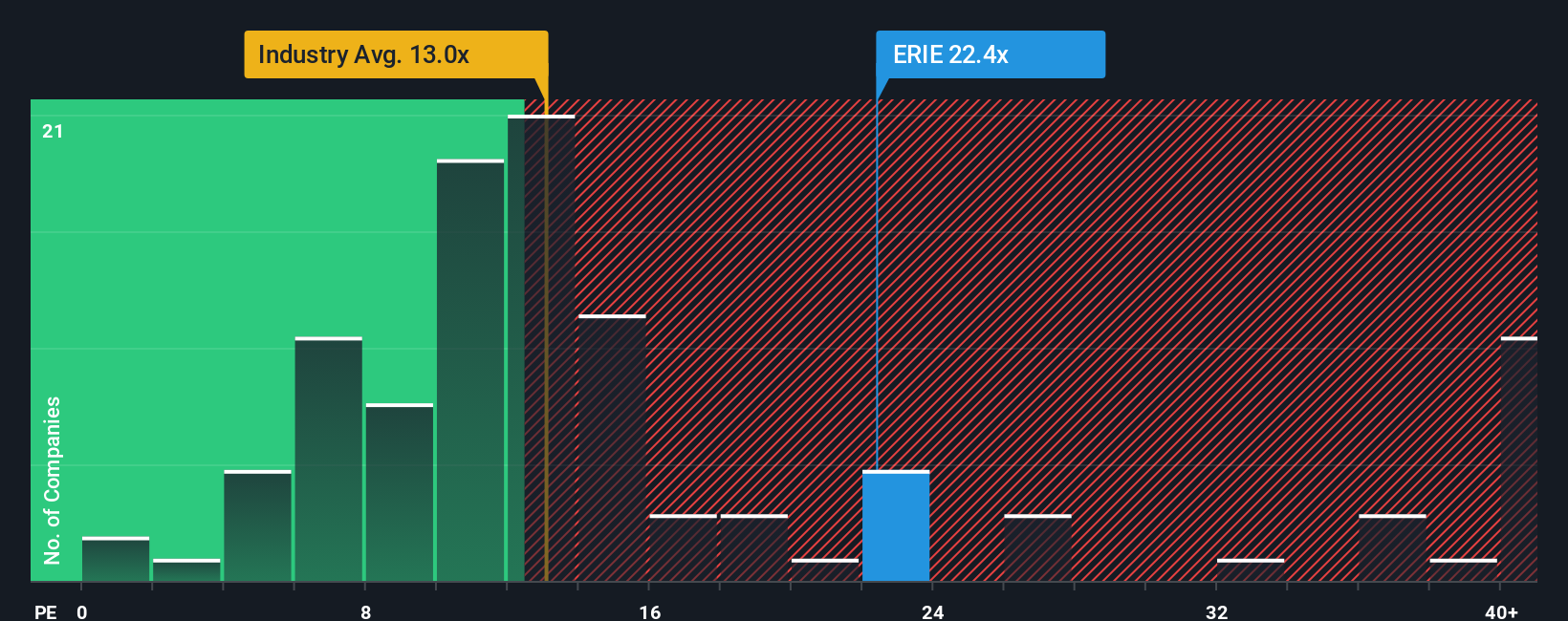

A "normal" or "fair" PE ratio depends on market expectations for growth and the risk profile of the business. Companies expected to grow faster or with lower risk tend to command higher PE ratios. Those facing more headwinds or uncertainty warrant lower ones. In Erie Indemnity’s case, its current PE sits at 23.0x, noticeably above the insurance industry average of 13.4x and higher than its peer group, which averages 14.3x.

This is where Simply Wall St's proprietary “Fair Ratio” comes into play. Unlike a simple comparison against industry or peers, the Fair Ratio estimates a justifiable PE based on Erie’s unique growth prospects, profit margins, business risks, and its market cap, as well as sector-specific factors. For Erie Indemnity, the Fair Ratio is calculated at 14.1x. This tailored benchmark gives investors a more meaningful comparison, as it reflects whether the company’s strengths truly merit a premium. With Erie’s actual PE more than 8 points above the Fair Ratio, the stock currently looks expensive through this lens.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Erie Indemnity Narrative

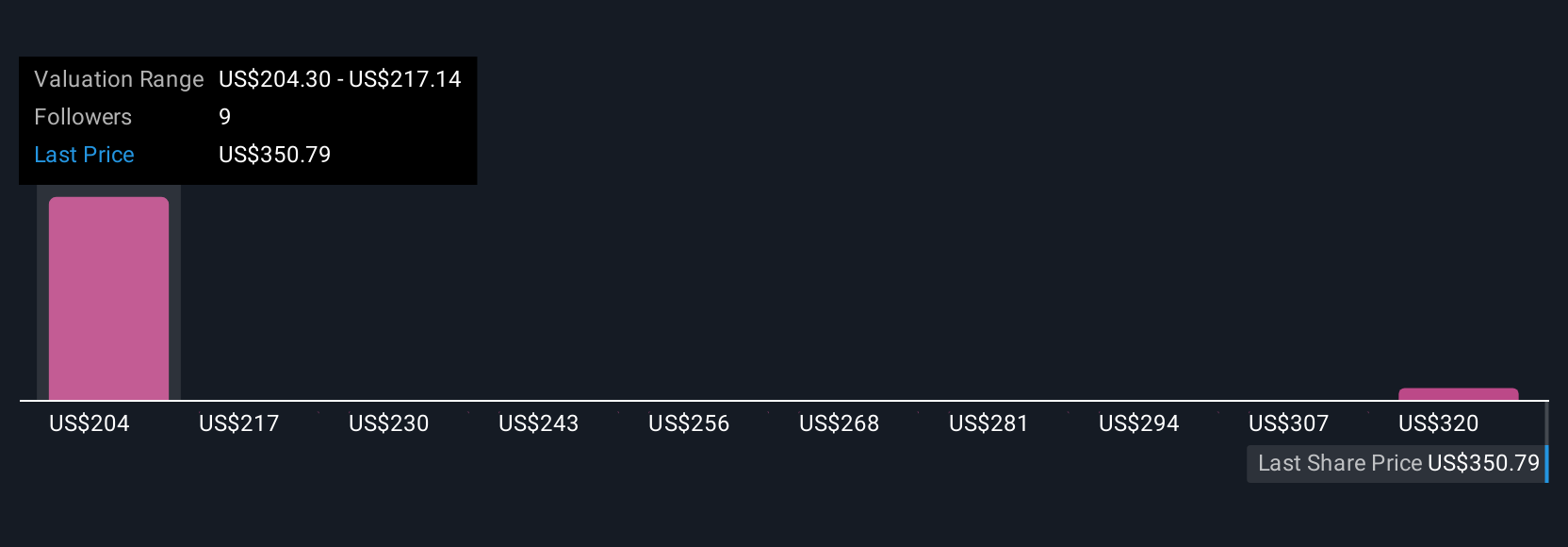

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story behind the numbers—your perspective on a company’s future, expressed through assumptions about its fair value, future revenue, earnings, and margins. Narratives bridge the gap between a company’s story, a real financial forecast, and its resulting fair value. This approach makes your analysis much more personal and insightful.

Narratives are an easy and accessible tool available to everyone on the Simply Wall St platform, within the Community page used by millions of investors. They help you decide when to buy or sell by directly comparing your fair value estimate to the company’s current price. Narratives also stay up to date with all the latest news, announcements, and earnings, continually refreshing your fair value as new information arrives.

For example, different investors currently project very different futures for Erie Indemnity, with some setting higher fair values based on optimism about earnings growth and others predicting much lower outcomes due to perceived market risks. This demonstrates how Narratives allow every investor to make decisions based on their own unique outlook.

Do you think there's more to the story for Erie Indemnity? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com