Can California Water Service (CWT) Sustain Dividends Amid Lower Earnings and Regulatory Headwinds?

- California Water Service Group recently reported its third quarter 2025 results, showing sales of US$311.24 million and net income of US$61.23 million, roughly in line with the same period last year, and declared its 323rd consecutive quarterly dividend of US$0.30 per share.

- Despite stable quarterly earnings, the company's net income and earnings per share for the nine-month period fell compared to the prior year, highlighting ongoing operational and regulatory challenges.

- We’ll assess how California Water Service Group’s ability to sustain its dividend, despite lower nine-month earnings, reshapes its investment outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

California Water Service Group Investment Narrative Recap

Being a shareholder in California Water Service Group means believing in the long-term value of regulated water utilities and the company’s ability to invest in infrastructure while navigating regulatory hurdles. The latest results affirm stable quarterly performance and continued dividend payments, but the primary near-term catalyst, the outcome of the California General Rate Case, remains unresolved, and the biggest risk continues to be regulatory delays. This news does not materially shift those near-term dynamics.

Among recent announcements, the company’s 323rd consecutive dividend declaration stands out amid lower year-to-date net income. While reliable dividends can be attractive, the sustainability of payouts over time is closely linked to regulatory outcomes, especially as operating earnings fluctuate and capital needs remain high.

By contrast, investors should be aware of the potential implications if General Rate Case negotiations drag on or fall short of company expectations, especially since...

Read the full narrative on California Water Service Group (it's free!)

California Water Service Group's narrative projects $1.1 billion in revenue and $187.9 million in earnings by 2028. This requires 3.9% yearly revenue growth and a $52.1 million earnings increase from $135.8 million today.

Uncover how California Water Service Group's forecasts yield a $55.50 fair value, a 23% upside to its current price.

Exploring Other Perspectives

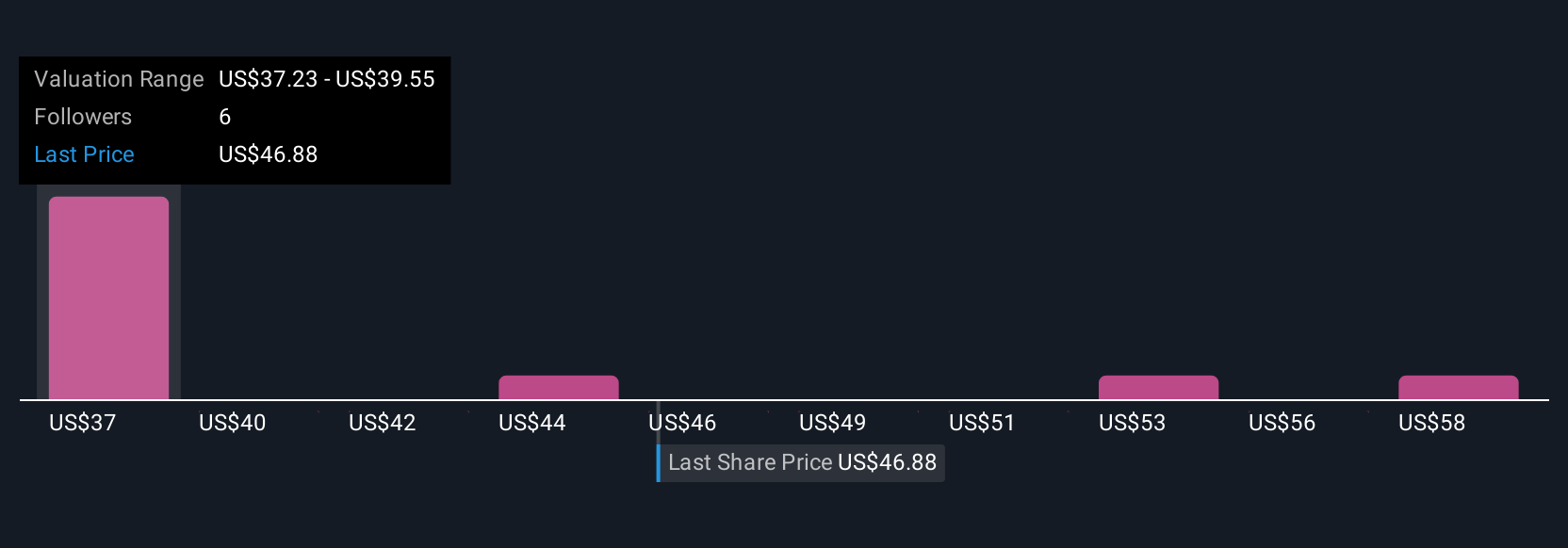

Four individual fair value estimates from the Simply Wall St Community range from US$36.33 to US$60.39 per share. Investor outlooks vary widely, highlighting how regulatory delays and future rate decisions could make a significant difference to California Water Service Group’s performance, explore these varying viewpoints for a deeper understanding.

Explore 4 other fair value estimates on California Water Service Group - why the stock might be worth 19% less than the current price!

Build Your Own California Water Service Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your California Water Service Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free California Water Service Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate California Water Service Group's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com