Unitil (UTL): Margin Decline Reinforces Investor Caution Despite History of Earnings Growth

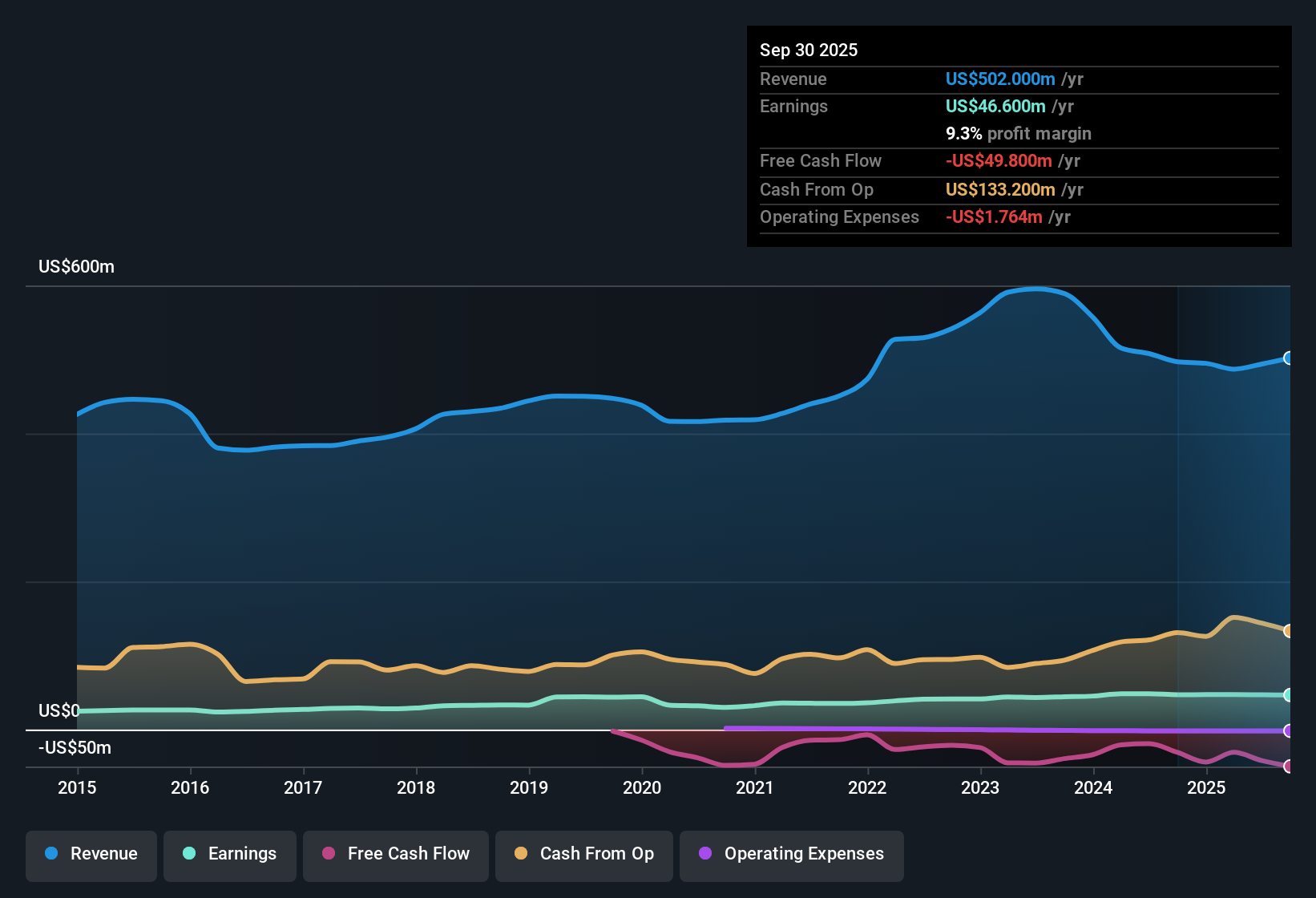

Unitil (UTL) reported earnings that have grown at an average rate of 8.3% per year over the last five years. However, its most recent year saw a negative earnings result, making a direct comparison to its longer-term trend difficult. Revenue is projected to rise 5.1% annually, which is notably slower than the broader US market’s anticipated 10.5% pace. The company’s net profit margin slipped to 9.3% from 9.5% last year. Despite the recent softness, Unitil’s high-quality earnings and a share price of $48.74, which sits below its estimated fair value of $57.36, may catch investor attention.

See our full analysis for Unitil.The next step is to see how Unitil’s latest results stack up against the most widely discussed narratives. Some assumptions may hold, while others could be up for debate.

See what the community is saying about Unitil

Margin Pressure from Rising Expenses

- Unitil’s net profit margin edged down to 9.3% from 9.5% last year, as rising operating expenses and new project investments tightened profitability despite steady revenue growth.

- Consensus narrative notes higher labor and utility costs are compressing margins at the same time major growth initiatives are underway.

- For example, the $40 million Advanced Metering Infrastructure investment is intended to improve efficiency long-term, but up front it adds to costs and financial risk.

- What is surprising is that, although modernization efforts and acquisitions may support future growth, consensus flags the near-term margin squeeze as a key risk for investors to monitor.

Acquisition and ESG Initiatives Fuel Growth Discussion

- Material investments such as the Bangor Natural Gas acquisition and the AMI project are highlighted in consensus as key drivers expected to grow the customer base and improve operational efficiency, potentially leading to future earnings uplift.

- Analysts' consensus view puts weight on two themes:

- The plan to cut greenhouse gas emissions by 50% by 2030 could appeal to ESG-focused investors and enhance brand loyalty, which could in turn support stock value and long-term earnings strength.

- However, with revenue forecast to grow at just 5.1% annually, about half of the broader US market’s 10.5%, consensus underscores that execution on these initiatives must be measured against headwinds from increased sector competition and regulatory uncertainty.

Sense check how slated infrastructure upgrades and green commitments stack up to expectations in the full consensus narrative for Unitil. 📊 Read the full Unitil Consensus Narrative.

Valuation Runs Close to Fair Value

- At a Price-to-Earnings Ratio of 18.6x, Unitil trades roughly in line with the sector and just above the global integrated utilities average of 18.5x. Its share price of $48.74 sits below the DCF fair value figure of $57.36, suggesting a modest value opportunity.

- Consensus narrative highlights a narrow gap to analyst price targets and positions Unitil as fairly valued rather than a bargain.

- The current share price remains about 15% below the DCF fair value, but the analyst consensus target is just 8.5% higher than the current price. This signals that while analysts expect some upside, market optimism is moderate.

- This tight alignment between fundamentals and valuation supports the consensus view that Unitil’s attractiveness rests on steady execution rather than dramatic re-rating potential.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Unitil on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the figures from a unique angle? Share your perspective in minutes and shape your own view: Do it your way

A great starting point for your Unitil research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Unitil’s slower revenue growth and recent margin pressures suggest its near-term returns may lag both fast-growing competitors and the broader market.

If you’re looking for steadier performance through different market cycles, check out stable growth stocks screener (2081 results) to discover companies delivering more consistent growth and resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com