How Stronger Earnings Guidance and Dividend Hike at Pinnacle West (PNW) Has Changed Its Investment Story

- Pinnacle West Capital Corporation recently raised its 2025 earnings guidance, provided 2026 profit and sales outlooks, reported increased quarterly revenues, and announced a 1.7% annual dividend increase to US$3.64 per share.

- This combination of updated financial guidance and a dividend increase points to strengthened business expectations amid customer growth and infrastructure investments.

- We’ll explore how Pinnacle West Capital’s updated earnings guidance and dividend boost could influence its investment narrative and future outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Pinnacle West Capital Investment Narrative Recap

To be a shareholder of Pinnacle West Capital, you need confidence in Arizona’s sustained economic and population growth driving steady electricity demand and regulated earnings outlook. The recent boost to 2025 and 2026 earnings guidance may reinforce positive sentiment around the company’s near-term growth catalysts, such as customer additions and major infrastructure projects. However, the headline outlook does not materially change the principal short-term concern: ongoing regulatory lag and rate relief timing remain crucial hurdles for margin improvement.

The announcement of a 1.7% dividend increase to US$3.64 per share directly reflects management’s confidence in future cash flows, following the encouraging sales and customer growth signals. A higher dividend can appeal to income-focused investors, but with revenue and earnings only modestly outpacing projections, its sustainability and coverage alongside elevated capital spending will continue to attract scrutiny from the market. Yet, contrasting these upbeat headlines, there are important regulatory timing factors all investors should keep in mind as ...

Read the full narrative on Pinnacle West Capital (it's free!)

Pinnacle West Capital is projected to reach $6.1 billion in revenue and $791.6 million in earnings by 2028. This outlook assumes a 5.1% annual revenue growth rate and a $215.5 million increase in earnings from the current $576.1 million.

Uncover how Pinnacle West Capital's forecasts yield a $96.25 fair value, a 8% upside to its current price.

Exploring Other Perspectives

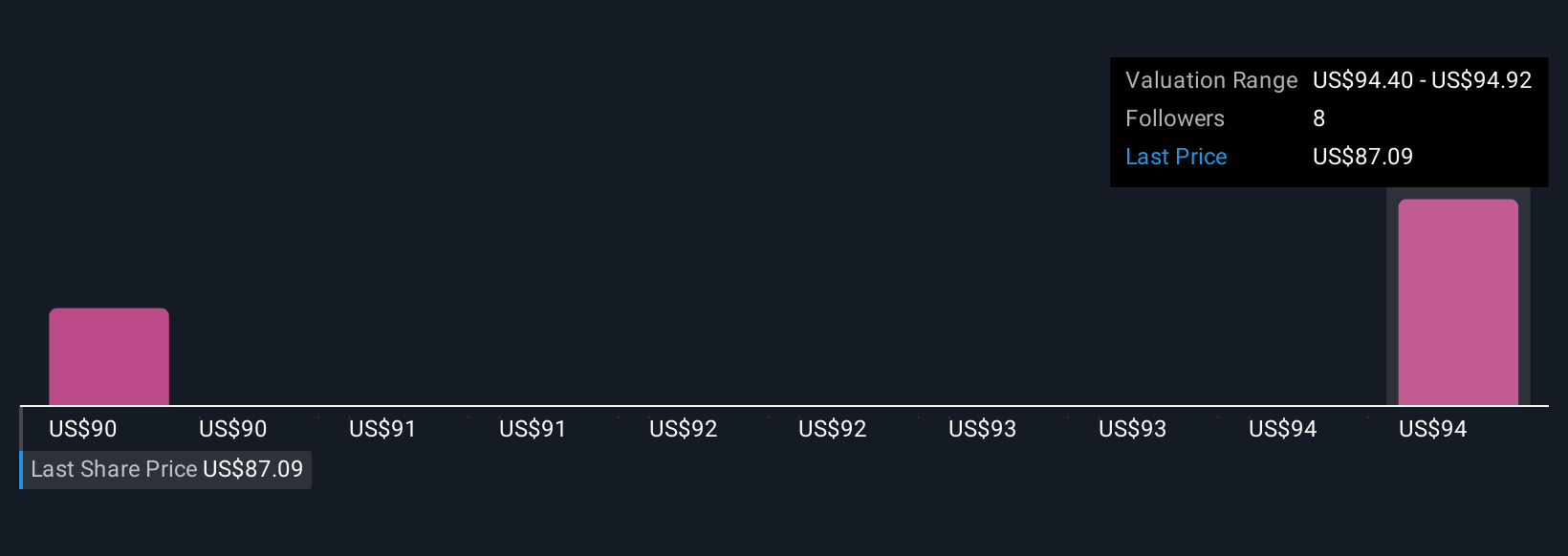

Simply Wall St Community fair value estimates for Pinnacle West Capital range from US$90.14 to US$96.25 per share, across two investor viewpoints. While expectations of expanded rate base and customer growth continue to shape bullish forecasts, persistent regulatory delays could significantly affect the company’s progress and future value. Review how others see it and consider whether your outlook aligns.

Explore 2 other fair value estimates on Pinnacle West Capital - why the stock might be worth just $90.14!

Build Your Own Pinnacle West Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pinnacle West Capital research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Pinnacle West Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pinnacle West Capital's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com