Natural Resource Partners (NRP) Net Profit Margin Surges to 71.4%, Reinforcing Earnings Quality Narrative

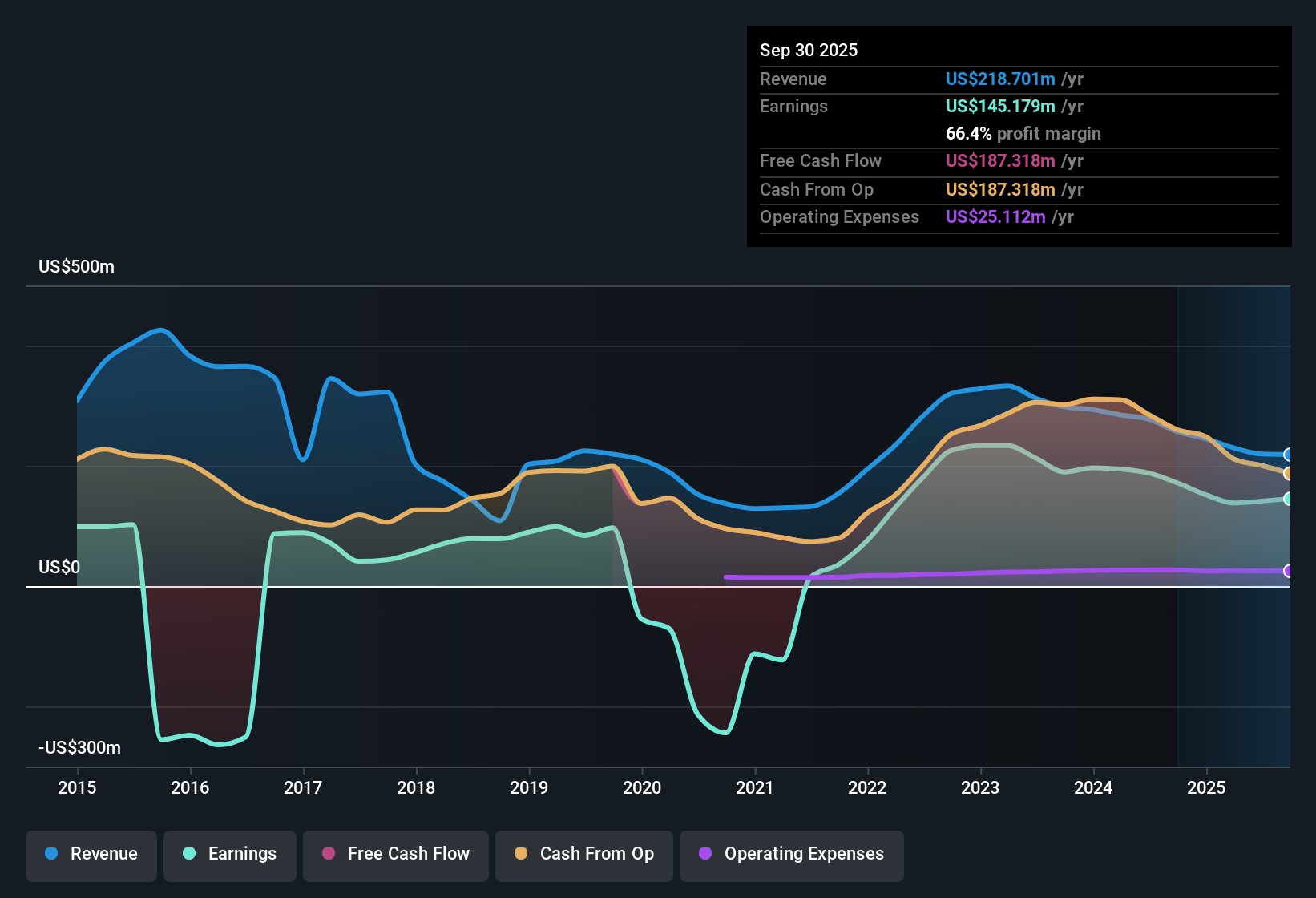

Natural Resource Partners (NRP) posted net profit margins of 71.4%, a strong showing compared to last year’s 66.8%. Over the past five years, NRP has achieved an average annual earnings growth rate of 35.3%, though the most recent year saw a decline compared to that long-term trend. With a price-to-earnings ratio of just 9.3x and shares trading well below the estimated fair value, NRP's earnings quality and relative value are likely to catch investor attention.

See our full analysis for Natural Resource Partners.Now, let's see how these headline numbers stack up against the prevailing market and community narratives. Some views are likely to be reinforced, while others may face fresh questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Five-Year Profit Surge Reverses in Recent Period

- NRP delivered a 35.3% average annual earnings growth rate over the past five years, but in the most recent year, earnings declined compared to this long-term trend.

- Income-focused investors see this strong multi-year growth record as a positive sign; however, the most recent pullback highlights the core risk that results can swing with commodity cycles.

- Although NRP’s ability to become profitable and sustain high margins supports the case for cash flow resiliency, the dip in annual earnings may challenge the view that long-term growth at this pace is guaranteed.

- The evidence suggests steady growth may not be a given, as macro factors and sector cycles are capable of impacting year-on-year profitability.

Peer Valuation Gap Widens

- With a price-to-earnings multiple of 9.3x, NRP trades at a deep discount to both the US Oil and Gas industry average of 12.8x and direct peers at 67.9x.

- Supporters highlight that this valuation gap heavily favors NRP’s status as a value play, while critics counter that the lower multiple may price in uncertainty about coal exposure and growth potential.

- The current share price of $103.28 remains well below the DCF fair value of $226.58, which is a sharp contrast to more fully valued industry peers.

- Still, the discount may persist unless investors gain greater confidence in a transition to non-coal revenue. This echoes ongoing debates about the scope and sustainability of the current business model.

High Margins Support Strong Cash Generation

- NRP’s net profit margin has climbed to 71.4%, up from 66.8% last year. This level stands out even among natural resource firms.

- These high margins reinforce optimism about the company’s cash-generating model, given that mineral and royalty assets deliver results without the direct costs and risks of mining operations.

- Such profitability lends weight to claims about reliable cash flow and flexible capital returns, especially as NRP maintains a capital-light approach.

- Nevertheless, the sustainability of these elevated margins will depend on the future mix of revenue sources and the company’s pace of diversification, not just past performance.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Natural Resource Partners's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite NRP’s impressive long-term growth and high margins, its recent earnings dip underscores the risk that profits can fluctuate sharply with commodity cycles.

If uncertain year-on-year results have you looking for more consistency, check out stable growth stocks screener (2079 results) to discover companies delivering steady earnings and revenue growth across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com