Ardmore Shipping (ASC): Profit Margin Drop Challenges Bullish Value Narratives

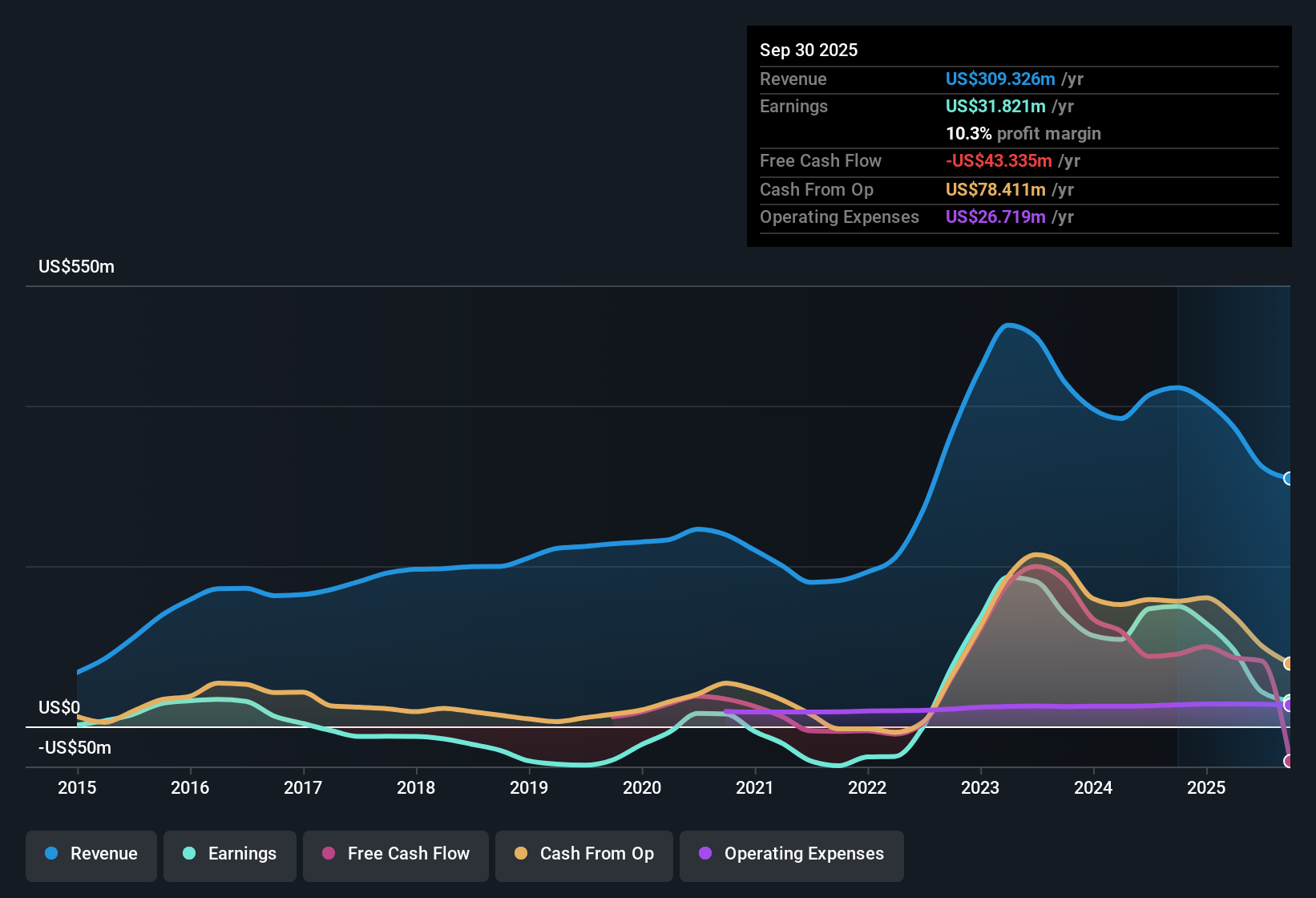

Ardmore Shipping (ASC) reported annual revenue growth of 6.8% per year, trailing the US market average of 10.5%. Net profit margins fell sharply to 13.3% from last year’s 35.5%. Earnings actually declined over the most recent period, despite a robust five-year earnings growth rate of 44.3% per year. Shares were last seen trading at $12.46, significantly below an estimated fair value of $25.38. The company’s Price-To-Earnings Ratio of 11.8x stands out favorably against industry and peer averages. The results highlight persistent margin pressure but also underscore Ardmore’s attractive valuation in the context of its sector.

See our full analysis for Ardmore Shipping.Next up, we’ll see how these headline numbers compare with the dominant market narratives, highlighting where stories might be reinforced or challenged.

See what the community is saying about Ardmore Shipping

Profit Margin Drop Signals Cautious Near-Term Outlook

- Net profit margins fell steeply from 35.5% last year to 13.3% this year, directly impacting Ardmore Shipping’s recent profitability despite strong long-term gains.

- Analysts' consensus view sees tighter tanker supply and shifting trade patterns providing long-term support for higher earnings. However, the present loss of margin strength reveals near-term vulnerability.

- This downward margin pressure contradicts the expectation for improved profitability and underlines how crucial higher fleet utilization and favorable spot rates will be going forward.

- With industry margins sensitive to both geopolitical uncertainty and regulatory shifts, analysts stress that Ardmore’s ability to modernize its fleet and control costs remains a deciding factor for margin recovery.

- To understand how consensus still sees upside amid falling margins, read the full consensus narrative for Ardmore Shipping. 📊 Read the full Ardmore Shipping Consensus Narrative.

Valuation Discount Versus Peers and DCF Fair Value

- Ardmore trades at just $12.46 per share, which is significantly below both its DCF fair value of $25.38 and the US Oil and Gas peer average Price-To-Earnings ratio of 55.3x. Its own P/E is 11.8x.

- Analysts' consensus narrative notes that this valuation gap, paired with a below-market P/E, positions Ardmore as a potential value play even as analysts’ target price of $14.40 only modestly exceeds the current share price.

- The sharp discount to DCF fair value suggests that recent margin weakness is already priced in and may leave room for upside if sector trends turn favorable.

- However, if profit margins fail to return to prior highs, the modest size of the premium to the analyst target brings the sustainability of value upside into question.

Dividend Sustainability Now in Focus

- Risks flagged include a concern that the current dividend may not be sustainable, a notable change from Ardmore’s previous profile of robust earnings growth supporting shareholder returns.

- Analysts' consensus view acknowledges healthy earnings quality and good value, but cautions that enduring margin compression and the burden of potential regulatory-driven fleet upgrades could squeeze free cash flow, making dividend continuity a key risk if revenue volatility persists.

- With tighter cash flow and growing industry costs, any cut to dividends would directly impact Ardmore’s appeal to income-focused investors.

- Shareholders may need to watch both profit margins and regulatory changes closely to assess whether the company’s dividend can be maintained through shipping market cycles.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ardmore Shipping on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on these figures? Share your perspective and shape your own investment narrative in just a few minutes. Do it your way

A great starting point for your Ardmore Shipping research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Explore Alternatives

While Ardmore Shipping shows long-term earnings growth, its sharp drop in profit margins and risk to dividend sustainability signal uncertainty ahead for income-focused investors.

If dependable income is your priority, discover companies with a stronger record of payout reliability among these 1979 dividend stocks with yields > 3% that offer higher yields and better dividend safety.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com