Pursuit Attractions and Hospitality (PRSU): Evaluating Valuation After Surprising Revenue and Earnings Growth

Pursuit Attractions and Hospitality (PRSU) delivered third quarter results that defied expectations, reporting solid gains in both revenue and earnings at a time when analysts had been bracing for a meaningful drop. This surprise performance quickly grabbed investors’ attention.

See our latest analysis for Pursuit Attractions and Hospitality.

This earnings beat arrives after a stretch where the 1-year total shareholder return is down 15.3%, and the year-to-date share price return is still negative. However, with shares rising 5.9% in a single day following the report, the market seems to be warming to Pursuit Attractions and Hospitality’s turnaround prospects. Despite some bumps, long-term holders have still seen a 25% total return over three years, indicating real momentum could be building if this performance is sustained.

If today’s surprise has you wondering what else might be primed for a shift, it could be an ideal moment to discover fast growing stocks with high insider ownership.

With shares still trading at a 15% discount to analyst price targets despite a sharp one-day surge, the question now is whether Pursuit Attractions and Hospitality remains undervalued or if the market has already accounted for the next stage of growth.

Most Popular Narrative: 13.3% Undervalued

Pursuit Attractions and Hospitality’s widely followed consensus narrative suggests the company’s fair value is $42, notably higher than its latest close of $36.41. This gap highlights optimism about its turnaround and growth story, despite recent volatility.

Continued expansion into iconic, high-demand travel destinations like Costa Rica and ongoing investments in premium, immersive experiences (for example, upgrades in Montana, new attractions in Jasper) are likely to capture a growing global middle class and increasing demand from millennial/Gen Z travelers seeking authentic, shareable experiences. These trends are seen as supporting sustained revenue and earnings growth.

What’s fueling this promising valuation? Hint: the narrative hinges on bold growth projections in both revenues and margins. These numbers could dramatically shift perceptions if realized. Want to see what aggressive assumptions are under the surface?

Result: Fair Value of $42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks like climate-driven disruptions and rising labor costs could quickly challenge these optimistic forecasts and prompt a reassessment of Pursuit’s outlook.

Find out about the key risks to this Pursuit Attractions and Hospitality narrative.

Another View: Multiples Paint a Different Picture

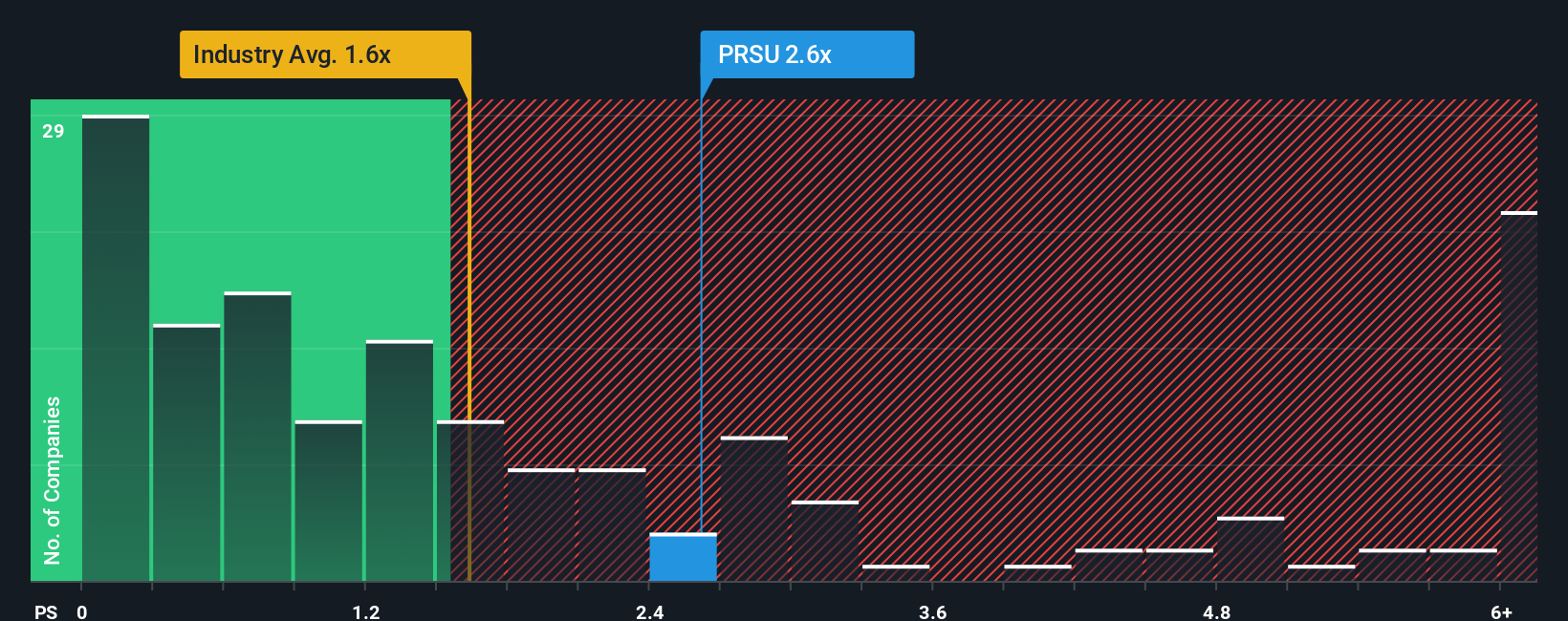

Looking through the lens of price-to-sales, Pursuit Attractions and Hospitality appears expensive compared to peers. It trades at 2.7 times sales, while the US Hospitality industry averages just 1.6 times and the fair ratio sits at 0.9. This sizable gap could mean higher downside risk if sentiment cools. Is the market overpaying for growth, or will results justify the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pursuit Attractions and Hospitality Narrative

If you want to reach your own conclusions or think a different story is taking shape, you can quickly build your perspective using the same data. Create and share your take in just a few minutes with Do it your way.

A great starting point for your Pursuit Attractions and Hospitality research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let standout opportunities pass you by while focusing on a single stock. Boost your investing edge now by tapping into fresh market directions and expert-curated picks.

- Capture rising income streams and potential stability by targeting these 20 dividend stocks with yields > 3%, which offer attractive yields and a history of rewarding shareholders.

- Capitalize on the booming field of artificial intelligence by seizing these 26 AI penny stocks, propelling innovation across industries and fueling the next wave of tech growth.

- Lock in value and growth opportunity with these 836 undervalued stocks based on cash flows, which stand out for their impressive fundamentals and untapped upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com