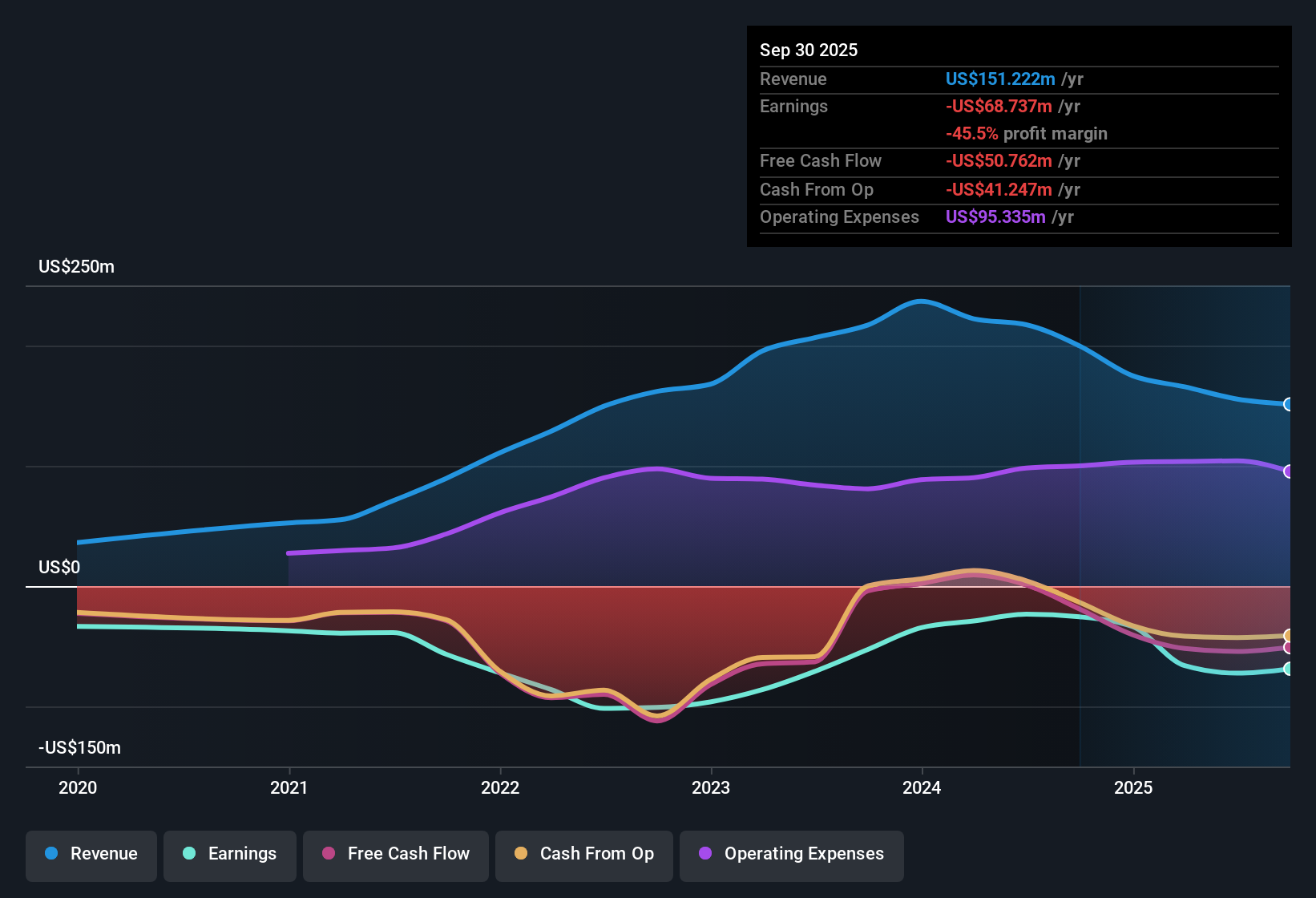

SmartRent (SMRT): Losses Narrow 5.7% Annually, But Profitability Remains Out of Reach

SmartRent (SMRT) remains unprofitable, but it has managed to reduce its losses at an average rate of 5.7% per year over the past five years. The stock trades at $1.40, trading above its estimated fair value of $0.52, and it posts a Price-to-Sales Ratio of 1.7x, which is lower than both its peer average of 5.4x and the US Electronic industry average of 2.6x. While profitability is still out of reach and net profit margins have not shown improvement, investors may look to narrowing losses and relatively attractive sales multiples to gauge the potential for a turnaround.

See our full analysis for SmartRent.The next section will dig into how the latest numbers compare to the most common narratives about SmartRent. This will reveal where the numbers reinforce or challenge market expectations.

See what the community is saying about SmartRent

Recurring SaaS Revenue Hits 37% of Total

- SaaS makes up 37% of SmartRent's total revenue. This increase stands out because SaaS revenue is generally more predictable and carries high gross margins of about 70%, compared to traditional hardware sales.

- Analysts' consensus view highlights that this shift boosts gross margins and cash flow stability, but creates tension as total revenue actually fell 21% year over year. This supports top-line expansion on one hand while pulling overall numbers down on the other.

- Consensus narrative notes that higher-value SaaS bookings (average revenue per user for new bookings rose to $8.21 versus $5.66 for the deployed base) are offset by lost hardware revenue. This means the transition has both advantages and drawbacks for near-term growth.

- Consensus also points to expanded AI and IoT offerings as supporting cross-selling and up-sell opportunities, even as macroeconomic risks and a slower recurring revenue ramp could delay the move to profitability.

- What matters for investors is that recurring revenue typically makes future profit potential steadier, but the speed and scale of the transition remains an open question.

- See what both bull and bear analysts are debating in the full consensus narrative. 📊 Read the full SmartRent Consensus Narrative.

Losses Narrow, but Profit Remains Distant

- SmartRent’s net losses have been reduced at an average rate of 5.7% per year for the last five years, but the company has not posted any net profit margin improvement and remains firmly unprofitable.

- Consensus narrative weighs in that, while operational efficiency improvements such as a $30 million annualised cost reset help shrink losses, analysts do not expect SmartRent to become profitable within the next three years.

- All major analyst projections still show profit margins significantly below the industry average, with consensus expecting the breakeven point to remain out of reach in the medium term.

- This view is reinforced by the fact that even strong SaaS revenue growth and solid customer retention have not yet led to actual margin expansion at the bottom line.

Sales Multiple Beats Peers, But Shares Remain Above DCF Fair Value

- The Price-to-Sales Ratio for SmartRent is 1.7x, making it look attractively valued relative to its direct peers (5.4x) and the broader US Electronic industry average (2.6x). However, the share price of $1.40 trades well above the DCF fair value estimate of $0.52 per share.

- Consensus narrative contends that despite SmartRent's favorable sales multiple, the current price nearly matches the $1.48 analyst target and offers little margin for error, especially considering ongoing risks around scalability, industry headwinds, and unproven profitability pathways.

- Consensus highlights that share price upside is capped in the near term unless recurring revenue ramps up quickly or margins improve significantly.

- The market is currently pricing in a substantial future turnaround, so any further disruption or slower-than-projected SaaS growth could put pressure on the stock toward the DCF fair value.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for SmartRent on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the data that others might miss? Share your unique angle and build your own narrative in just minutes. Do it your way

A great starting point for your SmartRent research is our analysis highlighting 1 important warning sign that could impact your investment decision.

See What Else Is Out There

SmartRent’s struggle with unproven profitability, falling revenue, and a share price that is above fair value leaves limited near-term upside and significant risk.

If you want to target companies that appear meaningfully undervalued relative to their growth prospects, check out these 837 undervalued stocks based on cash flows for fresh opportunities fitting your requirements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com