Can Middlesex Water’s (MSEX) 53rd Dividend Hike Reveal More About Its Long-Term Capital Priorities?

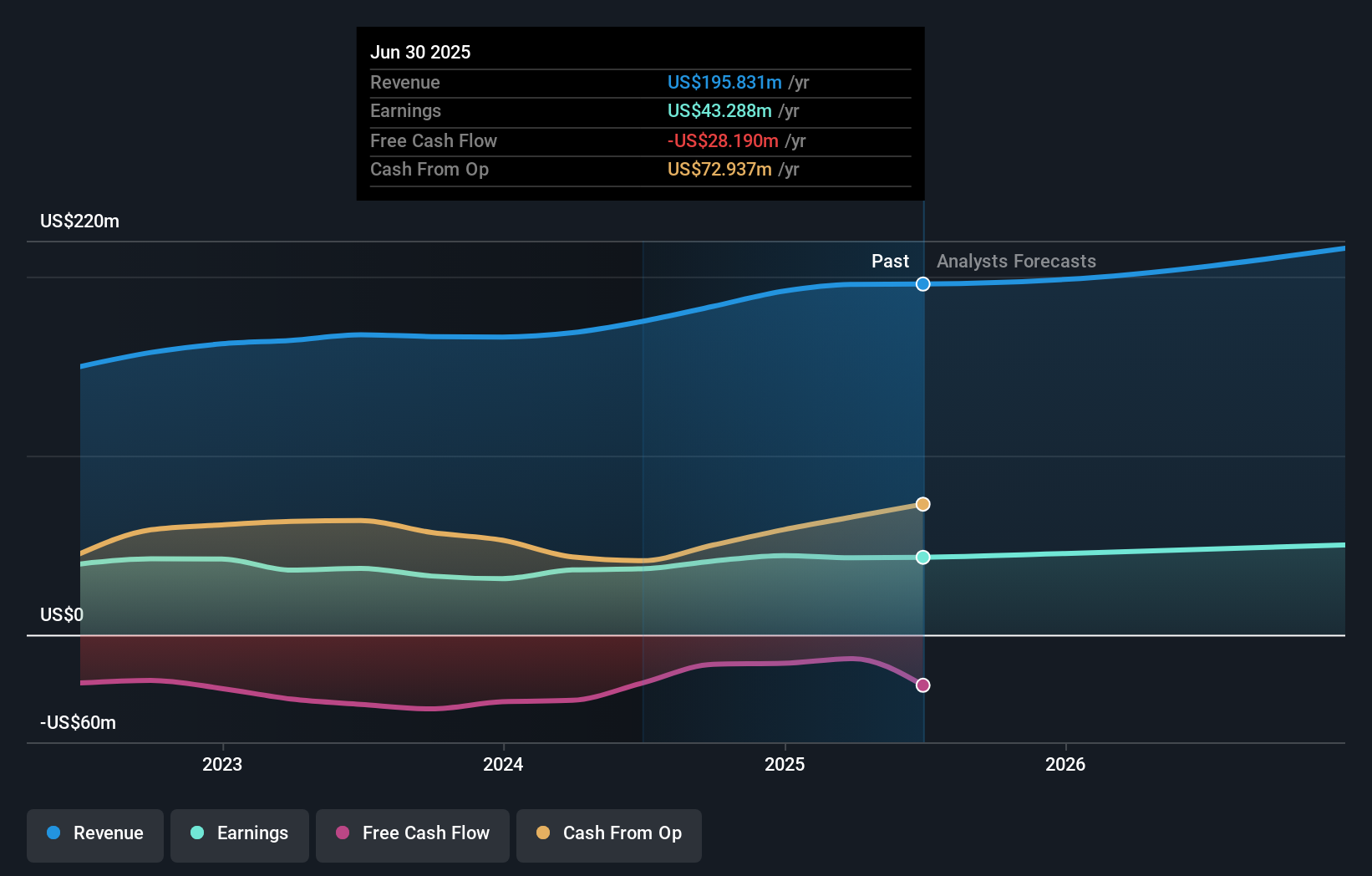

- Middlesex Water Company recently reported third quarter 2025 earnings showing net income of US$13.96 million on sales of US$54.09 million, alongside a declared quarterly dividend increase to US$0.36 per share.

- This marks the company's 53rd consecutive year of raising dividends, underlining its continued emphasis on returning value to shareholders despite slightly lower earnings compared to the previous year.

- We'll explore how the latest dividend increase shapes Middlesex Water's broader investment narrative and signals stability in its shareholder approach.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Middlesex Water's Investment Narrative?

To get comfortable owning Middlesex Water, an investor really needs to buy into the company’s reliability, specifically, its track record of consistent dividends and stable operations. The latest dividend increase, marking 53 consecutive years, fits this narrative and signals strong confidence from management even though earnings were slightly lower compared to last year. For most shareholders, this upward revision in dividend policy likely outweighs modest short-term revenue softness, especially given the company’s focus on critical infrastructure projects like the US$9.7 million water upgrade in Woodbridge. However, the news doesn’t seem to materially alter the near-term catalysts or risks. Key risks such as slower earnings and revenue growth forecasts versus market averages, coverage concerns around the dividend, and a relatively high share price compared to both fair value estimates and broad industry ratios remain. The recent earnings and dividend news may reinforce stability, but underlying growth and valuation questions are still very much in play.

Yet, those dividend sustainability and growth concerns could become more relevant if market trends shift.

Exploring Other Perspectives

Explore another fair value estimate on Middlesex Water - why the stock might be worth as much as $38.42!

Build Your Own Middlesex Water Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Middlesex Water research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Middlesex Water research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Middlesex Water's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com