Investors Title (ITIC) Margin Rebound Challenges Persistent Bearish Narratives on Profit Trends

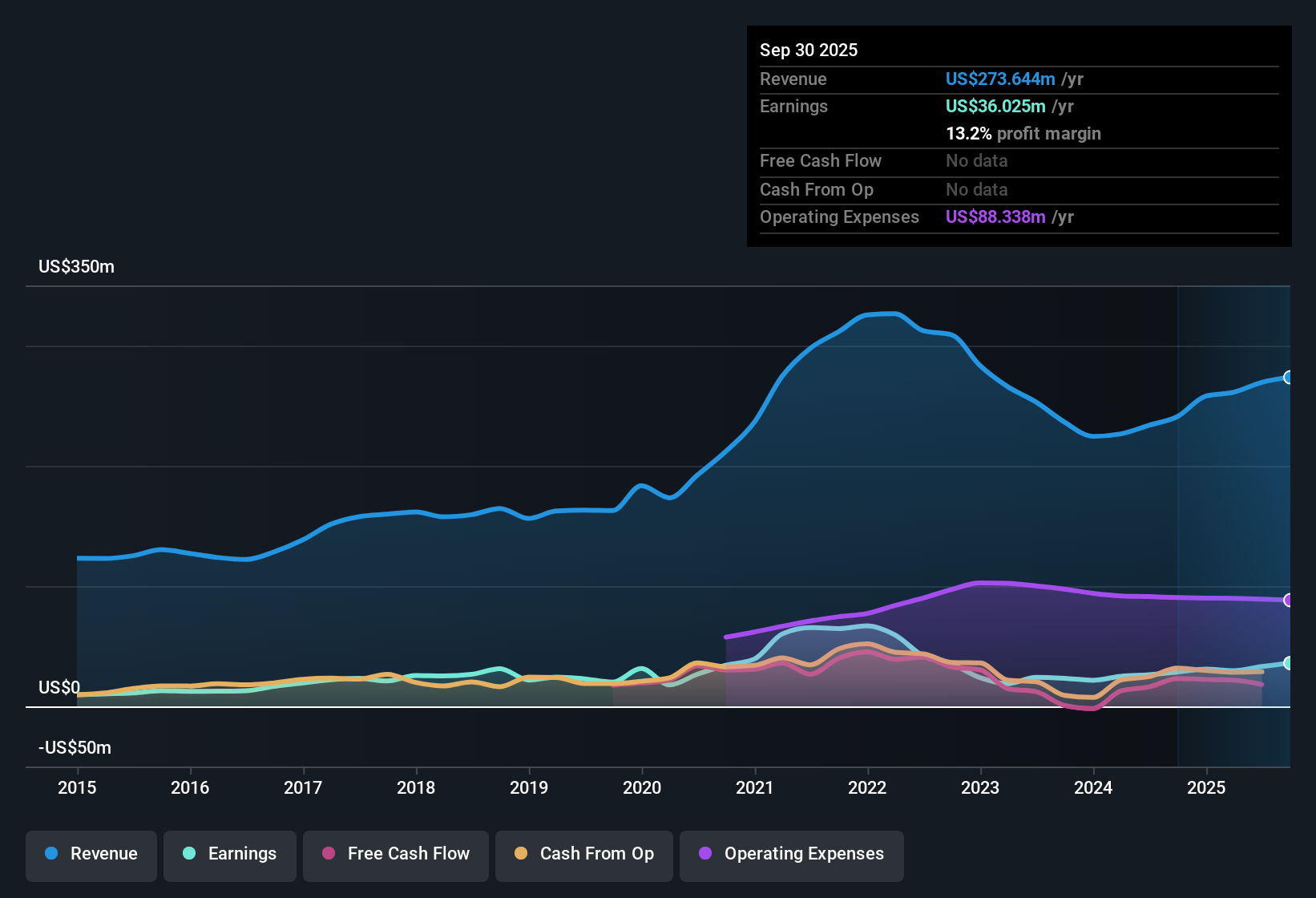

Investors Title (ITIC) reported a net profit margin of 13.2%, topping last year’s 11.8%, with annual earnings growth coming in at 26.2%. This turnaround stands out after a five-year period in which earnings had declined by an average of 16.1% per year, even as the company’s earnings remain classified as high quality. Investors now face a balance between the sharp recent recovery in margins and the stock’s relatively high valuation compared to both peers and the wider US insurance sector.

See our full analysis for Investors Title.Next, we will see how these headline numbers measure up against the most widely held narratives for Investors Title, so you can see which stories the earnings confirm and which might need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Rebound Contrasts With 5-Year Decline

- Over the past five years, Investors Title's earnings declined by an average of 16.1% annually. This stands in sharp contrast to the recent 26.2% growth and the current 13.2% net profit margin.

- Bulls point to the recovery in profitability as evidence of the company's resilience, but some tension remains as the longer-term trend tells a more muted story:

- The current margin improvement is significant. However, the sustained long-term deterioration explains why investors remain cautious.

- The high-quality classification for earnings adds some durability, though the magnitude of the prior multi-year declines means optimism is balanced with skepticism.

Premium Valuation Exceeds Peer Average

- The stock is priced at a 14.8x price-to-earnings ratio, which is notably higher than both the 9.3x average for peers and the 13.6x average for the wider US insurance industry. Shares are currently trading at $282.90.

- While recent results appear strong, investors may struggle to justify the premium without continued outperformance:

- The share price exceeding the estimated DCF fair value of $258.67 suggests that the stock is considered pricey even by conservative valuation methods.

- The combination of historical profit declines and a higher multiple makes it a challenge for those expecting the stock to re-rate even higher without new catalysts.

Dividend Sustainability Draws Scrutiny

- The sustainability of Investors Title’s dividend is flagged as a key risk, given long-term earnings pressure despite some annual growth periods.

- The narrative around income reliability is called into question by the numbers:

- The company's reputation as a steady payer appeals to risk-averse investors, but extended periods of earnings decline suggest less cushion for supporting consistent dividends during downturns.

- Ongoing evaluation of payout ability is warranted since the recent uptick does not fully erase concerns from the multi-year trend.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Investors Title's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite a recent rebound, Investors Title faces lingering concerns about its premium valuation and the sustainability of both its growth and dividends.

If premium pricing and valuation risks give you pause, check out these 836 undervalued stocks based on cash flows to quickly spot companies trading at more attractive prices with upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com