Are Genworth Financial's (GNW) Operational Metrics Hinting at a Shift in Core Business Focus?

- Genworth Financial recently announced its third quarter results, reporting net income of US$116 million and adjusted earnings of 4 cents per share after excluding non-recurring gains.

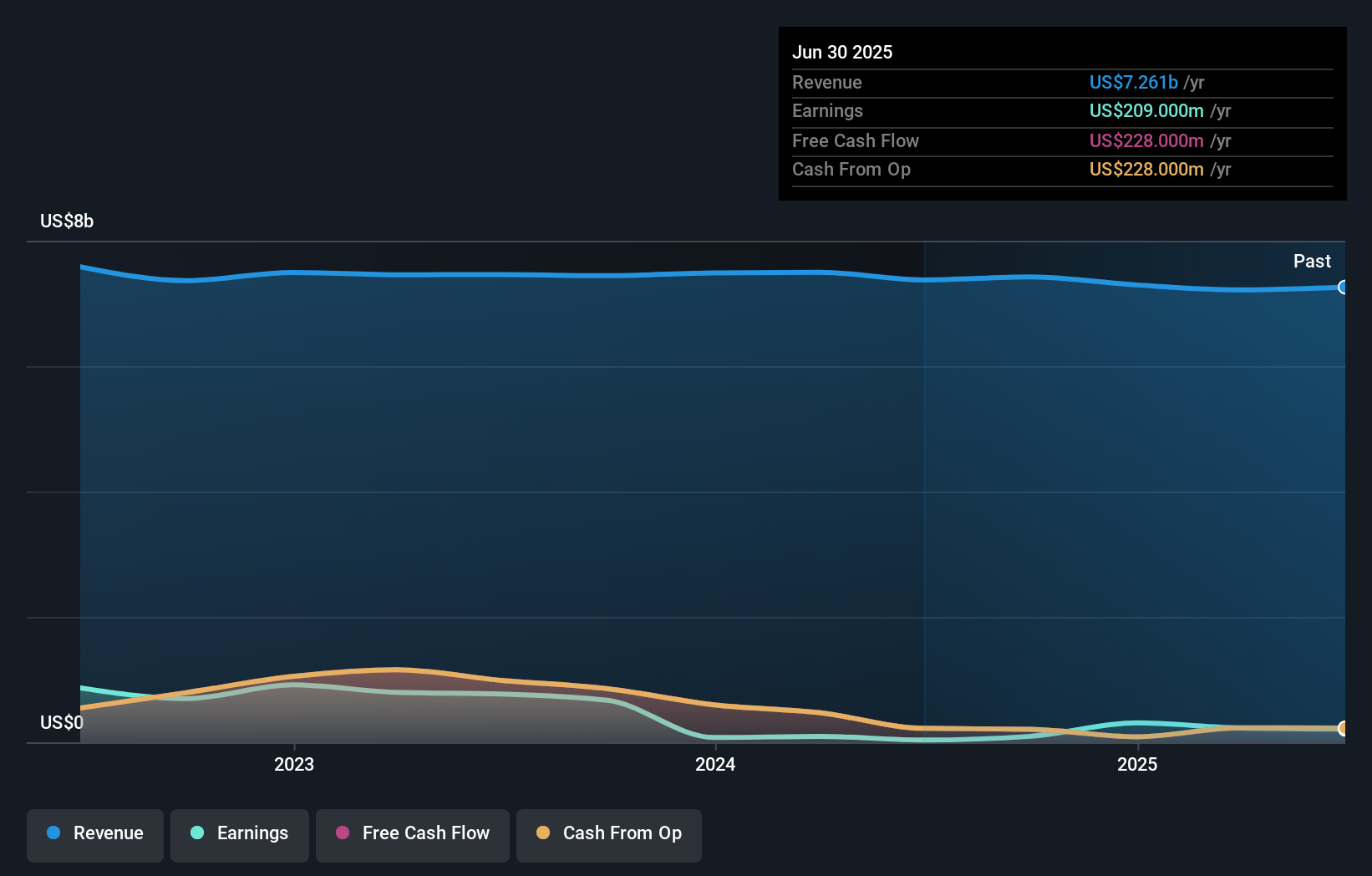

- An interesting detail is that the company’s adjusted revenue for the period was US$1.78 billion, reflecting a focus on core operational performance.

- We'll explore how Genworth's emphasis on adjusted earnings and operational metrics influences its current investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Genworth Financial's Investment Narrative?

For anyone considering Genworth Financial, the core narrative hinges on the company’s ability to sustain operational stability and deliver consistent profitability despite its recent earnings volatility. The third-quarter update, with net income of US$116 million and adjusted earnings of just 4 cents per share, underlines this ongoing transition, coming after a previous quarter of softer results and activist investor pressure. The active share buyback and dividend programs suggest management’s focus on shareholder returns, but the sharp drop in adjusted earnings increases questions about near-term profit resilience. While the headline Q3 results don’t appear to materially shift the larger risks or catalysts, they do reinforce the central debate: whether Genworth’s restructuring and renewed operational focus can counteract long-running challenges like profit variability and governance changes. The recent news event fits in as a further datapoint highlighting that these issues remain front and center for investors.

But keep in mind, investor activism and governance uncertainties could suddenly reshape the outlook. Genworth Financial's shares are on the way up, but they could be overextended by 31%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on Genworth Financial - why the stock might be worth 26% less than the current price!

Build Your Own Genworth Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genworth Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Genworth Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genworth Financial's overall financial health at a glance.

No Opportunity In Genworth Financial?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com