How Softer Cement Demand and Economic Turmoil at Loma Negra (LOMA) Has Changed Its Investment Story

- Loma Negra reported a 12.1% decline in net sales for the third quarter of 2025, largely caused by weaker demand in its cement segment amid ongoing political and economic instability in Argentina.

- The company responded by issuing a new Class 5 Corporate Bond in July to manage upcoming debt maturities, and management expressed optimism that recent election results could help stabilize the operating environment going forward.

- We'll examine how softer cement demand and external headwinds now affect Loma Negra's previously optimistic investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Loma Negra Compañía Industrial Argentina Sociedad Anónima Investment Narrative Recap

At its core, Loma Negra’s investment appeal has always hinged on a recovery in Argentine construction and infrastructure, underpinned by stable cement demand and the company’s financial resilience. The recent 12.1% drop in Q3 net sales highlights the fragility of this narrative, with softer cement demand now weighing heavily on the short-term outlook, while persistent macroeconomic volatility remains the biggest risk to watch. For now, this latest sales decline is a material reminder of how dependent results are on Argentina’s broader stability.

Among recent announcements, the July issuance of a new Class 5 Corporate Bond stands out as especially relevant: it points to management’s ongoing efforts to refinance upcoming debt obligations amid uncertainty. While this move provides some near-term financial breathing room, it does not fully mitigate risk from margin compression or currency devaluation, both of which remain tied to Argentina’s unpredictable economic and political conditions.

Yet despite signs of a turnaround following election results, investors should be aware of currency and refinancing risks that could suddenly...

Read the full narrative on Loma Negra Compañía Industrial Argentina Sociedad Anónima (it's free!)

Loma Negra Compañía Industrial Argentina Sociedad Anónima is projected to reach ARS 956.1 billion in revenue and ARS 155.6 billion in earnings by 2028. This outlook assumes a 12.7% annual revenue growth rate and an increase in earnings of ARS 103.8 billion from the current level of ARS 51.8 billion.

Uncover how Loma Negra Compañía Industrial Argentina Sociedad Anónima's forecasts yield a $14.82 fair value, a 38% upside to its current price.

Exploring Other Perspectives

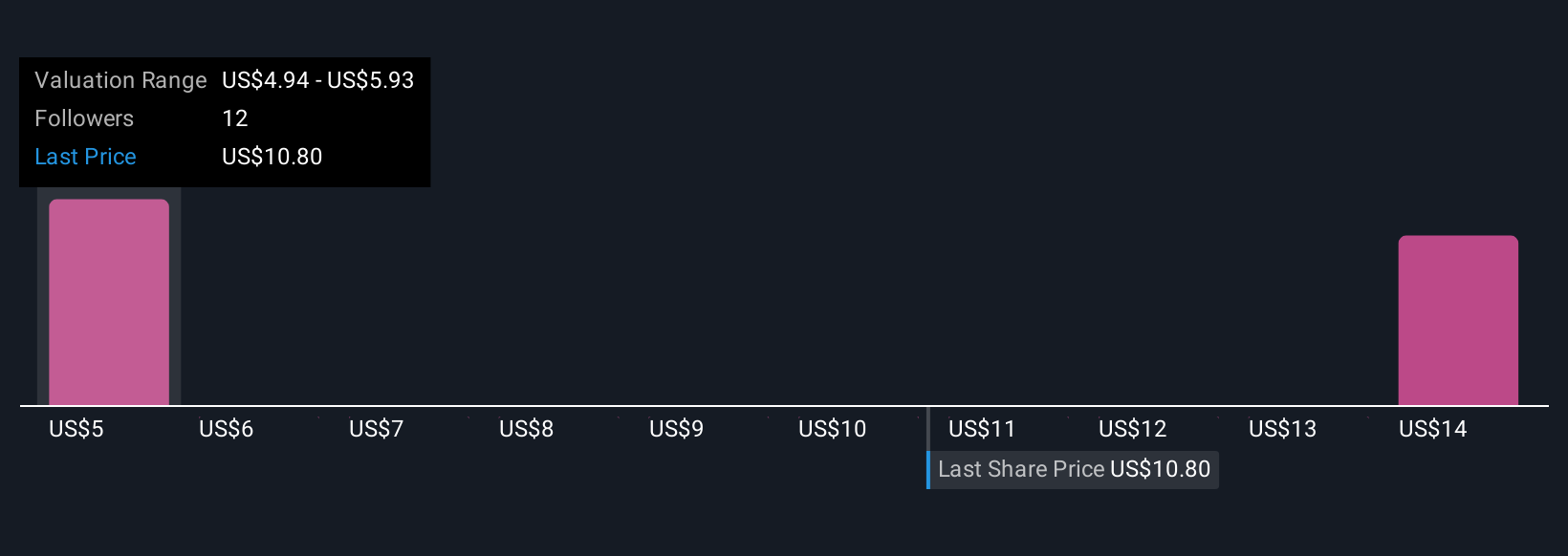

Three Simply Wall St Community members assigned Loma Negra fair values ranging from ARS 4.84 to ARS 14.82 per share. With recent sales pressures and refinancing needs top of mind for the market, these differing outlooks show just how much company performance and expectations can shift when external conditions are in flux, explore other investor perspectives for a fuller view.

Explore 3 other fair value estimates on Loma Negra Compañía Industrial Argentina Sociedad Anónima - why the stock might be worth less than half the current price!

Build Your Own Loma Negra Compañía Industrial Argentina Sociedad Anónima Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Loma Negra Compañía Industrial Argentina Sociedad Anónima research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Loma Negra Compañía Industrial Argentina Sociedad Anónima research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Loma Negra Compañía Industrial Argentina Sociedad Anónima's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com