The Bull Case For TAL Education Group (TAL) Could Change Following Strong Q2 Earnings and Share Buyback

- On October 30, 2025, TAL Education Group reported strong second-quarter results, with sales reaching US$861.35 million and net income at US$124.08 million, alongside completing a share repurchase of 4,195,065 shares for US$134.7 million.

- The significant year-over-year growth in both revenue and earnings highlights improved operational performance and growing demand for TAL’s educational services.

- We’ll analyze how TAL’s robust earnings growth and completed buyback shape the company’s updated investment narrative and outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

TAL Education Group Investment Narrative Recap

To be a TAL Education Group shareholder, you typically need to believe in the company's ability to expand its role in China's evolving education sector, leveraging technology and a wide product portfolio to drive earnings. The recent combination of strong quarterly results and a completed share buyback is encouraging, but these do not significantly alter the most important short-term catalyst: ongoing growth in the AI-driven learning device segment. The primary risk remains the segment's continued operating losses, which still put pressure on overall margins.

Of the recent company announcements, the completion of the US$134.7 million share buyback most directly relates to shareholder value, as it reduces share count and can support earnings per share growth. Still, while this move may signal confidence in the business, it does not directly address uncertainty around achieving profitability in high-growth but loss-making segments like smart learning devices.

Yet, investors should be aware that increased investment in sales and marketing, now over 30% of revenues, could quickly become problematic if revenue growth slows...

Read the full narrative on TAL Education Group (it's free!)

TAL Education Group's outlook anticipates $4.5 billion in revenue and $395.9 million in earnings by 2028. This is based on a projected annual revenue growth rate of 22.8% and a $291.4 million increase in earnings from the current $104.5 million.

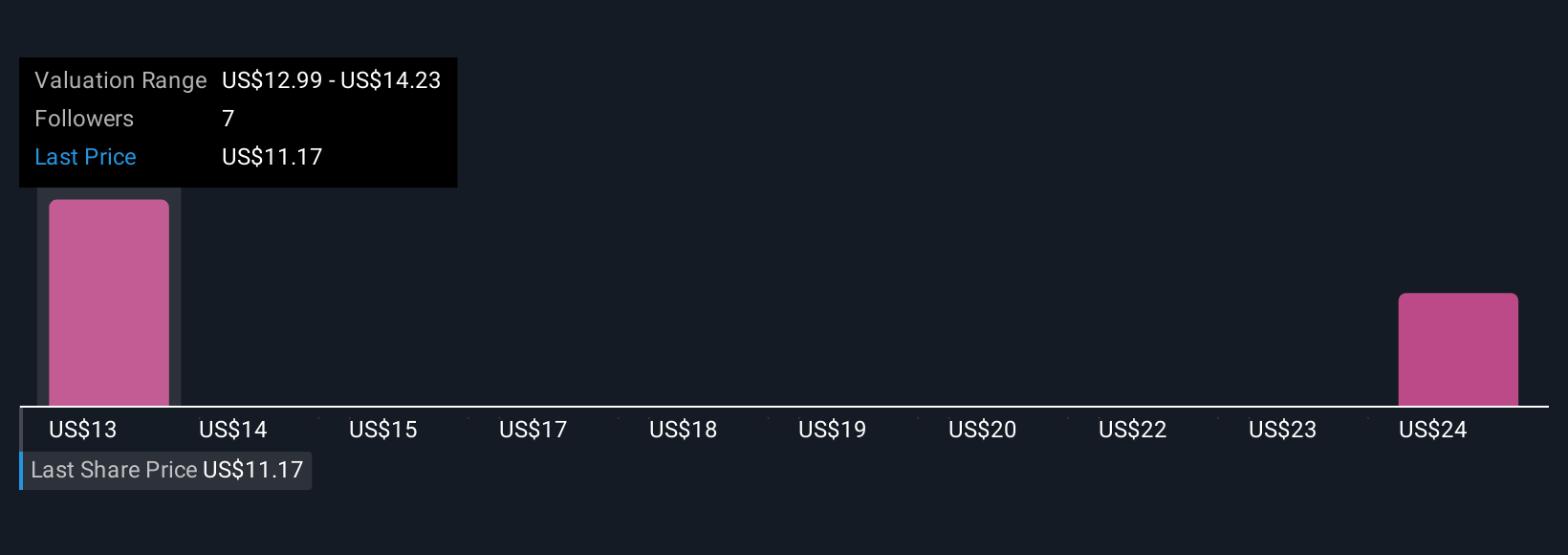

Uncover how TAL Education Group's forecasts yield a $13.96 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for TAL Education Group, ranging widely from US$13.96 to US$31.68 per share. While this spread shows investor opinions are far apart, TAL's sizable investments in product innovation and channel expansion raise questions about how quickly these efforts will translate to sustained margin improvement.

Explore 2 other fair value estimates on TAL Education Group - why the stock might be worth over 2x more than the current price!

Build Your Own TAL Education Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TAL Education Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free TAL Education Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TAL Education Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com