How Alexander & Baldwin’s New Term Loan and Higher Guidance May Shape ALEX’s Investment Outlook

- Alexander & Baldwin, Inc. recently amended its US$450 million revolving credit facility, adding a new term loan facility of up to US$200 million, and raised its 2025 earnings guidance to a range of US$0.95 to US$1 per diluted share.

- These developments point to a focus on both financial flexibility and growth opportunities, particularly as the company actively searches for acquisitions in Hawaii’s competitive investment market.

- Let's examine how the creation of this new term loan facility might influence Alexander & Baldwin’s longer-term investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Alexander & Baldwin Investment Narrative Recap

To be a shareholder in Alexander & Baldwin, an investor needs to believe in the unique supply-demand dynamics of Hawaii’s real estate market and the company’s ability to leverage its dominant local position for steady income growth. The recent amendment to the revolving credit facility, adding up to US$200 million in term loan capacity, is focused on financial flexibility and may support near-term acquisition activity; however, it does not materially alter the most important catalyst, A&B’s capacity to redeploy capital into high-yielding Hawaii assets, or minimize its reliance on the state’s economy, which remains the biggest risk.

Of the recent announcements, the ongoing search for acquisitions stands out as most relevant. This aligns directly with the new term loan facility, which could allow Alexander & Baldwin to act quickly on new opportunities in Hawaii’s tight and highly competitive investment market, sharpening the focus on transaction-driven growth as a short-term catalyst given heightened deal volume on the islands this year.

However, investors should be aware that if tourism or the broader Hawaiian economy were to falter...

Read the full narrative on Alexander & Baldwin (it's free!)

Alexander & Baldwin is projected to generate $174.8 million in revenue and $40.7 million in earnings by 2028. This forecast reflects a 9.8% annual revenue decline and a decrease of $37.8 million in earnings from the current $78.5 million.

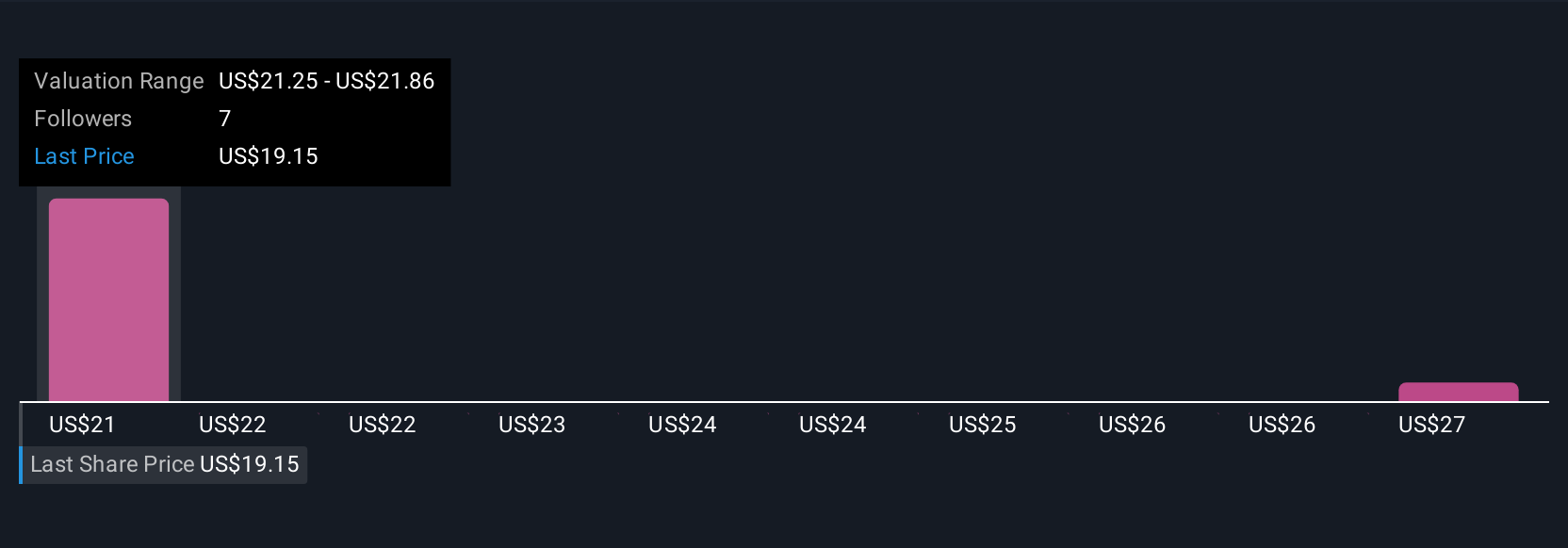

Uncover how Alexander & Baldwin's forecasts yield a $21.25 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for Alexander & Baldwin, ranging from US$21.25 to US$26.36 per share. While some see value upside, persistent dependence on Hawaii’s local market highlights how shifts in demand can rapidly influence future returns, making it vital to explore several perspectives before drawing conclusions.

Explore 2 other fair value estimates on Alexander & Baldwin - why the stock might be worth as much as 70% more than the current price!

Build Your Own Alexander & Baldwin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alexander & Baldwin research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Alexander & Baldwin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alexander & Baldwin's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com