AptarGroup (ATR): Evaluating Valuation After Strong Q3 Earnings and Fresh Buyback Update

AptarGroup (ATR) just released its third quarter results, revealing healthy year-over-year gains in both sales and net income. Stronger earnings per share stood out, giving investors a bit more to consider this quarter.

See our latest analysis for AptarGroup.

Beyond solid earnings, AptarGroup’s recent buyback update added to the mix, but stronger quarterly results have been the real driver. Even so, shares are still down sharply, with a 1-year total shareholder return of -33%. This reinforces that momentum has faded despite healthy operations in the background.

If you’re looking for more ideas beyond AptarGroup’s latest numbers, now’s a great time to branch out and discover fast growing stocks with high insider ownership

With shares trading nearly 29% below intrinsic value estimates despite improved fundamentals, the question for investors becomes clear: is this an overlooked opportunity, or is the market wisely discounting AptarGroup’s growth prospects ahead?

Most Popular Narrative: 31.9% Undervalued

With AptarGroup’s last close at $116.22, the most closely followed narrative calculates a fair value at $170.71, setting up a notable gap to watch. As the narrative weighs in, a few major drivers come sharply into focus.

Ongoing investments in innovation, such as next-generation nasal and derma dispensing systems and expansion into active material sciences, are anticipated to capture share in both pharmaceuticals and high-growth dermacosmetic markets. This strengthens AptarGroup's market leadership and supports long-term top-line growth.

Want to know why analysts think AptarGroup’s future could rival the tech elite? The secret is in bold revenue growth assumptions and a profit multiple that defies industry norms. Curious which projections push its fair value sky-high? Get the inside track on the big numbers driving this premium.

Result: Fair Value of $170.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing legal expenses and unpredictable demand for key pharmaceutical delivery systems could easily undermine the bullish outlook presented in current forecasts.

Find out about the key risks to this AptarGroup narrative.

Another View: Is the Market Multiple Telling a Different Story?

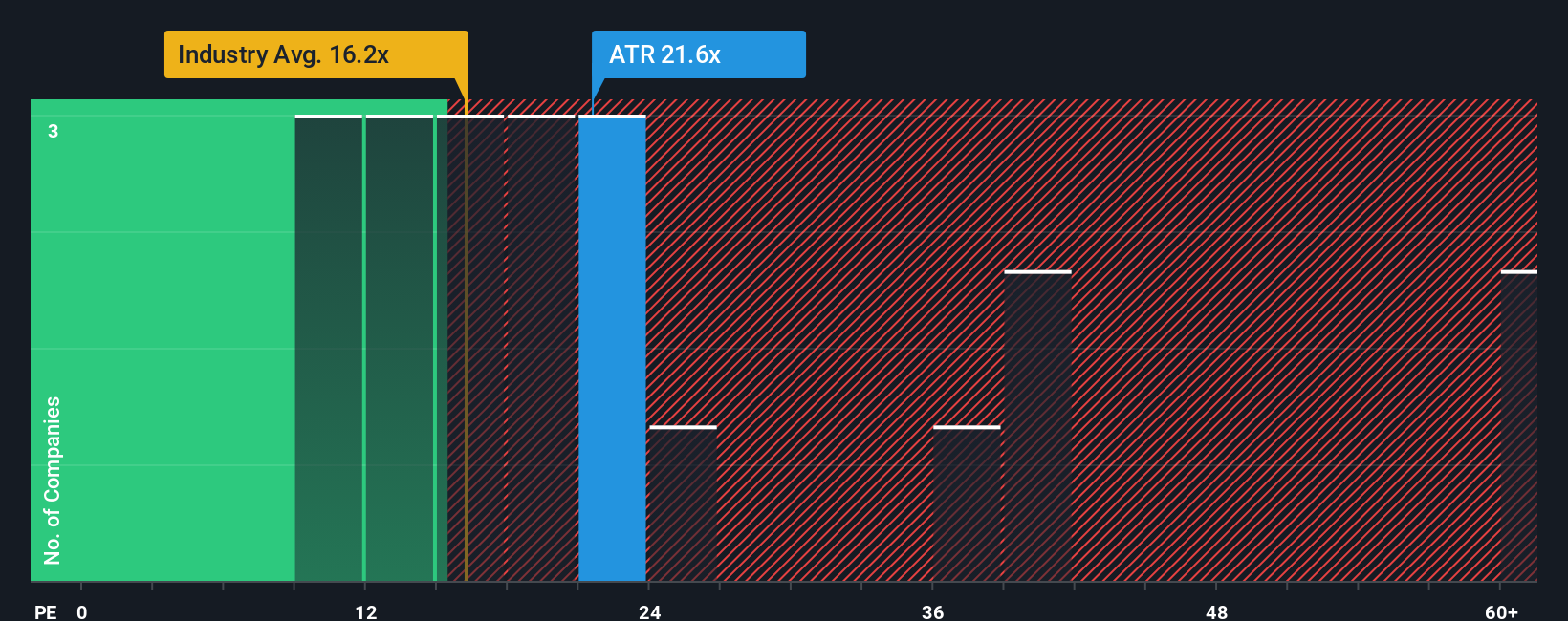

Looking from a market perspective, AptarGroup’s current price-to-earnings ratio sits at 18.2x, which is just below the North American industry average of 18.7x. However, it is higher than the fair ratio calculated at 16.6x. This means shares may not have as much cushion as the discounted cash flow outlook suggests. Could the market be pricing in more risk than growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AptarGroup Narrative

If you see things differently or want your own perspective, you can dig into the numbers and shape your personal narrative in just a few minutes: Do it your way

A great starting point for your AptarGroup research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready to Supercharge Your Watchlist?

Don’t limit your investment search. Take advantage of unique opportunities just waiting to be found on Simply Wall Street. New trends and performance leaders are making headlines every day, so acting now keeps you ahead of the curve.

- Unlock tomorrow’s winning companies by screening for value and access these 870 undervalued stocks based on cash flows that are trading below their estimated intrinsic worth.

- Pounce on explosive growth as you scan these 24 AI penny stocks shaping entire industries through artificial intelligence and automation breakthroughs.

- Grow your passive income and boost your portfolio with steady returns by sorting for these 16 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com