PC Connection (CNXN): Evaluating Valuation Following Q3 Results, Dividend Commitment, Buybacks, and M&A Updates

PC Connection (CNXN) attracted investor interest after delivering several updates. These included its third quarter earnings report, a continued dividend commitment, progress on share buybacks, and an ongoing search for strategic acquisitions.

See our latest analysis for PC Connection.

Despite the steady drumbeat of news, including ongoing buybacks, a maintained dividend, and active M&A scouting, PC Connection’s share price has struggled to gain momentum, slipping over 15% year-to-date. The stock’s total shareholder return paints a mixed picture, with longer-term investors still ahead thanks to a 17% three-year and 31% five-year total return. However, recent sentiment clearly remains cautious.

If you’re weighing fresh opportunities in the market, this could be an ideal moment to widen your search and discover fast growing stocks with high insider ownership

With shares now trading at a significant discount to analyst price targets and a history of solid returns, the question stands: is CNXN undervalued at these levels, or is the market already anticipating the company’s next move?

Most Popular Narrative: 23.6% Undervalued

PC Connection’s last close of $58.08 stands well below the most tracked narrative’s fair value estimate of $76. The narrative frames this gap as an opportunity if expected market shifts play out as projected.

Strong customer backlog and pipeline, especially in advanced technologies such as AI, data center modernization, edge AI, and AI-enabled endpoints, positions the company to capture incremental revenue as organizations increase investments in complex IT infrastructure upgrades and digital transformation initiatives.

Which underlying growth levers pushed the narrative to that high target? The numbers depend on bold profit and margin improvements, but the precise details are reserved for those who explore the full story. Wondering which financial assumptions truly separate this fair value from the current share price? Dive in to uncover what is really powering the narrative’s valuation math.

Result: Fair Value of $76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on hardware resales and pressure on gross margins could undermine long-term profitability if industry shifts accelerate more quickly than expected.

Find out about the key risks to this PC Connection narrative.

Another View: Multiples Tell a Cautious Story

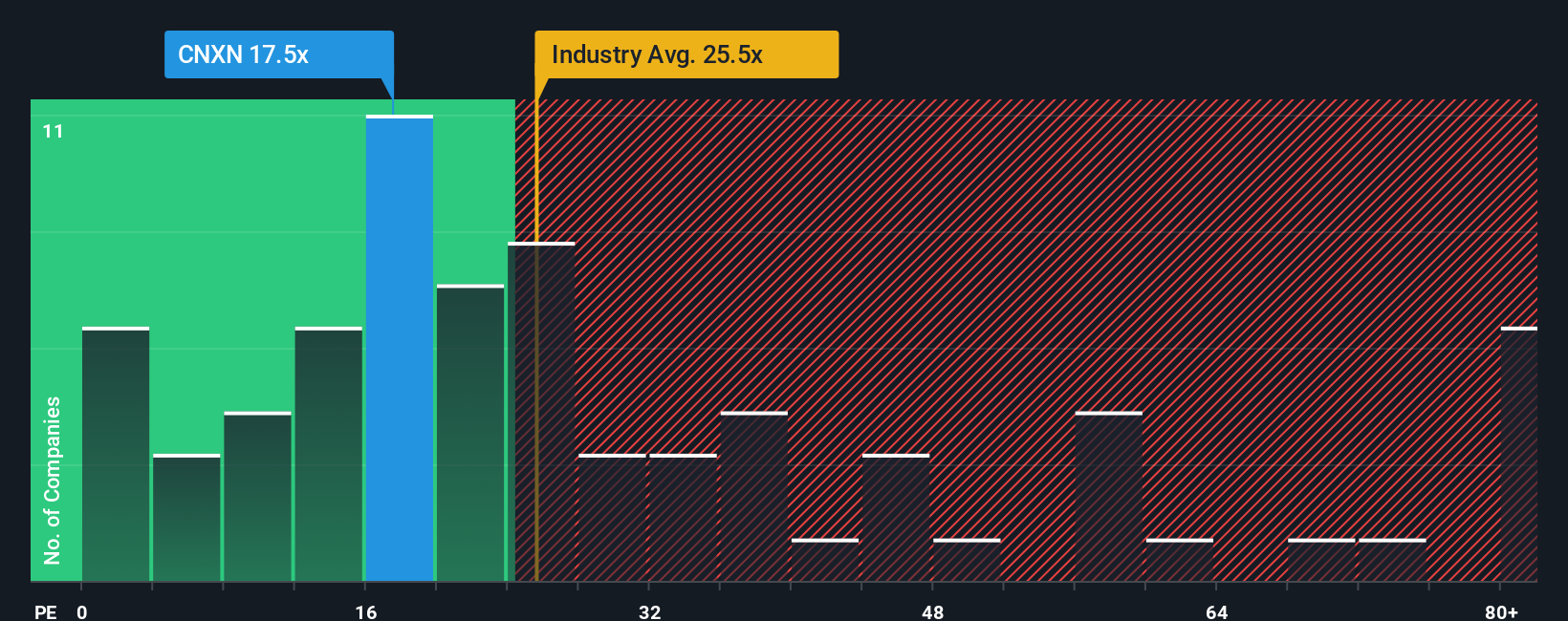

While the leading narrative points to undervaluation, looking at PC Connection’s valuation through its price-to-earnings ratio tells a different story. At 17.5x, the ratio is above the peer average of 16.4x, but below the broader US Electronic industry average of 24.9x and still under the fair ratio of 20.8x.

This suggests the market may be pricing in some caution, despite the apparent room for upside. Could market expectations shift closer to the fair ratio, or is there a risk that recent challenges will keep a lid on the shares?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PC Connection Narrative

If you see the story differently or want to put your own analysis to the test, building a personalized narrative takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding PC Connection.

Looking for more investment ideas?

Great investors never wait around for just one opportunity. Spark your portfolio with bold ideas by using the Simply Wall Street Screener and unlock your next big winner.

- Supercharge your hunt for the next breakthrough by checking out these 24 AI penny stocks for opportunities to invest in companies driving artificial intelligence forward.

- Catch steady income opportunities when you browse these 16 dividend stocks with yields > 3%, featuring stocks with solid dividends and robust yields.

- Tap into the future of finance with these 82 cryptocurrency and blockchain stocks to pinpoint businesses at the core of blockchain and cryptocurrency innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com