Dividend Hike Amid Weak Earnings Might Change the Case for Investing in UFP Industries (UFPI)

- On October 23, 2025, UFP Industries' Board of Directors approved a quarterly cash dividend of US$0.35 per share, a 6% year-over-year increase, payable December 15, with third quarter earnings revealing declines in both sales and net income compared to the prior year.

- Despite recent earnings pressures, UFP Industries continued to return capital to shareholders through a higher dividend and completion of a US$291 million share repurchase program.

- We'll explore how the increased dividend, despite weaker earnings, could impact UFP Industries’ longer-term investment outlook and narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

UFP Industries Investment Narrative Recap

UFP Industries shareholders typically buy into a belief in resilient US housing and construction demand, ongoing product innovation and a margin-focused strategy. The recent dividend increase, despite year-over-year declines in both sales and net income, is unlikely to materially shift what remains the key near-term catalyst: the pace of recovery in US housing and construction end markets. The biggest current risk is continued cyclicality and pricing pressure in these same segments, which could further impact volumes and profitability if underlying market weakness persists.

Among recent company actions, completion of the US$291 million share repurchase program stands out as particularly relevant. This initiative, paired with the dividend increase, shows the company deploying capital to support shareholder returns at a time of earnings softness, while giving management flexibility to adjust strategies as demand conditions evolve.

Yet despite the ongoing return of capital, investors should be aware that continued soft demand in key construction segments could...

Read the full narrative on UFP Industries (it's free!)

UFP Industries' outlook projects $7.1 billion in revenue and $443.8 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 2.8% and an $109.6 million increase in earnings from the current $334.2 million.

Uncover how UFP Industries' forecasts yield a $113.17 fair value, a 23% upside to its current price.

Exploring Other Perspectives

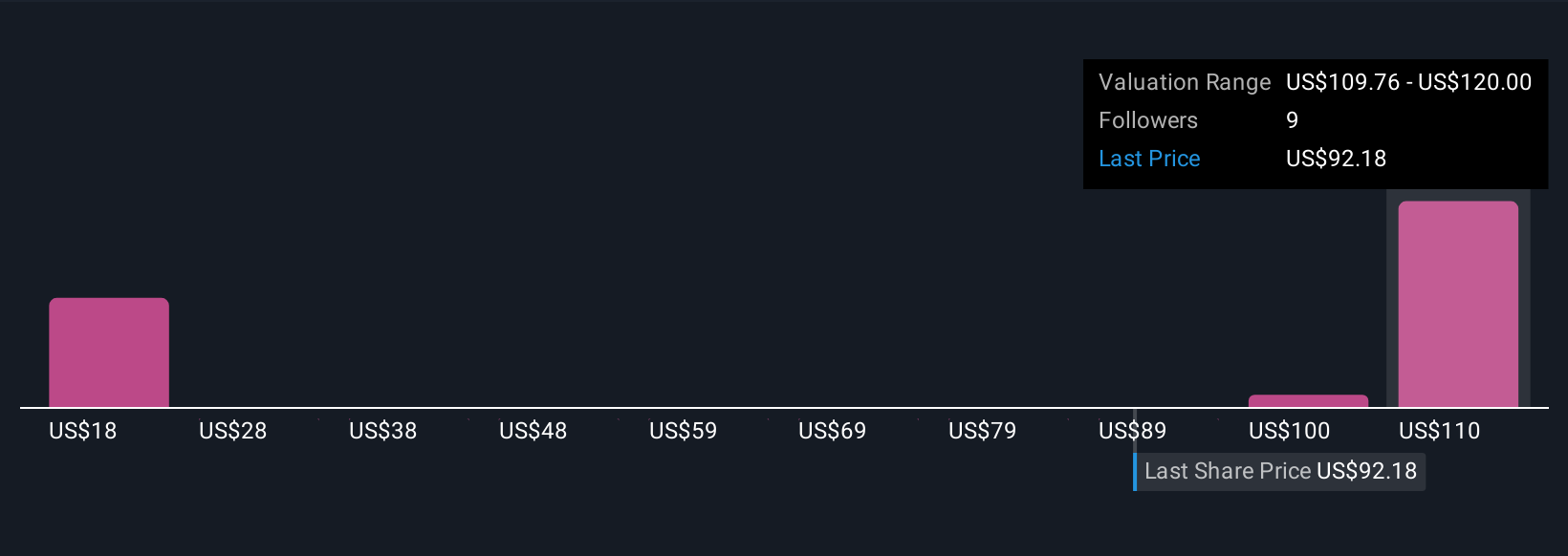

With fair value estimates from the Simply Wall St Community spanning from US$67.74 to US$120 based on four individual models, opinions on UFP Industries’ worth vary widely. These contrasting views reflect how ongoing end market risks and broader economic shifts may weigh on future performance, inviting readers to compare the range of potential scenarios.

Explore 4 other fair value estimates on UFP Industries - why the stock might be worth 26% less than the current price!

Build Your Own UFP Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UFP Industries research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free UFP Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UFP Industries' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com