Black Hills (BKH): Assessing Valuation Following Analyst Upgrades on Data Center Growth and Infrastructure Expansion

Black Hills (BKH) shares moved higher after the company drew a series of analyst upgrades, with recent attention focused on major data center projects and its expanding infrastructure initiatives. The buzz centers on operational momentum and growing demand from large customers.

See our latest analysis for Black Hills.

After a period of sluggishness, Black Hills’ share price has surged nearly 20% year-to-date. This reflects renewed optimism as the company advances large-scale data center projects and completes a series of rate review wins. The one-year total shareholder return is nearly 17%, indicating that recent momentum is building as investors look for earnings growth from both traditional and new infrastructure initiatives.

If this kind of shift in sentiment has you wondering where else opportunity might be taking off, now’s a smart time to broaden your investing search and discover fast growing stocks with high insider ownership

With shares trading near recent highs after analyst upgrades and infrastructure wins, investors are left asking whether Black Hills is still undervalued or if the expected growth is fully reflected in today’s price.

Most Popular Narrative: 5% Undervalued

With Black Hills trading at $69.72 and the most-followed fair value estimate now pegged at $73.50, the latest widely accepted narrative suggests there is still room for upside. Expectations hinge on accelerating capital projects and a bigger earnings base after the planned merger.

The combination of grid modernization, enhanced resiliency initiatives, and the ability to attract tech customers in regulated territories positions Black Hills to benefit from sustainable financing advantages. This could potentially lower capital costs and further improve capital efficiency and future earnings generation.

Want to know the blueprint behind this bullish outlook? The real surprise lies in the bold growth projections and a future profit multiple rarely seen in its sector. Which catalysts and financial leaps make up this fair value? Click through now to unravel the drivers behind the price target.

Result: Fair Value of $73.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy capital investment demands and unforeseen shifts in tech customer demand could challenge Black Hills’ growth projections and potentially disrupt the optimistic narrative.

Find out about the key risks to this Black Hills narrative.

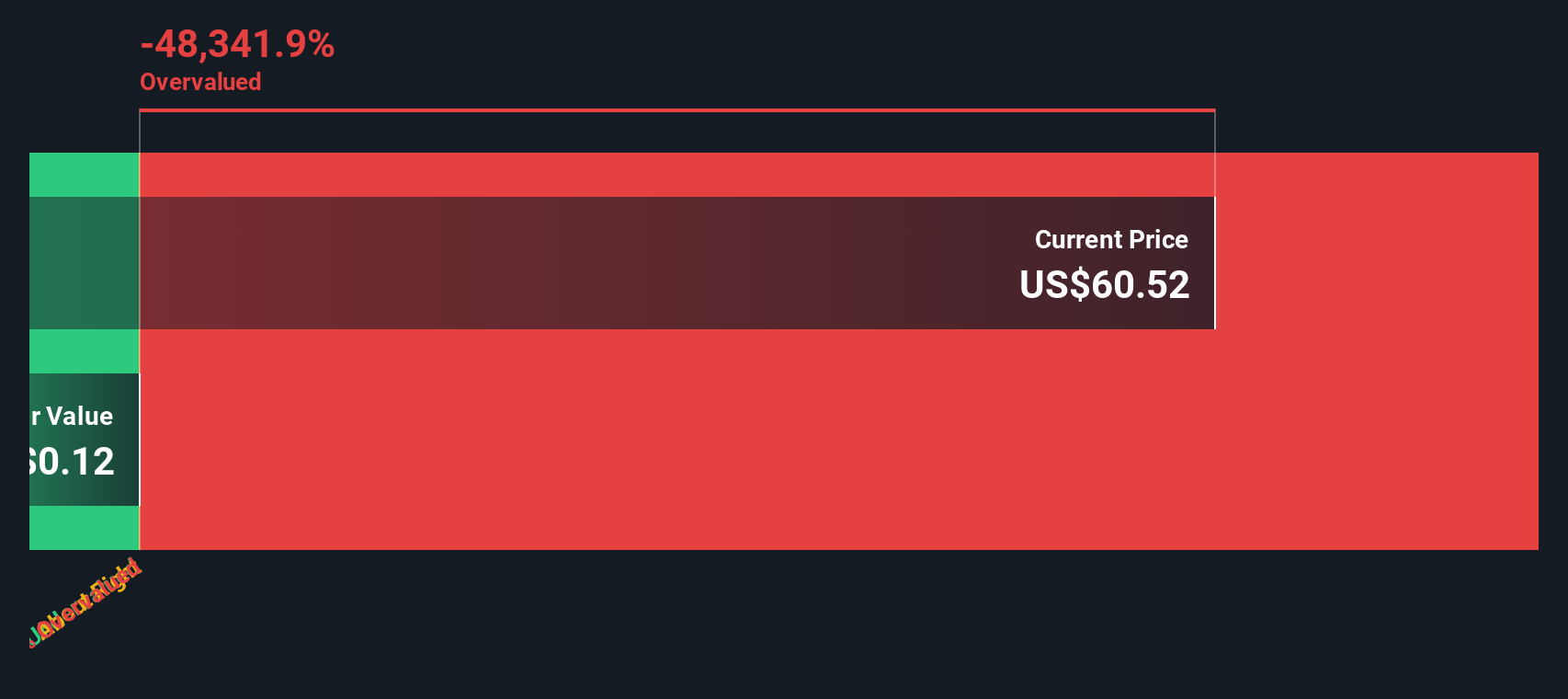

Another View: Discounted Cash Flow Model

For a different perspective, the SWS DCF model suggests Black Hills might actually be trading well above its fair value estimate right now. While the market is focused on near-term earnings and peer comparisons, the DCF approach highlights possible long-term valuation risks if aggressive growth does not materialize.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Black Hills for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Black Hills Narrative

If you want to challenge these conclusions or prefer to dive into the numbers on your own terms, you can shape your perspective in just a few minutes by using the following option: Do it your way

A great starting point for your Black Hills research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one winning stock. Expand your opportunities and shorten your search time with these top picks hand-selected to match your strategy.

- Start earning while you invest by tapping into attractive yields with these 16 dividend stocks with yields > 3% featuring robust companies offering dividends above 3%.

- Join the artificial intelligence transformation and gain an edge by reviewing these 25 AI penny stocks packed with innovators driving the next era of growth.

- Grab tomorrow’s potential at today’s prices by targeting these 881 undervalued stocks based on cash flows that stand out for solid fundamentals and notable upside. Don’t miss these rare gems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com