Did Nine-Month Earnings Softness Just Shift California Water Service Group's (CWT) Investment Narrative?

- California Water Service Group recently reported its third quarter and nine-month earnings for 2025, showing third quarter sales of US$311.24 million and net income of US$61.23 million, with steady earnings per share compared to the prior year.

- An important finding is that while third quarter performance was stable, nine-month results reflected a year-over-year decline in both sales and net income, highlighting some pressure on longer-term revenue trends.

- We’ll now consider how the nine-month dip in net income and sales may affect the longer-term investment case for California Water Service Group.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

California Water Service Group Investment Narrative Recap

To be a shareholder in California Water Service Group, you need to believe in the long-term value of regulated water utilities, underpinned by reliable demand and opportunities to earn higher allowed returns through successful rate cases. The recent nine-month sales and net income decline is a reminder of revenue pressure, but the steady third quarter suggests no material short-term shift in the company’s key catalyst: resolution of the California General Rate Case. The biggest risk remains delays or adverse outcomes in rate approvals given ongoing regulatory uncertainty.

Alongside earnings, the company’s recent declaration of its 323rd consecutive quarterly dividend at US$0.30 per share stands out. This signals consistency in capital returns, and while the dividend is a reassuring sign for income-focused investors, it does not offset the regulatory challenges still facing the business as it seeks to secure future revenue growth. However, with regulatory risk firmly top of mind, it’s important for investors to also recognize that...

Read the full narrative on California Water Service Group (it's free!)

California Water Service Group’s outlook estimates $1.1 billion in revenue and $187.9 million in earnings by 2028. This projection relies on 3.9% annual revenue growth and a $52.1 million earnings increase from $135.8 million currently.

Uncover how California Water Service Group's forecasts yield a $53.00 fair value, a 14% upside to its current price.

Exploring Other Perspectives

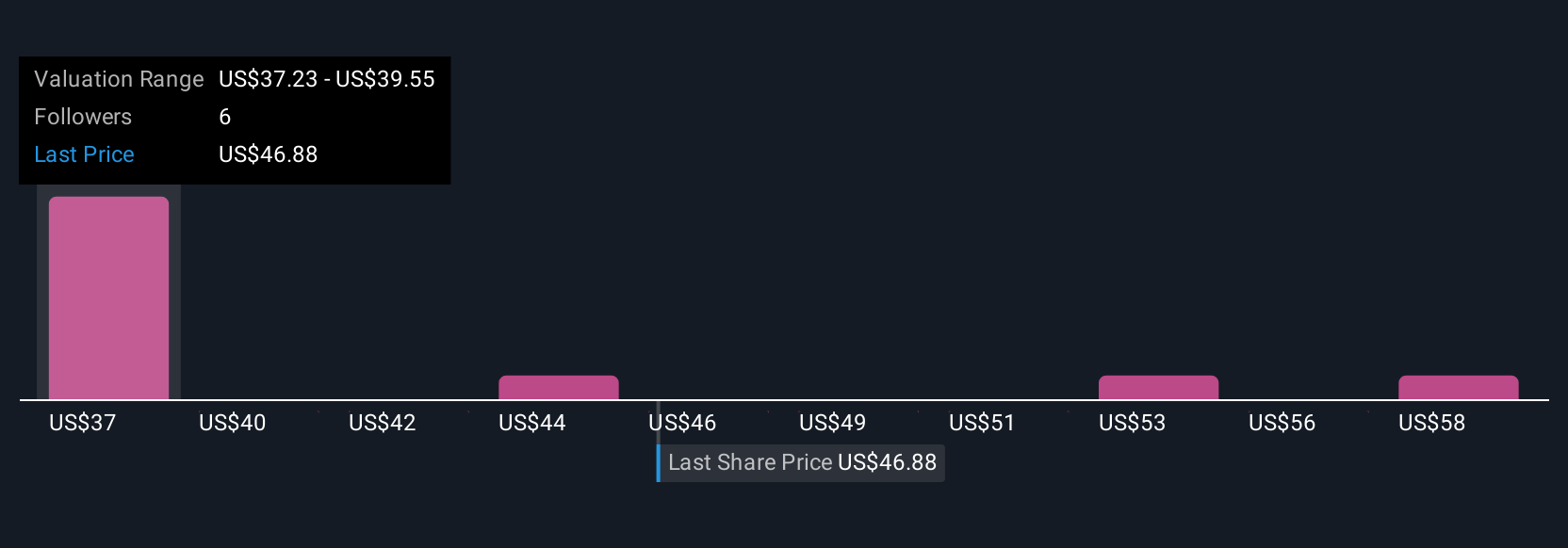

Four members of the Simply Wall St Community put fair value estimates for California Water Service Group stock between US$36.06 and US$60.39 per share. Such wide-ranging views reflect how ongoing regulatory uncertainty could lead to markedly different expectations for the company’s future results.

Explore 4 other fair value estimates on California Water Service Group - why the stock might be worth as much as 30% more than the current price!

Build Your Own California Water Service Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your California Water Service Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free California Water Service Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate California Water Service Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com