How Investors May Respond To Littelfuse (LFUS) Earnings Jump and Shareholder Returns Momentum

- Littelfuse, Inc. recently reported third quarter earnings showing increased sales to US$624.64 million and net income of US$69.52 million, alongside affirming a US$0.75 dividend and completing a share buyback program announced in April 2024.

- This combination of higher sales, strengthened earnings, continued capital returns, and updated guidance signals operational progress and ongoing shareholder focus.

- Next, we will explore how Littelfuse's improved quarterly financial performance could influence the company's future growth outlook and investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Littelfuse Investment Narrative Recap

To be a Littelfuse shareholder, one must be confident in the company’s ability to harness global growth in electrification, particularly in automotive and industrial end-markets, while executing on portfolio expansion. The latest quarterly results, marked by higher sales, net income, and continued capital returns, reinforce the company’s operational momentum, but do not materially shift the near-term catalyst: volume recovery in core power semiconductors. The biggest risk still centers on Littelfuse’s exposure to cyclical end-markets, which can magnify earnings swings during sector downturns or slower adoption of integrated circuit protection.

Among recent news, the completion of the share buyback program stands out by affirming Littelfuse’s ongoing focus on using its strong balance sheet for shareholder returns. While this supports investor confidence and highlights disciplined capital allocation, it does not alter the importance of driving sustainable earnings growth through margin improvement and innovation, especially as demand in core segments ebbs and flows.

By contrast, investors should be aware that growing reliance on automotive and industrial sectors can expose the company to...

Read the full narrative on Littelfuse (it's free!)

Littelfuse's narrative projects $2.9 billion revenue and $400.8 million earnings by 2028. This requires 8.6% yearly revenue growth and a $293.6 million earnings increase from $107.2 million today.

Uncover how Littelfuse's forecasts yield a $307.50 fair value, a 27% upside to its current price.

Exploring Other Perspectives

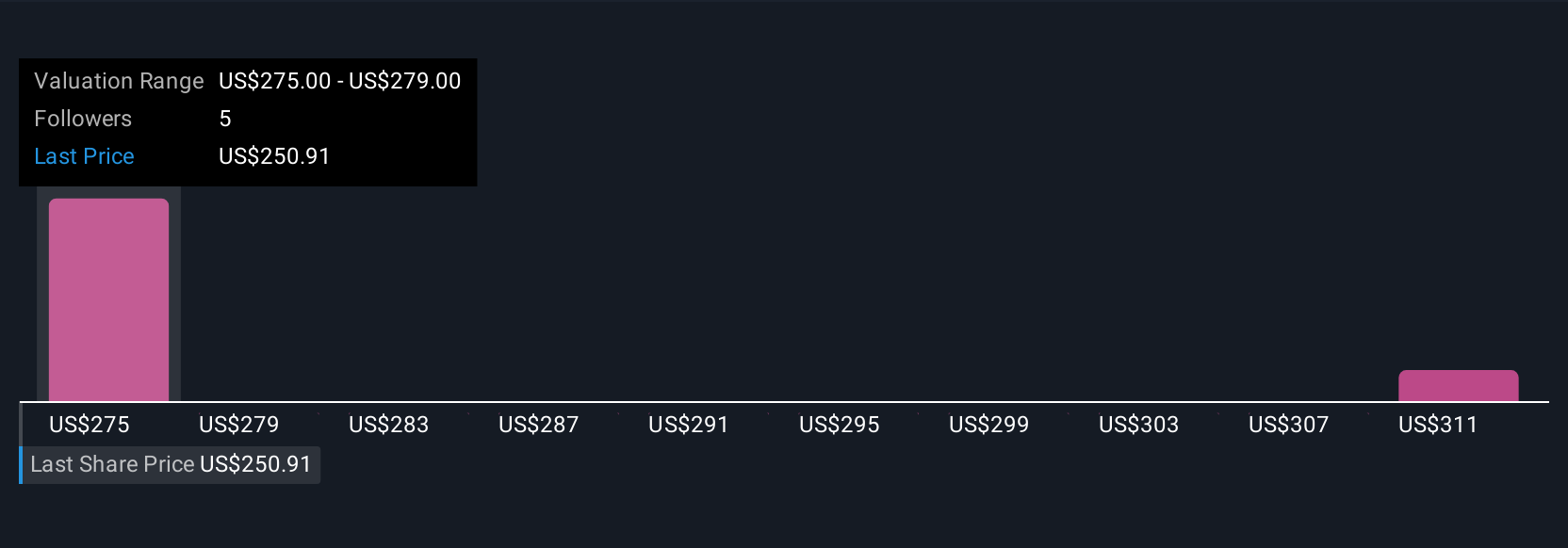

Simply Wall St Community members placed Littelfuse’s fair value between US$293.58 and US$307.50, with two independent forecasts reflecting consensus near analyst targets. Yet with cyclical sector exposure still a key risk, it’s worth considering how differently other market participants assess both current resilience and future growth. Explore the full range of community viewpoints and implications for your approach.

Explore 2 other fair value estimates on Littelfuse - why the stock might be worth just $293.58!

Build Your Own Littelfuse Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Littelfuse research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Littelfuse research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Littelfuse's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com