How Investors May Respond To Hub Group (HUBG) Q3 Profit Gains Amid Lower Sales and 2025 Outlook

- On October 30, 2025, Hub Group reported its third-quarter results, showing net income of US$28.55 million and diluted earnings per share of US$0.47, with revenue of US$934.5 million, and also issued 2025 guidance for full-year diluted EPS of US$1.80–US$1.90 and revenue of about US$3.6 billion–US$3.7 billion.

- Despite a year-over-year decline in sales, the company achieved improved profitability, highlighting its efforts to drive margin expansion even as revenue softened.

- We’ll explore how Hub Group’s reaffirmed focus on operational efficiencies and margin improvement shapes the current investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Hub Group Investment Narrative Recap

To hold Hub Group stock, investors need to believe in the company’s ability to translate operational efficiency and disciplined margin management into stable earnings, even when revenue trends are soft. The most recent quarterly results, showing improved profits despite lower sales, reinforce this narrative; however, they do little to ease the immediate risk of ongoing revenue pressure from a subdued logistics and intermodal environment, which remains the biggest short-term concern.

The recently announced three-year managed delivery partnership with Essendant stands out, aiming to expand Hub Group’s final mile offerings and potentially drive new customer wins, an important catalyst as the company looks to offset industry headwinds and capitalize on growth in e-commerce and end-to-end supply chain solutions.

On the other hand, what many investors might miss is just how much revenue softness exposes Hub Group to...

Read the full narrative on Hub Group (it's free!)

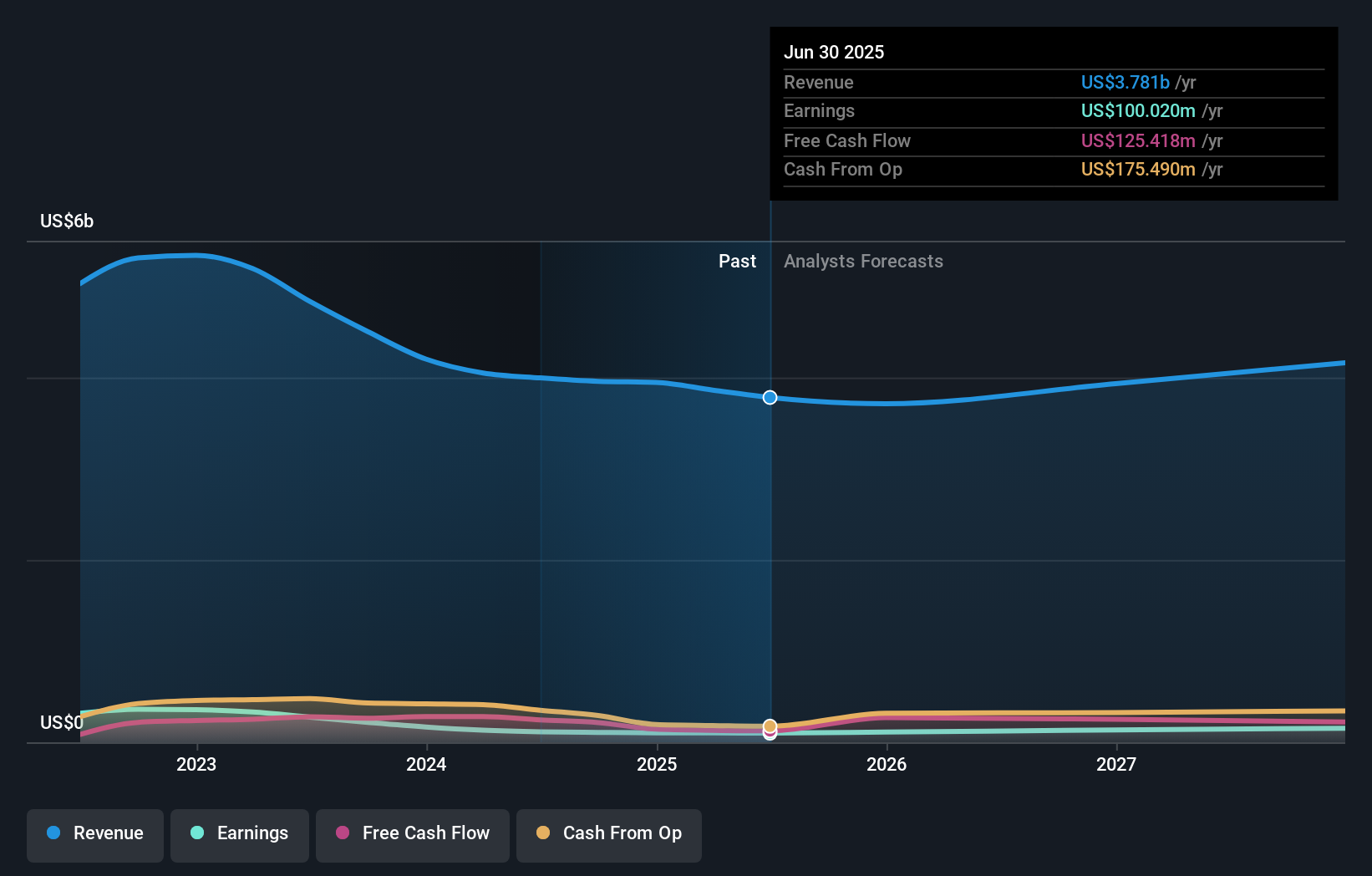

Hub Group's narrative projects $4.3 billion revenue and $164.5 million earnings by 2028. This requires 4.3% yearly revenue growth and a $64.5 million earnings increase from $100.0 million today.

Uncover how Hub Group's forecasts yield a $39.94 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members currently estimate fair values for Hub Group in a wide range from US$39.94 to US$65.82 across three views. As buyers and sellers weigh these opinions, the uncertain pace of revenue recovery may become even more important to your assessment of the company’s outlook.

Explore 3 other fair value estimates on Hub Group - why the stock might be worth as much as 83% more than the current price!

Build Your Own Hub Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hub Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Hub Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hub Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com