Is Kaiser Aluminum’s $500 Million Debt Refinancing Changing the Investment Case for KALU?

- Kaiser Aluminum Corporation recently closed a US$500 million private offering of 5.875% senior notes due 2034, with the proceeds planned to redeem its outstanding 4.625% senior notes due 2028.

- This refinancing move shifts the company's debt profile and could influence its future interest obligations and financial flexibility.

- Next, we’ll look at how this refinancing decision shapes Kaiser Aluminum’s investment narrative, particularly as it reshapes the company’s capital structure.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Kaiser Aluminum's Investment Narrative?

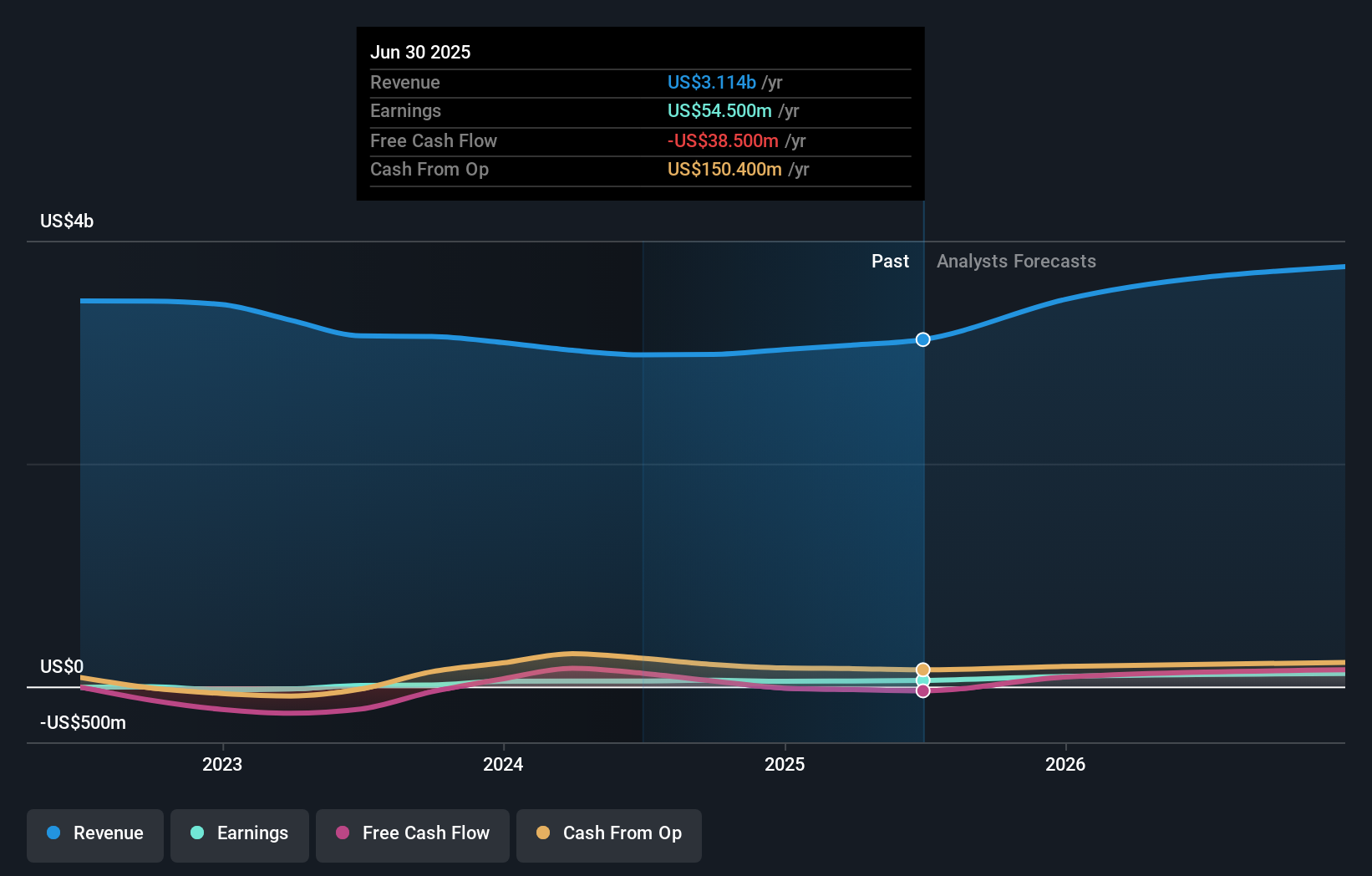

Owning Kaiser Aluminum right now means buying into a story of operational recovery and measured financial realignment. After reporting higher sales and profits in Q3 2025 and maintaining consistent dividends, the company has just refinanced existing debt with a US$500 million senior notes offering, pushing out maturities to 2034 at a higher rate. This could temporarily increase interest outflows but may improve flexibility in the near-term, easing pressure on short-term catalysts like earnings growth and dividend sustainability. Previous risks such as tight coverage of debt by operating cash flow and a dividend not fully backed by free cash flow remain, but the refinancing may give management better leeway to address these concerns. The stock’s recent sharp price gains suggest some of this optimism is already priced in. Still, elevated debt levels and modest revenue growth targets are factors worth watching as the investment case refocuses on cash flow strength and balance sheet discipline.

But higher interest costs could add a new wrinkle to the company’s cash generation story. Kaiser Aluminum's shares have been on the rise but are still potentially undervalued by 26%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Kaiser Aluminum - why the stock might be worth as much as 36% more than the current price!

Build Your Own Kaiser Aluminum Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kaiser Aluminum research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kaiser Aluminum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kaiser Aluminum's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com