Walmart’s Fresh Food RFID Push Could Be a Game Changer for Avery Dennison (AVY)

- Walmart recently announced a collaboration with Avery Dennison to expand the use of RFID technology across fresh food categories, aiming to reduce food waste and improve inventory management in bakery, meat, and deli departments.

- This initiative positions RFID solutions as a tool to enhance freshness, streamline operations, and elevate both customer and employee experiences in grocery retail.

- We'll explore how Avery Dennison's expanded RFID application in fresh foods may influence its position in digitized supply chains.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Avery Dennison Investment Narrative Recap

To be a shareholder in Avery Dennison, you need to have confidence in the company’s ability to diversify beyond its core apparel and retail base into faster-growing markets, such as food and logistics, leveraging its leadership in RFID and smart label solutions. The recent Walmart collaboration in fresh food directly addresses this catalyst, potentially accelerating diversification. However, competitive pressure and ongoing volatility in apparel and general retail still pose serious risks to earnings visibility and margin stability for now.

The recently announced quarterly dividend increase to US$0.94 per share is especially relevant alongside the Walmart partnership, reinforcing management’s commitment to returning capital to shareholders even as it invests in digital supply chain growth initiatives. This signals that Avery Dennison is balancing its growth priorities with shareholder returns, adding context to the company’s evolving mix of challenges and opportunities.

But while the Walmart agreement advances diversification, investors should also be aware that exposure to weaker apparel categories remains...

Read the full narrative on Avery Dennison (it's free!)

Avery Dennison's narrative projects $9.8 billion revenue and $909.0 million earnings by 2028. This requires 4.0% yearly revenue growth and a $198 million earnings increase from $711.0 million today.

Uncover how Avery Dennison's forecasts yield a $202.36 fair value, a 15% upside to its current price.

Exploring Other Perspectives

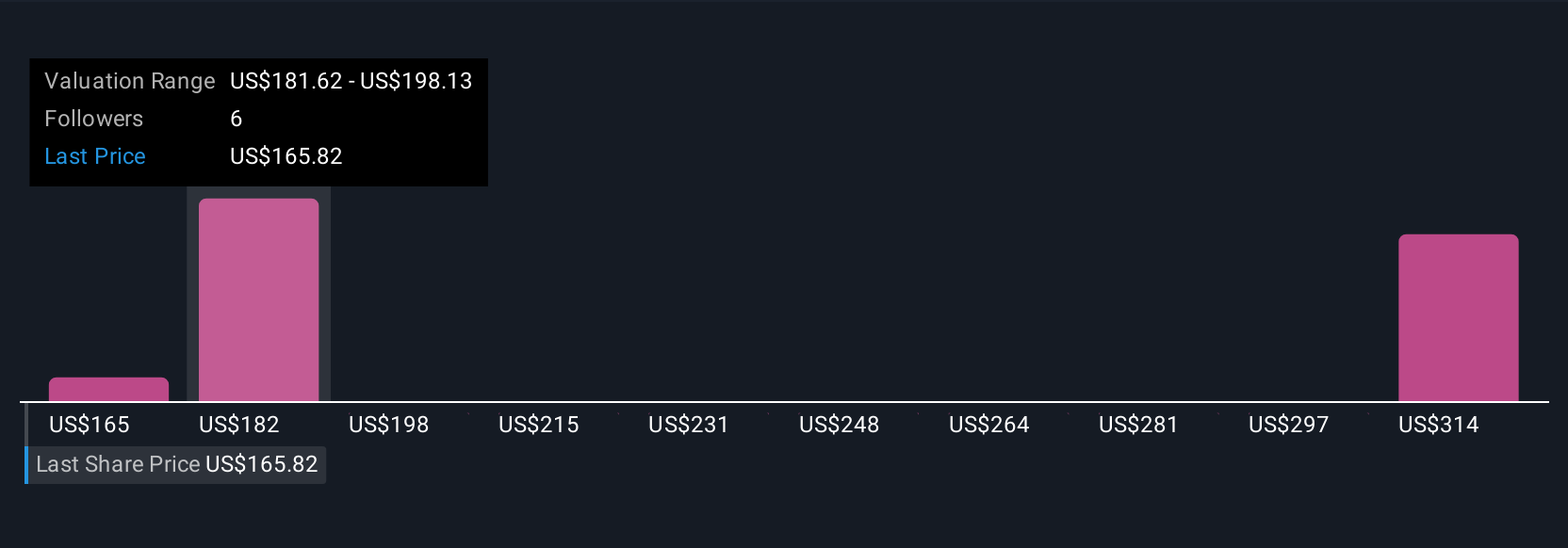

Simply Wall St Community members submitted three unique fair value estimates for Avery Dennison ranging from US$165.12 to US$320.84 per share. Despite these wide-ranging opinions, ongoing competitive pressures and the pace of diversification remain key issues that could affect future performance, so consider several viewpoints before making a decision.

Explore 3 other fair value estimates on Avery Dennison - why the stock might be worth as much as 82% more than the current price!

Build Your Own Avery Dennison Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avery Dennison research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Avery Dennison research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avery Dennison's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com