Are Genworth’s (GNW) Earnings Growth and Buybacks Driving Sustainable Shareholder Value?

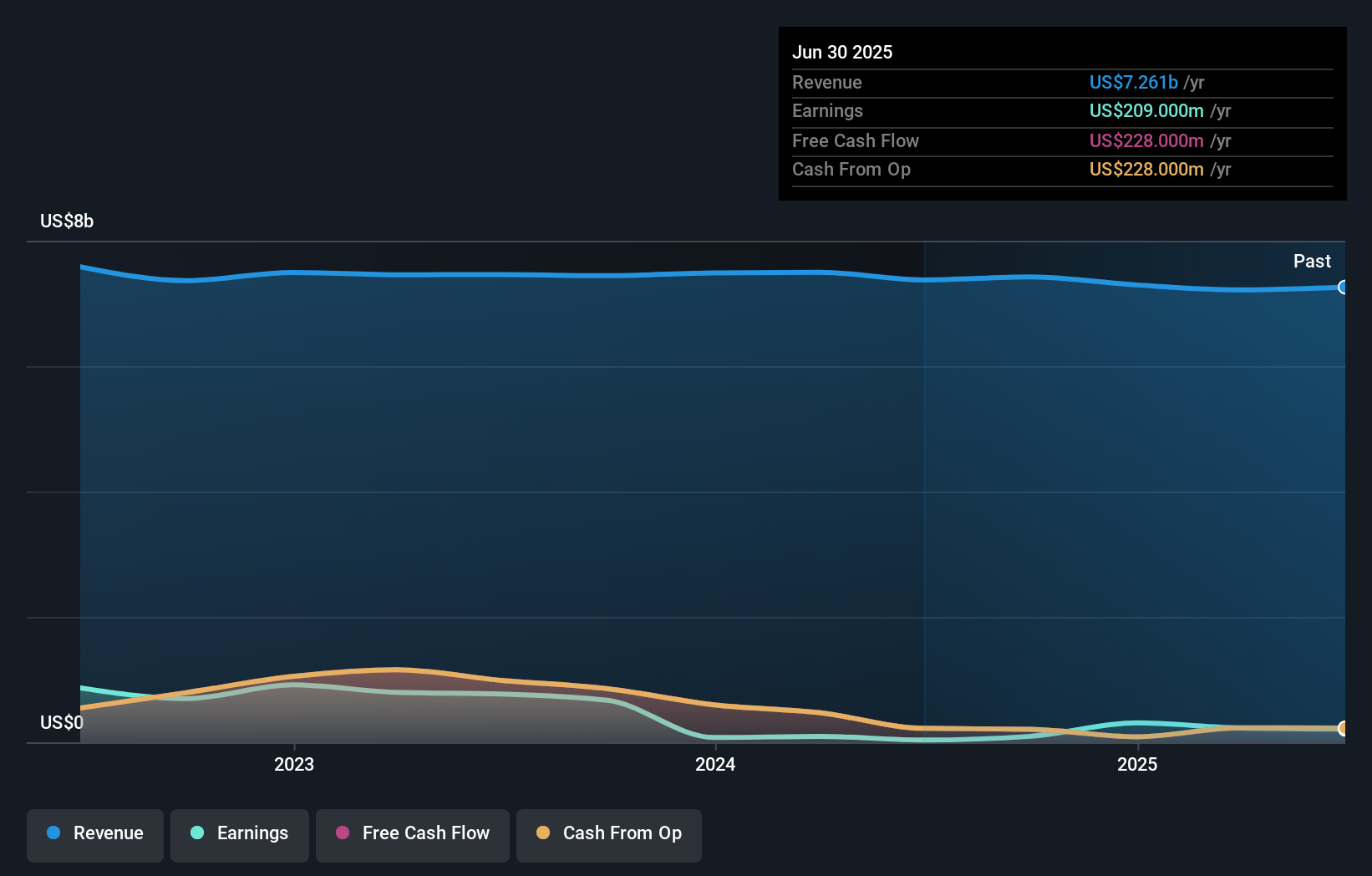

- Genworth Financial recently announced past third quarter results, reporting revenue of US$1,935 million and net income of US$116 million, both up from the previous year, along with updates on its share repurchase program totaling over 116 million shares bought since 2022.

- The combination of consistent earnings growth and a significant buyback program underscores the company's ongoing efforts to enhance shareholder value.

- We'll examine how Genworth Financial's continued earnings growth and substantial share repurchases shape its overall investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Genworth Financial's Investment Narrative?

For anyone considering Genworth Financial as an investment, the draw has often centered around improvement in profit margins, continued share buybacks, and renewed focus on delivering value to shareholders. With the third quarter bringing another boost to both revenue and net income, and the buyback program now totaling over 116 million shares since 2022, the company looks to be reinforcing its shareholder commitment. The new buyback authorization, combined with recent earnings progress, may add some energy to short-term sentiment, especially for investors who see buybacks as a catalyst for value creation. Yet, with shares trading above some recent fair value estimates, and ongoing concerns about board engagement and activist pressure, I'd say risk factors like future earnings volatility remain in focus. The latest news doesn't appear to fundamentally change the most pressing risks, but it does strengthen the case for those who value capital return programs.

But on the other hand, boardroom issues could impact future management direction, something investors should keep in mind. Genworth Financial's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 2 other fair value estimates on Genworth Financial - why the stock might be worth less than half the current price!

Build Your Own Genworth Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genworth Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Genworth Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genworth Financial's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com