How Eagle Materials' $750 Million Bond Offering Could Influence Liquidity and Strategy for EXP Investors

- Earlier this month, Eagle Materials Inc. completed a US$750 million senior notes offering due 2036, raising approximately US$734.9 million in net proceeds to support debt repayment and general corporate purposes.

- This substantial bond issuance underscores Eagle Materials’ focus on strengthening its liquidity, providing increased flexibility for future investments and financial stability.

- We’ll examine how this enhanced liquidity position could shape Eagle Materials’ investment narrative and support its capital allocation priorities going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Eagle Materials Investment Narrative Recap

To be a shareholder in Eagle Materials, you need to believe in the durability of U.S. infrastructure investment as a counterbalance to ongoing softness in residential construction and region-specific volatility. The recent US$750 million bond issuance strengthens the company’s liquidity, but it does not materially alter the key short-term catalyst, infrastructure-driven demand for cement, or the most significant risk of prolonged softness in wallboard demand and revenue pressure from housing market challenges.

Of the company’s updates, the recently declared $0.25 per-share quarterly dividend stands out. This announcement is relevant here as it reflects confidence in consistent cash flows despite ongoing margin pressures, and supports Eagle Materials’ disciplined approach to capital allocation while balancing investment and shareholder returns.

In contrast, investors should be aware that even with strong liquidity, sustained weak demand for wallboard could challenge revenue and margin stability if...

Read the full narrative on Eagle Materials (it's free!)

Eagle Materials is projected to reach $2.6 billion in revenue and $524.5 million in earnings by 2028. This outlook implies a 3.8% annual revenue growth rate and an increase in earnings of about $71.6 million from the current $452.9 million.

Uncover how Eagle Materials' forecasts yield a $251.70 fair value, a 25% upside to its current price.

Exploring Other Perspectives

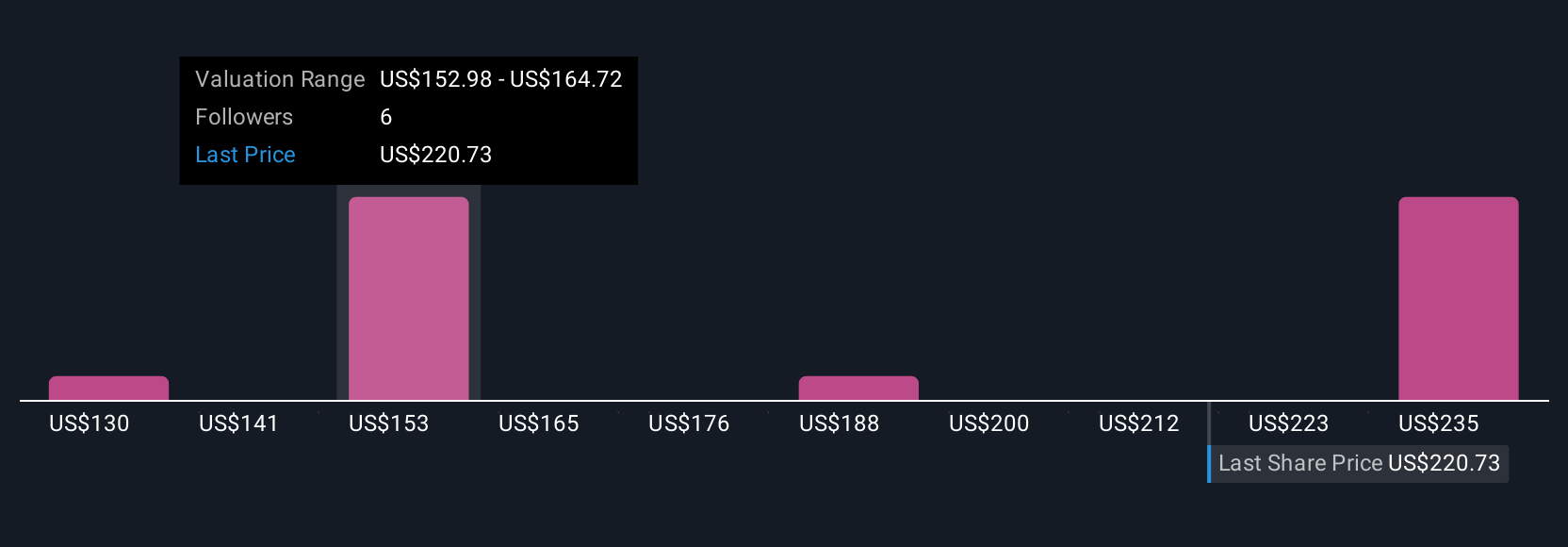

Four members of the Simply Wall St Community estimate fair value for Eagle Materials shares ranging from US$129.50 to US$449.54. These viewpoints emerge as management focuses on infrastructure gains, but persistent risks in residential segments could shape future results quite differently. Explore several alternative viewpoints to inform your decision.

Explore 4 other fair value estimates on Eagle Materials - why the stock might be worth 36% less than the current price!

Build Your Own Eagle Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eagle Materials research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eagle Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eagle Materials' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com