Is Sweetgreen's (SG) Infinite Kitchen Drive-Thru a Glimpse Into Its Automation Advantage?

- Earlier this month, Sweetgreen announced the opening of its first Infinite Kitchen sweetlane drive-thru in Costa Mesa, California, featuring integrated digital ordering, dine-in, and pickup options powered by automation technology.

- This development not only marks a major step in Sweetgreen's digital and operational innovation but arrives alongside a new digital macronutrient tracking tool, underscoring the company's push for personalized, health-oriented dining experiences.

- We’ll explore how the rollout of Sweetgreen’s Infinite Kitchen sweetlane could influence its investment narrative focused on automation and digital engagement.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Sweetgreen Investment Narrative Recap

To be a Sweetgreen shareholder, you need confidence that automation and digital innovation, exemplified by the Infinite Kitchen sweetlane, can reverse persistent declines in same-store sales and improve guest engagement. While the Costa Mesa opening strengthens Sweetgreen's narrative around operational efficiency and digital convenience, the most important short term catalyst remains a sustained recovery in traffic and transaction growth. This latest rollout doesn’t materially shift the immediate risk: ongoing same-store sales weakness and negative traffic trends.

Among recent announcements, the launch of the digital macronutrient tracking tool best complements the sweetlane debut. This release emphasizes Sweetgreen's push to attract digitally engaged, health-focused diners, a critical factor in driving digital order growth and recapturing frequency, both key to addressing traffic declines.

By contrast, investors should be aware that if guest traffic does not rebound sustainably, even meaningful automation initiatives like Infinite Kitchen may not offset the risk that ...

Read the full narrative on Sweetgreen (it's free!)

Sweetgreen's narrative projects $1.0 billion in revenue and $84.5 million in earnings by 2028. This requires 14.5% yearly revenue growth and a $182.5 million earnings increase from current earnings of -$98.0 million.

Uncover how Sweetgreen's forecasts yield a $11.46 fair value, a 87% upside to its current price.

Exploring Other Perspectives

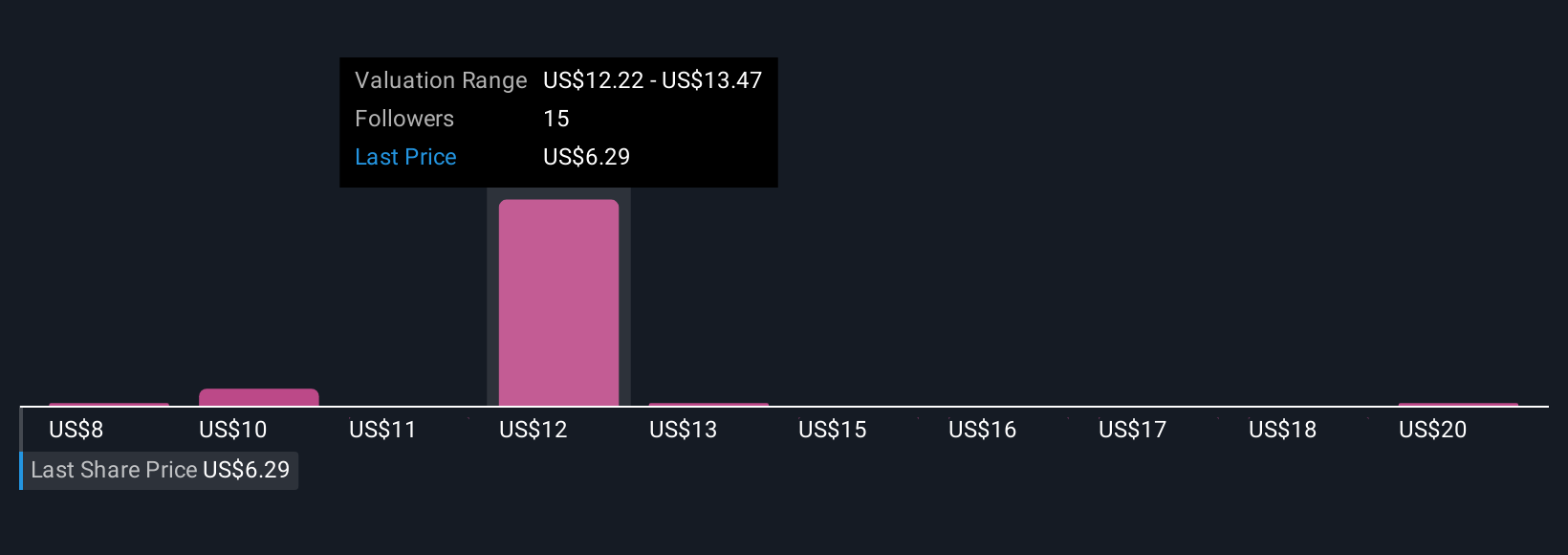

Six Simply Wall St Community fair value estimates for Sweetgreen range from US$8.45 to US$21 per share, reflecting varied views on the company's outlook. With ongoing traffic declines posing a risk to near-term sales performance, these differences underscore the importance of comparing several perspectives before making a decision.

Explore 6 other fair value estimates on Sweetgreen - why the stock might be worth just $8.45!

Build Your Own Sweetgreen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sweetgreen research is our analysis highlighting 1 important warning sign that could impact your investment decision.

- Our free Sweetgreen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sweetgreen's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com