A Look at Strategic Education’s (STRA) Valuation Following Strong Earnings and Growth in Key Platforms

Strategic Education (STRA) recently posted a third quarter earnings report showing higher revenue and greater profitability, mainly supported by steady growth from its Sophia Learning and Workforce Edge platforms. Management highlighted ongoing operational efficiencies and robust employer-affiliated enrollments as positive trends.

See our latest analysis for Strategic Education.

Alongside the solid earnings beat, Strategic Education has been active with its buyback program, repurchasing nearly 2% of its shares last quarter. Despite this, shares are still down more than 13% year-to-date and the total shareholder return over one year is also about -14%. Performance over the last three and five years has been modestly positive. This suggests that while momentum has picked up recently, investors remain cautious and are looking for stronger evidence of sustained growth potential.

If you're curious about what other companies are gaining traction, now’s a smart time to expand your perspective with fast growing stocks with high insider ownership.

With shares trading at a significant discount to analyst price targets and the company showing operational momentum, could this be a compelling entry point for investors? Or is the market already factoring in future growth?

Most Popular Narrative: 22.5% Undervalued

Strategic Education's most widely followed narrative places its fair value well ahead of the latest closing price, hinting at notable upside potential if expectations materialize. This current setup signals that the market has yet to fully price in forecasted improvements in operational performance and future earnings.

Strategic Education is benefiting from strong enrollment growth, particularly through its corporate partnerships. This could drive continued revenue growth as employer-affiliated enrollment increased by 16% in 2024. The Education Technology Services segment is experiencing significant growth, with revenue increasing by more than 30% in 2024, primarily through the Sophia Learning direct-to-consumer portal and expanding corporate partnerships, potentially boosting earnings.

Beneath the strong price target is a bold, numbers-driven thesis powered by ambitious profit margin gains and rapid earnings expansion. How aggressive are the growth and margin forecasts included here? Click through to uncover what assumptions drive this potential for outsized returns.

Result: Fair Value of $103.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including tighter regulation of international student enrollment and the potential for rising costs to squeeze future profit margins.

Find out about the key risks to this Strategic Education narrative.

Another View: Looking at Earnings Multiples

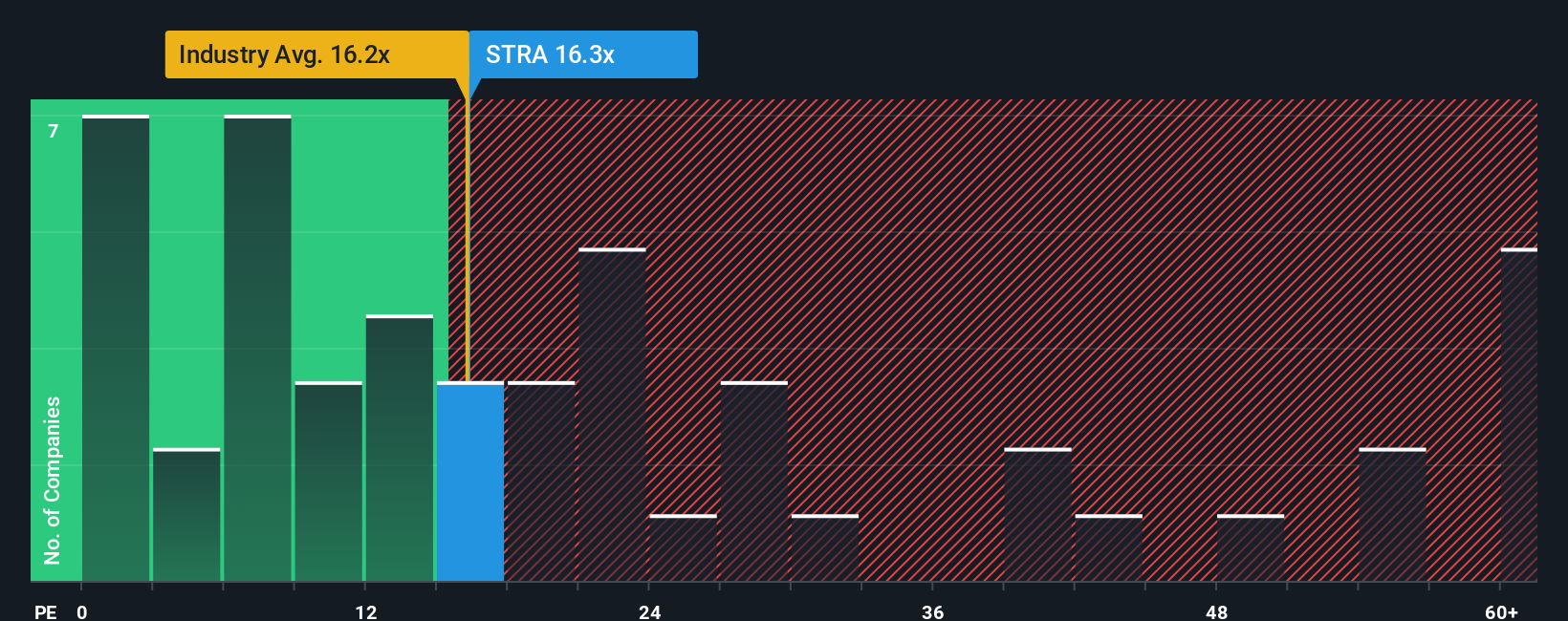

While fair value seems attractive by some measures, Strategic Education’s price-to-earnings ratio is currently 16.3x. This is just above the industry average of 16x but comfortably below peers at 20.4x. Notably, this is also well beneath the fair ratio of 21.4x that the market could drift toward. That gap implies potential for valuation to improve if sentiment shifts, but it also points to lingering caution among investors. Which side of the equation will prove right over time?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Strategic Education Narrative

If you have a different perspective or want to dig into the numbers yourself, you can easily shape your own Strategic Education narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Strategic Education.

Looking for More Smart Investment Ideas?

Give yourself an edge by seeking out fresh opportunities across the market. These carefully curated stock picks highlight momentum, innovation, and reliable returns you won’t want to overlook.

- Uncover potential among unstoppable market disrupters when you analyze these 25 AI penny stocks, which are poised for growth in artificial intelligence.

- Strengthen your portfolio with steady income by exploring these 16 dividend stocks with yields > 3%, which offers attractive yields above 3%.

- Capitalize on early-stage breakthroughs by evaluating these 3580 penny stocks with strong financials, which show robust financial profiles and ambitious trajectories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com