A Look at UFP Industries (UFPI) Valuation Following EvoTrim™ Product Award Recognition

UFP Industries (UFPI) is drawing attention after its Edge division’s EvoTrim product was recognized with a Good Housekeeping 2026 Home Reno Award. This recognition highlights EvoTrim’s design focus on durability and innovation in exterior building materials.

See our latest analysis for UFP Industries.

Even with strong moves like the EvoTrim award win, UFP Industries’ momentum has cooled lately, as seen in its 1-year total shareholder return of -29.07%. However, long-term holders have still benefited from a 74.91% five-year total return, showing that this is a business with staying power even through market cycles.

If this kind of product innovation sparks your interest, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares still well below analyst targets but recent growth slowing, investors now face a key question: is UFP Industries trading at a discount with upside potential, or is future growth already reflected in the price?

Most Popular Narrative: 20% Undervalued

With UFP Industries’ narrative fair value at $113.17 versus a last close of $90.49, investors see a meaningful gap to the upside. The narrative’s popularity suggests the market is watching closely to see if this opportunity plays out as underlying business improvements take hold.

Recent and ongoing investments in innovative, higher-margin, sustainable building products like the Surestone composite decking are expected to enable UFP Industries to capitalize on the growing consumer demand for eco-friendly materials. The company has set a goal to double composite decking and railing market share over the next 5 years, which could positively impact revenue and margins.

Want to see why this narrative is catching fire? The real story is built on bold projections for profit margins and a booming product shift. Discover the hidden assumptions driving this optimistic valuation—the numbers might surprise you.

Result: Fair Value of $113.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in home improvement demand or increased price competition could challenge UFP Industries’ ability to achieve the anticipated growth and margin improvements.

Find out about the key risks to this UFP Industries narrative.

Another View: What About Discounted Cash Flow?

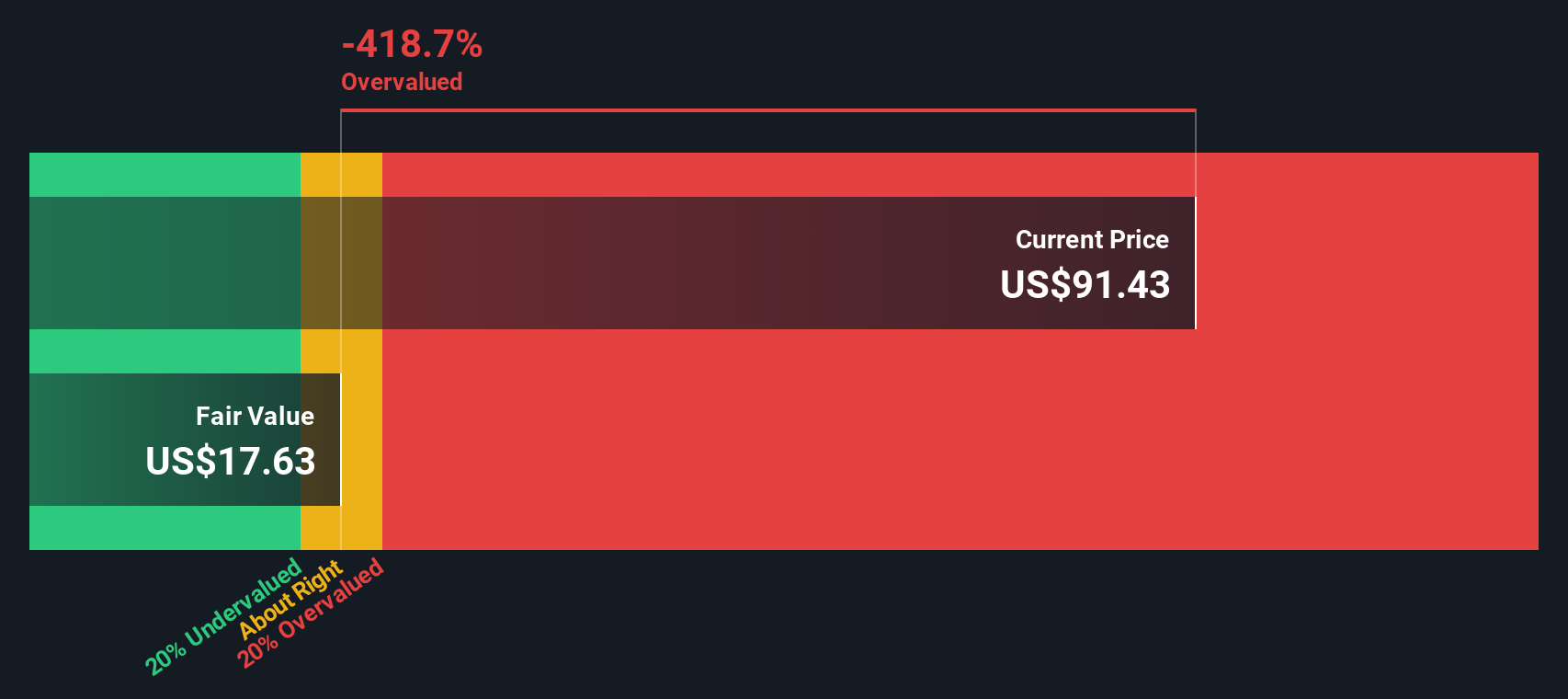

Taking a different angle, our SWS DCF model estimates UFP Industries' fair value at $68.17. This is below the current share price of $90.49. Unlike the narrative approach, this method suggests the stock might actually be trading above its intrinsic value. Which view lines up with your own expectations for future growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out UFP Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own UFP Industries Narrative

If you have a different perspective or want to investigate the numbers firsthand, you can build your own take on UFP Industries in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding UFP Industries.

Looking for more investment ideas?

Great investors cast a wide net. Don't let unique opportunities pass you by. The Simply Wall Street Screener surfaces hidden gems that can fuel your next breakthrough.

- Catch companies paying reliable income by reviewing these 16 dividend stocks with yields > 3% with yields above 3%. This can be ideal for building a stronger portfolio foundation.

- Spot next-gen breakthroughs in automation by tracking these 25 AI penny stocks, which are transforming industries with groundbreaking artificial intelligence solutions.

- Capitalize on market mispricing and find potential bargains among these 897 undervalued stocks based on cash flows, based on real cash flow strength and value indicators.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com