How Investors May Respond To Crown Holdings (CCK) $350 Million Debt Tender Offer Announcement

- On November 15, 2025, Crown Holdings announced a cash tender offer through its subsidiary to purchase any and all outstanding 7 3/8% Debentures due 2026, totaling US$350 million in principal, with settlement targeted for November 21, 2025.

- This debt repurchase move gives Crown Holdings flexibility to manage its capital structure and could influence investor sentiment toward the company's financial strategy.

- We'll examine how Crown Holdings’ proactive debt management through this tender offer could shift its investment outlook going forward.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Crown Holdings Investment Narrative Recap

To be a shareholder in Crown Holdings, you need to believe in the long-term demand for sustainable packaging and the company’s ability to expand capacity while maintaining financial flexibility. The recent cash tender offer for US$350 million of 2026 debentures is a capital management decision that does not materially alter the most significant short-term catalyst, steady demand for metal cans, or the principal risk, which remains exposure to geographic concentration and input cost volatility.

Among recent developments, the large share buyback completed in October aligns with the tender offer’s focus on capital allocation, but neither action directly addresses the ongoing risks associated with weakness in key international markets. Both announcements reinforce a cautious approach to managing debt and equity, which supports flexibility but does not reduce the revenue headwinds from potential volume softness in Asia and Europe.

Yet in contrast, investors should closely watch how persistent aluminum cost inflation could...

Read the full narrative on Crown Holdings (it's free!)

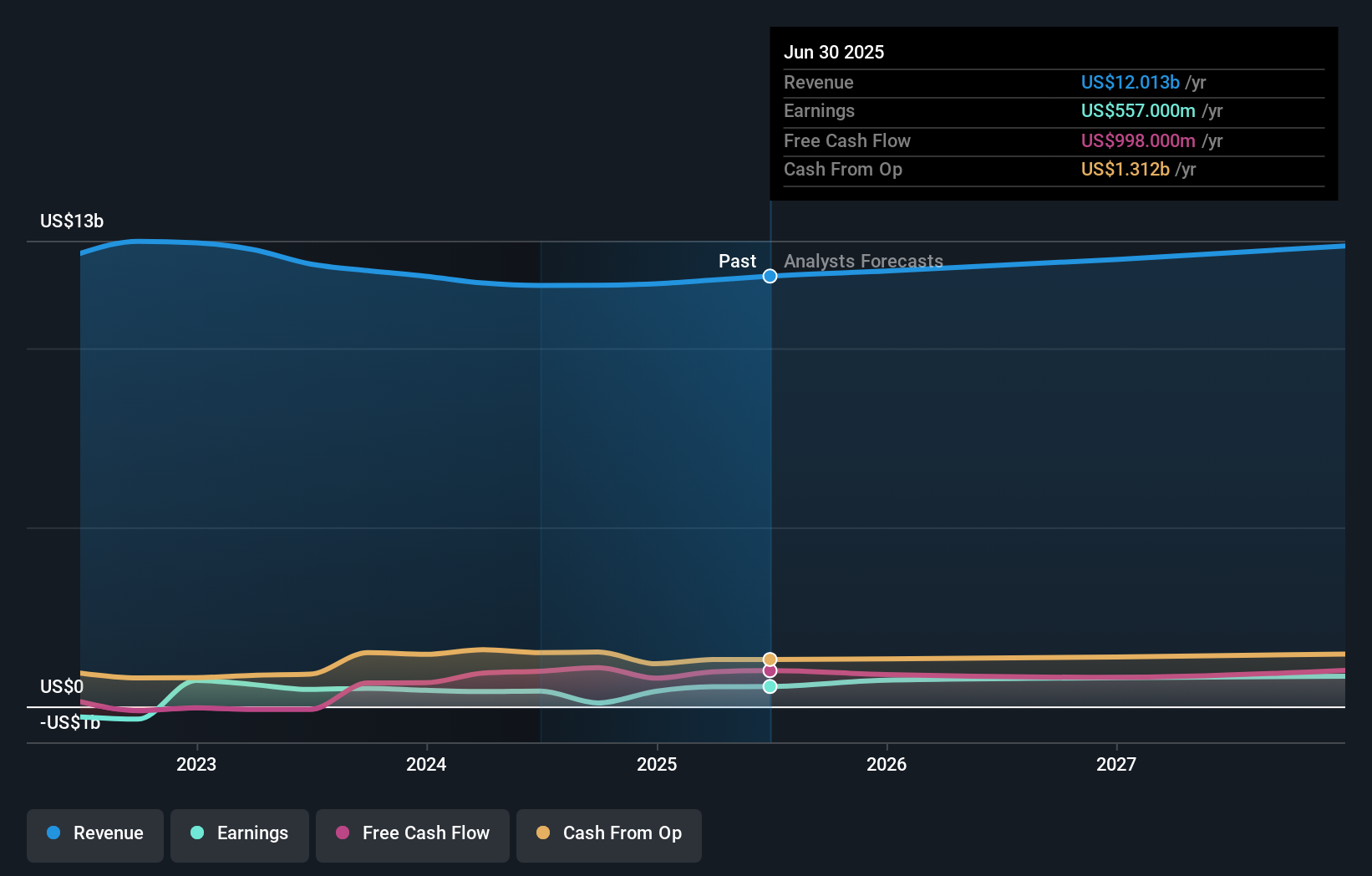

Crown Holdings' narrative projects $13.3 billion revenue and $886.4 million earnings by 2028. This requires 3.3% yearly revenue growth and a $329.4 million earnings increase from $557.0 million today.

Uncover how Crown Holdings' forecasts yield a $121.50 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for Crown Holdings range from US$121.50 to US$207.34, based on just two different perspectives from the Simply Wall St Community. With operational efficiency as a major catalyst, you can see how market participants may interpret future earnings potential quite differently, explore several alternative viewpoints for a broader understanding.

Explore 2 other fair value estimates on Crown Holdings - why the stock might be worth just $121.50!

Build Your Own Crown Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crown Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Crown Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crown Holdings' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com