ReNew Energy Global (NasdaqGS:RNW): Assessing Valuation Following $9.33 Billion Andhra Pradesh Expansion and Strong Financial Results

ReNew Energy Global (NasdaqGS:RNW) has just announced a sweeping $9.33 billion investment to broaden its renewable projects in Andhra Pradesh. This comes alongside headline financial results and fresh financing that are shaping investor expectations around the company’s next phase of growth.

See our latest analysis for ReNew Energy Global.

All eyes have turned to ReNew’s bold expansion plans and high-profile funding wins, which arrive amid a year of growing optimism. The 1-year total shareholder return sits at 36.9 percent, well ahead of the latest 9.7 percent share price gain year to date. This suggests investor confidence is building on the back of its new projects and financial momentum.

If you’re curious where the next wave of opportunity might be, now’s a great time to discover fast growing stocks with high insider ownership

With shares already up nearly 37 percent over the past year and expansion plans ramping up, the question is whether ReNew Energy Global is still trading at an attractive valuation or if future growth is fully reflected in the price.

Most Popular Narrative: 6.8% Undervalued

With ReNew Energy Global’s fair value pegged at $8.00, about 7% above the last close, market watchers are keenly assessing the case for further upside. These figures set the scene as prevailing forecasts and forward-looking assumptions shape sentiment on the stock’s runway for growth and profitability.

*Expansion in renewable assets, manufacturing capacity, and strategic partnerships is driving diversified revenue streams and improved profitability. Emphasis on technological innovation, operational efficiency, and supportive policy frameworks supports sustained growth and lowers long-term risks.*

Curious what earnings leap, margin boost, and profit multiple stand behind this higher fair value? Wondering which bold assumptions drive the consensus? Find out how analyst projections blend big top-line ambition with those all-important profit ratios, then decide if you’re convinced.

Result: Fair Value of $8.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in renewable energy bidding and potential project execution delays could quickly challenge the case for ReNew’s continued high margin growth.

Find out about the key risks to this ReNew Energy Global narrative.

Another View: Comparing Market Multiples

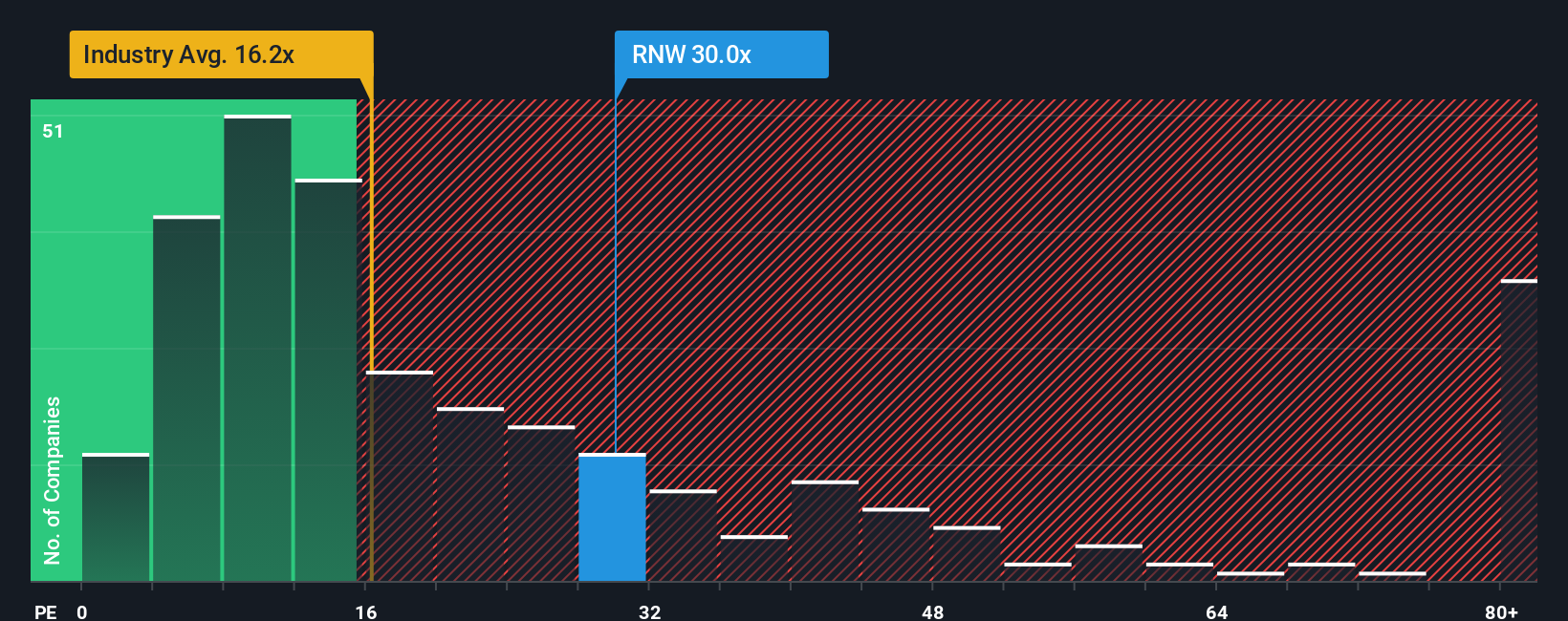

While analyst forecasts point to ReNew being undervalued, the share price tells a more nuanced story when compared to other renewable energy peers. Its price-to-earnings ratio of 28.5x is above the peer average (27.1x) and well above the global industry average (17.2x). However, it sits below the fair ratio the market could move toward (31.8x). This mix of premium and discount raises a real question: is the current price a justified stepping stone to future growth, or does it signal greater valuation risk to come?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ReNew Energy Global Narrative

Whether you want to challenge these numbers, question the assumptions, or dive deeper into your own research, crafting a personal view is just minutes away with Do it your way

A great starting point for your ReNew Energy Global research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next big opportunity pass by. Find unique stocks that suit your goals using expert-curated lists you can act on today.

- Tap into major yield potential by reviewing these 16 dividend stocks with yields > 3% which consistently deliver strong income and robust dividend growth.

- Capitalize on rapid innovation by assessing these 26 AI penny stocks that are powering breakthroughs in artificial intelligence and next-generation automation technologies.

- Spot exceptional value plays by checking out these 904 undervalued stocks based on cash flows trading below their intrinsic worth and positioned for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com