MakeMyTrip (NasdaqGS:MMYT): Assessing Valuation Following Recent Share Price Pullback

See our latest analysis for MakeMyTrip.

While MakeMyTrip’s share price has retreated sharply, down 16.9% over the past month and now off 36.3% year-to-date, the longer-term picture remains impressive, with a 161% total shareholder return over three years and 181% over five years. Momentum seems to be cooling after strong gains, as investors reassess both growth potential and current valuation following the recent rally.

If the latest volatility has you exploring new ideas, this could be the moment to discover fast growing stocks with high insider ownership.

With shares selling off but long-term returns remaining robust, investors now face a key question: does MakeMyTrip’s sharp pullback represent an attractive entry point, or is the market already reflecting all future growth potential?

Most Popular Narrative: 35% Undervalued

With MakeMyTrip closing at $74 while the most popular narrative sets fair value at $113.78, there is a significant gap between current price and perceived potential. This valuation difference has become a focal point for investors looking for upside. Here is one major narrative highlight fueling that optimism:

Ongoing investment in product innovation, particularly in AI-powered personalization and user experience improvements, positions MakeMyTrip for higher conversion rates, better customer retention, and ultimately supports expanding net margins through improved operating leverage.

Want to know exactly what backs this bold upside? The narrative rests on big assumptions about future growth, profits, revenues, and margins going into overdrive. The numbers driving these projections? You will want to see for yourself.

Result: Fair Value of $113.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition across India's online travel sector and unexpected volatility in travel demand remain key risks that could quickly change the outlook.

Find out about the key risks to this MakeMyTrip narrative.

Another View: Multiples Tell a Very Different Story

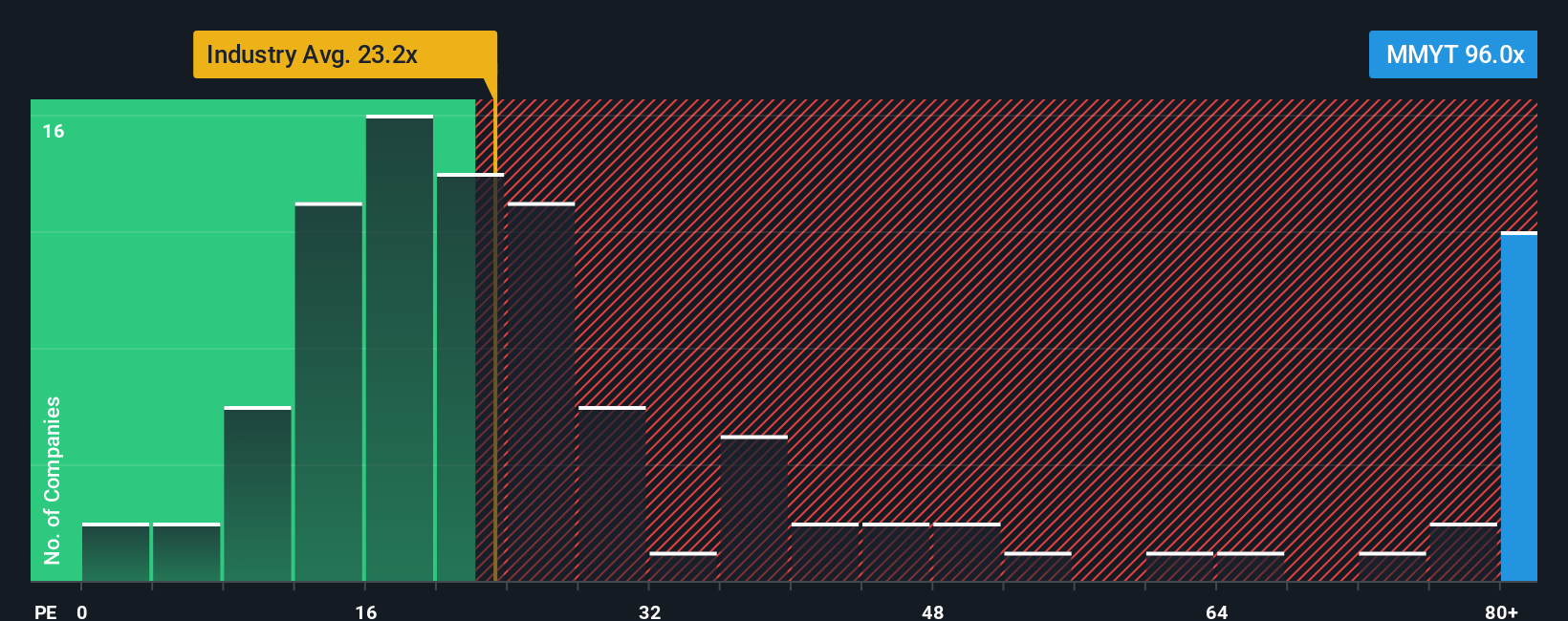

While narratives and analyst targets point to significant upside, MakeMyTrip trades at a P/E ratio of 92x, which is much higher than both the industry average of 20.8x and the peer group at 20.4x. Even compared to the fair ratio of 36.6x, the current valuation looks stretched. This raises the question: Is the market pricing in too much growth too soon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MakeMyTrip Narrative

If you want to chart your own course or dig deeper into the numbers, you can craft your own perspective in just a few minutes. Do it your way.

A great starting point for your MakeMyTrip research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't wait for opportunity to pass you by. Set yourself up for smarter investing by tapping into hand-picked ideas backed by solid research and actionable insights.

- Turbocharge your returns with potential bargains by checking out these 899 undervalued stocks based on cash flows, where cash flow metrics highlight hidden gems you will want to watch.

- Tap into unstoppable trends and find promising picks riding artificial intelligence momentum through these 26 AI penny stocks to capture tomorrow's leaders early.

- Secure reliable income streams by scanning these 18 dividend stocks with yields > 3% for companies offering strong, consistent dividends above 3 percent, perfect for building a resilient portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com