Green Brick Partners (GRBK): Assessing Valuation Following Recent Share Price Pullback

Green Brick Partners (GRBK) shares have faced downward pressure in the past month, with a drop of 8%, and are now roughly 10% lower over the past 3 months. However, the company’s year-to-date returns remain in positive territory.

See our latest analysis for Green Brick Partners.

While Green Brick Partners' 1-year total shareholder return is still down nearly 10%, its 3-year total return of more than 160% paints a picture of significant long-term outperformance. Recent weakness in the share price may reflect shifting sentiment, but the broader trajectory suggests momentum over the past few years remains strong, even though there has been some fading in the near term.

If you're keeping an eye on what else might be building momentum, it could be the perfect time to expand your search and discover fast growing stocks with high insider ownership

With recent pullbacks and muted revenue growth, the question for investors is whether Green Brick Partners is currently undervalued or if the market has already accounted for the company's future prospects. This raises the issue of whether a genuine buying opportunity is present or not.

Most Popular Narrative: Fairly Valued

With Green Brick Partners trading just below the consensus price target of $62.00, recent price action now closely mirrors what analysts believe is fair value. This narrows any valuation gap and frames the current debate around future profit drivers.

The company's industry-leading gross margins (over 30% for nine consecutive quarters) and flexible cost structure, including achieved reductions in labor/materials costs and construction cycle times, suggest strong resilience in net margins and potential for earnings stability, even when market incentives and price concessions are required.

Want to know which financial levers form the backbone of this resilient valuation? The narrative hints at operational advantages, stable margins, and a profitability formula that rivals the toughest market conditions. Find out what else is fueling this fair value outlook. There is more than meets the eye.

Result: Fair Value of $62 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, robust migration trends into key markets and persistent housing underbuilding could help offset margin pressures, which may bolster Green Brick’s long-term growth outlook.

Find out about the key risks to this Green Brick Partners narrative.

Another View: SWS DCF Model Challenges the Outlook

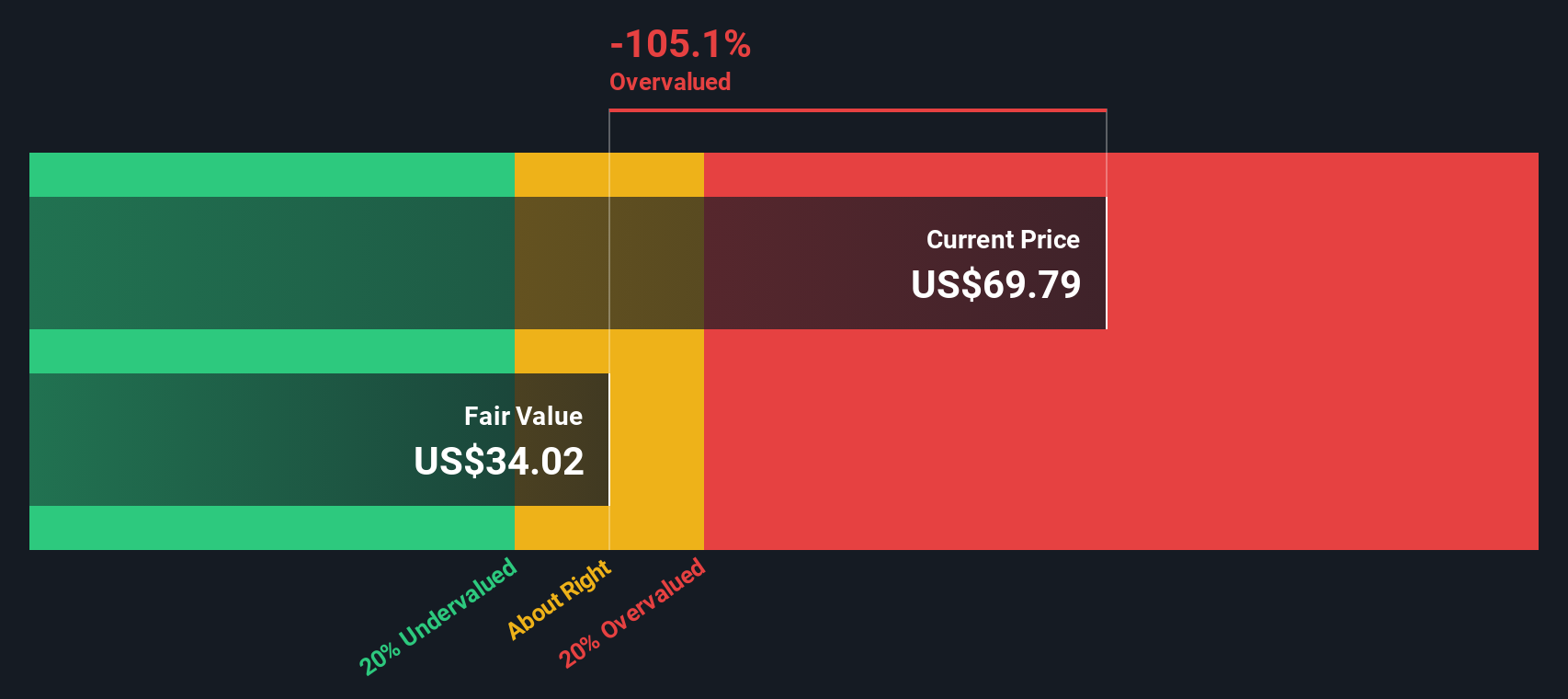

While market observers focus on price-to-earnings comparisons to judge Green Brick’s valuation, our SWS DCF model suggests a starkly different picture. According to this cash flow-based approach, Green Brick trades well above its estimated fair value. This raises the question of whether current optimism overlooks deeper risks.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Green Brick Partners Narrative

Keep in mind, if you want to dig into the data and come to your own conclusions, you can quickly craft a personal narrative in just a few minutes. Do it your way

A great starting point for your Green Brick Partners research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always seeking the next opportunity. Expand your watchlist with curated stock ideas that could help you unlock your true investment potential.

- Maximize your income potential and tap into steady cash flow with these 18 dividend stocks with yields > 3%, offering attractive payouts above 3%.

- Capture early growth by spotting opportunities among these 3584 penny stocks with strong financials, with strong financials and bright futures that haven't hit the mainstream radar yet.

- Ride the wave of innovation and stay ahead in fast-moving markets through these 27 AI penny stocks, focused on artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com