Will Share Repurchase Completion and Q3 Earnings Shift KE Holdings' (BEKE) Investment Narrative?

- KE Holdings Inc. recently reported its third-quarter results, highlighting revenue of CNY 23.05 billion and net income of CNY 749.28 million, while also announcing an asset impairment of US$11.87 million and completing a share repurchase of over 279 million shares between July and September 2025.

- This period also marked the completion of a buyback program totaling more than 435 million shares under an initiative launched in August 2022, alongside the company's ongoing focus on efficiency and digital transformation.

- We'll examine how the recent share repurchase completion and earnings performance shape KE Holdings' investment narrative and outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

KE Holdings Investment Narrative Recap

To be a shareholder in KE Holdings, you need to believe in the company's central role in China's property market transformation and its ability to execute on digital initiatives and diversify into higher-margin services. The recent buyback completion appears to support management's focus on capital efficiency, but does not significantly alter the biggest near-term catalyst, China’s gradual property market stabilization, or address the key risk of continued margin pressure from higher operating expenses and slowing network expansion.

The most relevant recent announcement is the Q3 earnings result, which showed a dip in net income and margins despite resilient revenue growth. This is particularly important for investors tracking whether efficiency programs and technology investments can offset structural pressures on earnings and protect against slower overall real estate transaction growth.

However, a key detail investors should be aware of is that, even with robust buybacks, margin erosion remains a pressing risk if operational improvements continue to lag underlying cost trends...

Read the full narrative on KE Holdings (it's free!)

KE Holdings' narrative projects CN¥136.4 billion revenue and CN¥8.6 billion earnings by 2028. This requires 9.8% yearly revenue growth and an increase of CN¥4.7 billion in earnings from the current CN¥3.9 billion.

Uncover how KE Holdings' forecasts yield a $22.55 fair value, a 35% upside to its current price.

Exploring Other Perspectives

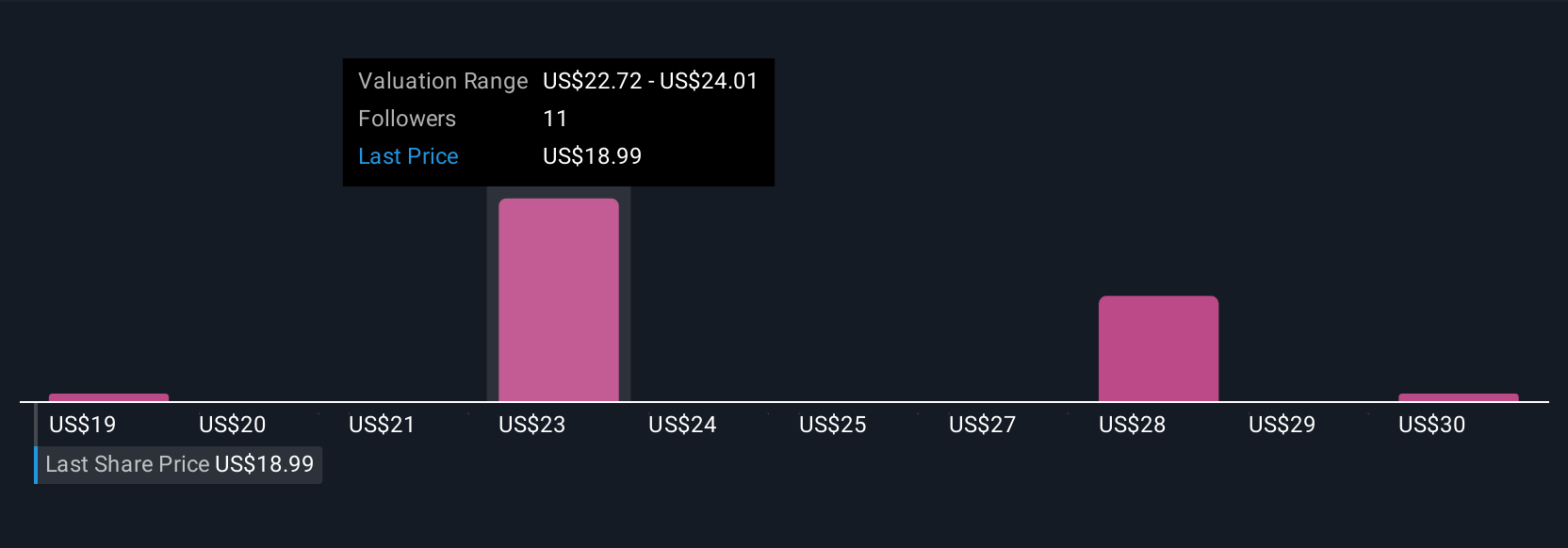

Four members of the Simply Wall St Community estimate fair value between US$18.86 and US$31.74 per share. Alongside this wide range, recent earnings suggest that differing views on profit margin trends could meaningfully impact future performance.

Explore 4 other fair value estimates on KE Holdings - why the stock might be worth just $18.86!

Build Your Own KE Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KE Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free KE Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KE Holdings' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com