Why Knife River (KNF) Is Down 6.1% After Lower Q3 Profits Despite Higher Revenue

- On November 4, 2025, Knife River Corporation reported its third quarter results and narrowed 2025 consolidated earnings guidance, expecting revenue between US$3.10 billion and US$3.15 billion with net income in the range of US$140 million to US$160.5 million.

- Despite higher quarterly and year-to-date revenues, both net income and earnings per share declined from the prior year, signaling shifts in operational or market conditions for the company.

- We'll look at how the combination of increased revenue and reduced earnings shapes Knife River's future investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Knife River Investment Narrative Recap

To be a shareholder in Knife River, you generally need to believe in the ongoing demand for public infrastructure and the company's ability to grow through acquisitions and operational improvements. The recent earnings report, which saw revenue climb but profits dip, and the narrowing of 2025 guidance, does not materially alter the company's largest near-term risk: persistent infrastructure funding delays and legislative uncertainty, especially in Oregon. The focus remains on how quickly revenue growth can turn into improved margins and sustainable earnings.

Of the company's recent announcements, the update to consolidated earnings guidance is the most pertinent here. The revised range, which tightens both revenue and net income expectations, highlights ongoing challenges to margin expansion, despite expectations for top-line growth driven by public infrastructure spending and acquisition-led expansion. This fits squarely within the narrative that execution and cost control, especially in contested state markets, will likely determine outcomes for the next several quarters.

Yet while optimism around infrastructure backlogs is high, investors should keep in mind the ongoing risk of state-level funding stagnation and how it could...

Read the full narrative on Knife River (it's free!)

Knife River's outlook anticipates $3.6 billion in revenue and $264.4 million in earnings by 2028. Achieving these targets would require a 7.4% annual revenue growth rate and a $111 million increase in earnings from the current $153.3 million.

Uncover how Knife River's forecasts yield a $98.22 fair value, a 45% upside to its current price.

Exploring Other Perspectives

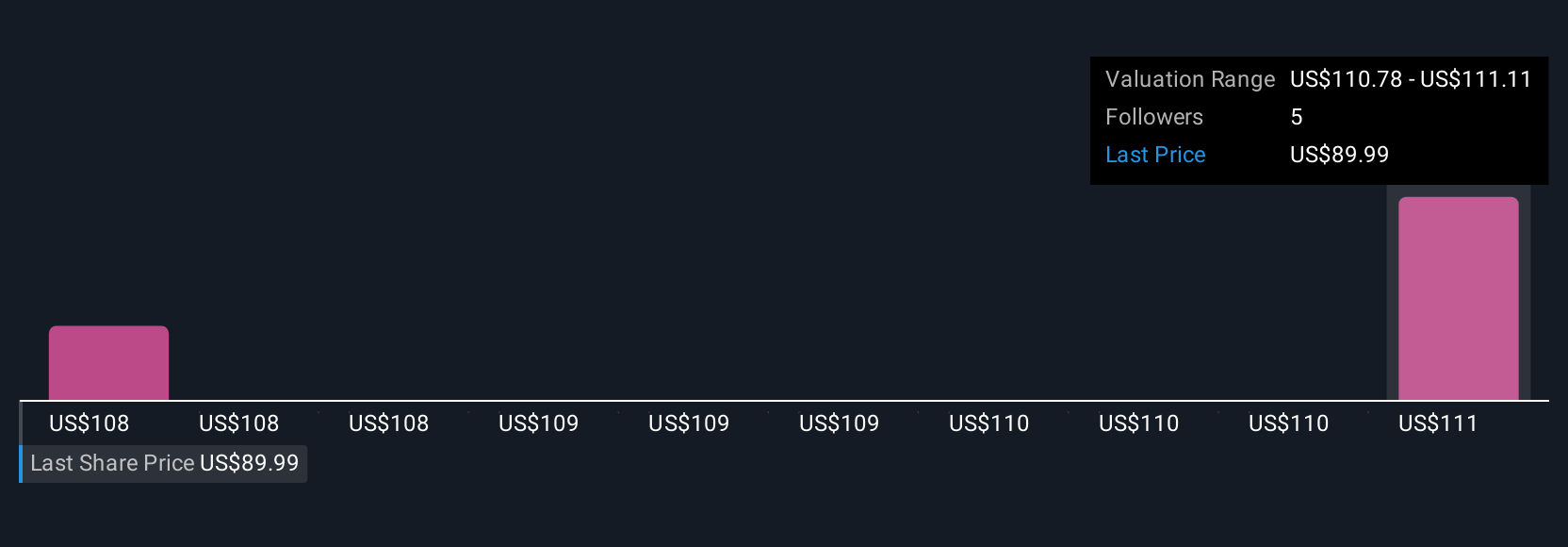

Simply Wall St Community members posted fair value estimates for Knife River ranging from as low as US$6.53 to US$98.22. With only two perspectives captured, many are watching to see if the gap between revenue growth and earnings gets addressed to drive long-term improvement.

Explore 2 other fair value estimates on Knife River - why the stock might be worth as much as 45% more than the current price!

Build Your Own Knife River Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Knife River research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Knife River research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Knife River's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com