AptarGroup’s (ATR) $600 Million Bond Issue Could Be a Game Changer for Its Expansion Plans

- In the past week, AptarGroup, Inc. completed a fixed-income offering of approximately US$600 million in 4.750% senior unsecured notes due March 2031, providing added financial flexibility through callable, unsubordinated corporate bonds priced at 99.917% of par value.

- This infusion of capital through unsecured notes can provide significant funding for future operational initiatives, acquisitions, or balance sheet management, potentially impacting the company’s risk profile and expansion capacity.

- We’ll explore how this substantial bond issuance could influence AptarGroup’s investment case and reshape expectations for its financial strategy.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

AptarGroup Investment Narrative Recap

To be an AptarGroup shareholder, it helps to believe in the long-term advantages of proprietary drug delivery and sustainable packaging as growth drivers, even amid near-term volatility. The recent US$600 million fixed-income offering provides capital flexibility but does not immediately address the biggest short-term catalyst, recovery in pharmaceutical system demand, or the largest current risk, which remains elevated legal costs from ongoing intellectual property litigation.

Of all recent company updates, AptarGroup’s collaboration extension with Nasus Pharma around intranasal epinephrine devices is most relevant. This move aligns with high-value pharmaceutical innovation catalysts but does not directly mitigate margin pressures caused by legal disputes or slowing demand for emergency medicine delivery systems.

However, investors should be aware that continued uncertainty around legal expenditures could influence...

Read the full narrative on AptarGroup (it's free!)

AptarGroup's outlook anticipates $4.3 billion in revenue and $450.9 million in earnings by 2028. This scenario is based on a 6.1% annual revenue growth rate and an increase in earnings of $59.4 million from the current $391.5 million.

Uncover how AptarGroup's forecasts yield a $161.43 fair value, a 35% upside to its current price.

Exploring Other Perspectives

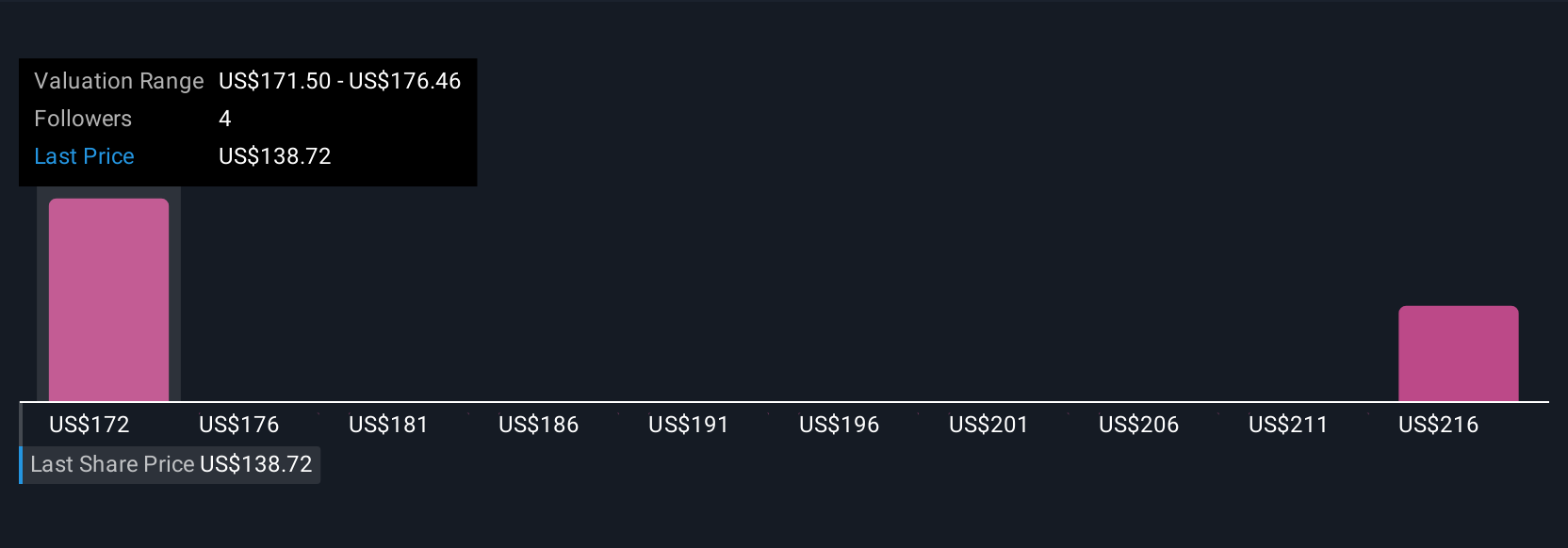

Simply Wall St Community members estimate fair value for AptarGroup between US$153 and US$164.55 based on four distinct views. While legal costs are weighing on sentiment, recovery in key pharmaceutical segments may shift opinions and widen the debate on future earnings prospects.

Explore 4 other fair value estimates on AptarGroup - why the stock might be worth just $153.00!

Build Your Own AptarGroup Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AptarGroup research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AptarGroup research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AptarGroup's overall financial health at a glance.

No Opportunity In AptarGroup?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com