Cheesecake Factory (CAKE): Exploring Valuation After Recent Share Price Weakness

Cheesecake Factory (CAKE) shares have slipped roughly 17% over the past month, trending lower along with several other casual dining stocks. Investors are taking a close look at the latest spending data and changing consumer confidence as they assess future prospects.

See our latest analysis for Cheesecake Factory.

Shares have struggled to gain traction in recent months, with a one-month share price return of -16.66% and a year-to-date decline of 7.26% reflecting broader caution in casual dining. Still, Cheesecake Factory investors holding on for three and five years have earned total shareholder returns above 32%, which shows the long-term story has not been derailed, even though short-term momentum is fading.

If the pullback in restaurant stocks has you reconsidering your next move, now could be the perfect time to discover fast growing stocks with high insider ownership

With the stock now trading at a substantial discount to analyst price targets, the big question is whether Cheesecake Factory is currently undervalued or if the market has already accounted for all its future growth prospects.

Most Popular Narrative: 39% Undervalued

According to Zwfis, the fair value estimate for Cheesecake Factory stands far above the current market price. This gap is based on ambitious long-term forecasts and sets up a compelling dynamic between perceived intrinsic value and recent market pessimism.

This is one thing that I absolutely love about CAKE. Not only do they already have a large restaurant that is bringing in revenue for them, but they also have new concepts that are starting to spread nationally and are continually working to create even more for future growth. Especially from FRC, that is what one of the biggest benefits from that acquisition is, the fact that it is able to continue to test out new concepts and find something that sticks and then push it out nationally.

What unlocks this bullish outlook? The narrative hinges on expanding restaurant brands, scalable new concepts, and margins not usually seen in casual dining. Which strategic bets drive the sky-high fair value? Click in for the inside math and ambitious rollout plans that make up this narrative's argument.

Result: Fair Value of $73.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent consumer caution and slowing comparable sales trends could challenge the optimistic long-term trajectory that supports the current bullish outlook.

Find out about the key risks to this Cheesecake Factory narrative.

Another View: DCF Tells a Different Story

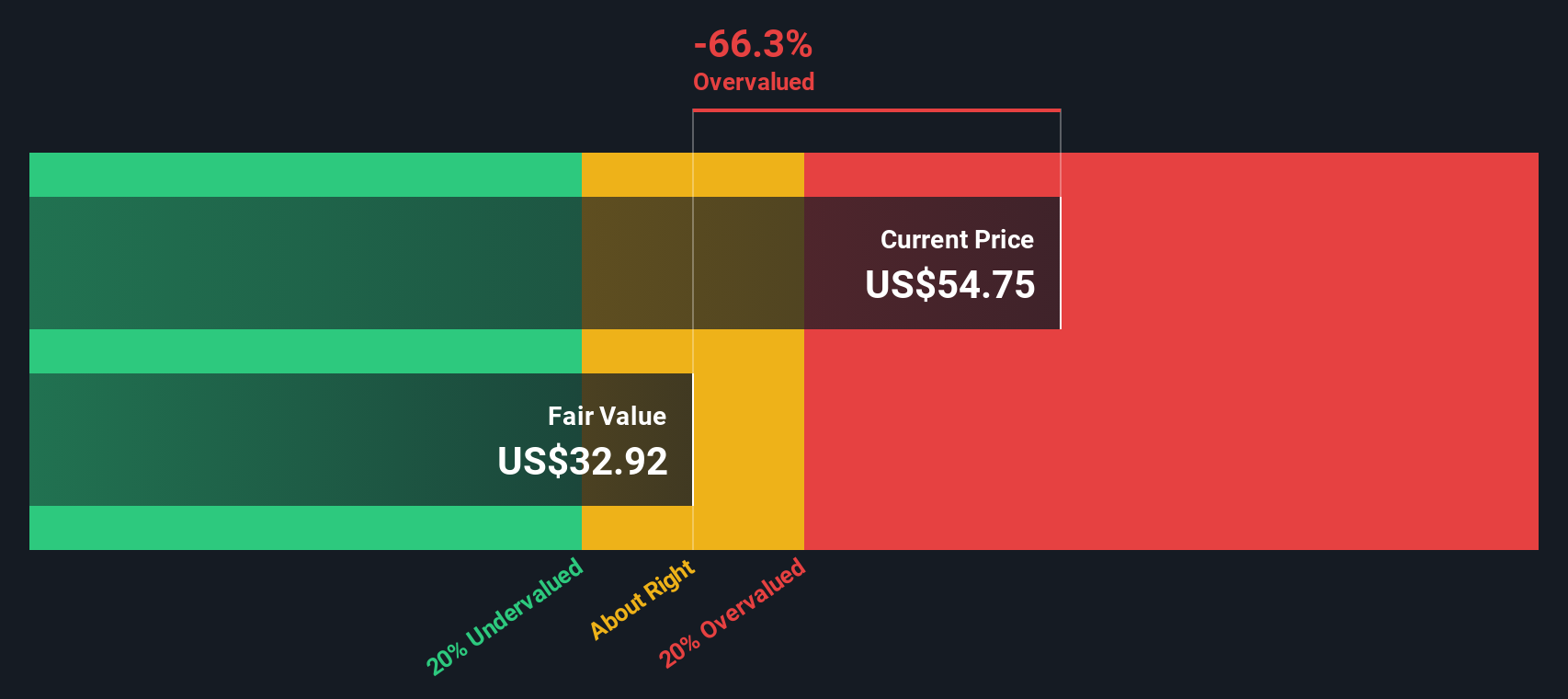

Taking a look at our SWS DCF model, Cheesecake Factory actually comes up as overvalued, with the current share price sitting above what the model calculates as fair value. This stands in sharp contrast to the bullish narrative fueled by multiples. Could the truth lie somewhere between these two views?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cheesecake Factory for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cheesecake Factory Narrative

If you see the facts differently or want to dig deeper into the numbers, you can easily build your own narrative in just a few minutes: Do it your way

A great starting point for your Cheesecake Factory research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Go beyond the obvious and uncover stocks others are missing. Hand-pick your next investment winner by taking advantage of these must-see growth and value ideas.

- Tap into lucrative returns with these 18 dividend stocks with yields > 3% for steady income from companies with yields above 3%.

- Seize the momentum in artificial intelligence by targeting these 27 AI penny stocks making breakthroughs that are transforming entire industries.

- Amplify your portfolio's upside by zeroing in on these 905 undervalued stocks based on cash flows that may be trading at a fraction of their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com