Smarter Learning Tools Could Be a Game Changer for TAL Education Group (TAL)

- In recent days, TAL Education Group has advanced its digital learning platform by integrating smarter instructional tools to simplify complex subjects and provide structured learning pathways for students. This development signals TAL’s continuing shift towards technology-driven education models amid evolving market expectations and the broader rise of digital learning solutions globally.

- We will now examine how integrating advanced digital learning tools could influence TAL Education Group's overall investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

TAL Education Group Investment Narrative Recap

To be a TAL Education Group shareholder, investors need to believe in the long-term potential of digital-enabled education in China, supported by strong demand for quality learning tools. The recent rollout of smarter digital instructional tools highlights TAL’s push to enhance operational efficiency and enrich its product suite, but it does not materially alter near-term catalysts such as rapid digital adoption or immediate risks like intensifying competition in the learning device market. Among recent announcements, the expansion of TAL’s share buyback program stands out. This move underscores management’s commitment to shareholder returns despite continued margin pressures in newer business segments, adding context to the company’s ongoing investments in digital products and user growth. Yet, in contrast to TAL’s innovation-led story, investors should also pay close attention to signs of margin compression and...

Read the full narrative on TAL Education Group (it's free!)

TAL Education Group's narrative projects $4.5 billion in revenue and $395.9 million in earnings by 2028. This requires 22.8% annual revenue growth and a $291.4 million increase in earnings from the current $104.5 million.

Uncover how TAL Education Group's forecasts yield a $14.48 fair value, a 29% upside to its current price.

Exploring Other Perspectives

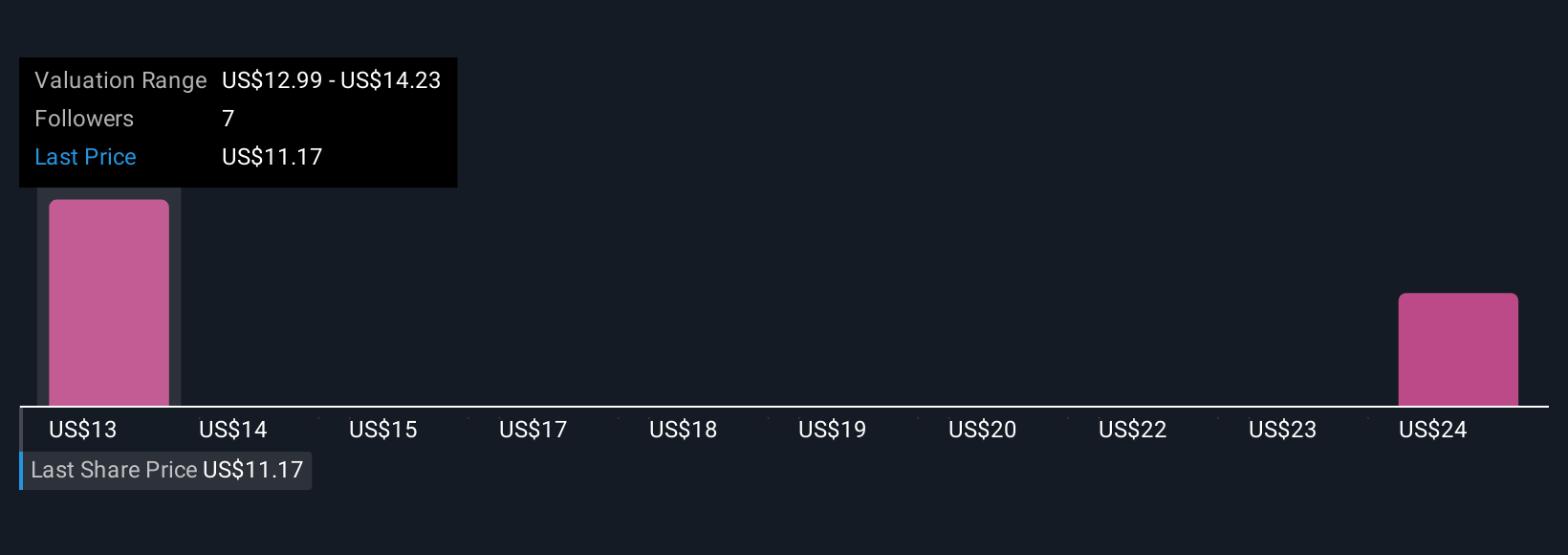

Fair value estimates from the Simply Wall St Community range from US$14.48 to US$31.59, based on 2 independent analyses. While digital adoption is a key catalyst, community perspectives show opinions around TAL’s growth and profitability can differ widely, so consider several viewpoints.

Explore 2 other fair value estimates on TAL Education Group - why the stock might be worth over 2x more than the current price!

Build Your Own TAL Education Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TAL Education Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free TAL Education Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TAL Education Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com