A Fresh Look at NiSource (NI) Valuation After Strong 2024 Share Performance

See our latest analysis for NiSource.

NiSource has kept up solid momentum in 2024, with an 18.4% year-to-date share price return and a one-year total shareholder return of 19.3%. These figures point to both recent gains and steady longer-term performance. Investors seem to be rewarding steady growth and a resilient business model amid shifting market conditions.

If you’re curious about where else you might find reliable performance, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

The real question now is whether NiSource’s strong track record and steady growth are already reflected in its share price, or if there is still room for investors to benefit from future gains.

Most Popular Narrative: 4.9% Undervalued

With NiSource’s fair value calculation sitting just above the current market price, the narrative suggests investors may have a modest margin on today’s share price. A closer look at the model’s underpinning assumptions reveals a carefully engineered foundation for this positive appraisal.

Strong visibility into multi-year, rate-based capital expenditure ($19.4B base plan, plus $2B+ in upside/incremental projects) positions NiSource for 6 to 8% annual EPS growth and compound growth in regulated revenue. NiSource's proactive engagement with economic development (particularly data centers) and decarbonization investments is expanding its addressable market and enabling greater long-term reinvestment, further supporting durable top-line and EPS growth.

Curious about what triggers that higher fair value? The narrative leans on bold financial bets and steady, double-barreled growth assumptions. Want the full set of forecasts and the story behind the numbers? Unlock the logic and surprises packed into the narrative’s projection.

Result: Fair Value of $45.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing electrification trends and heavy capital needs could put pressure on NiSource's earnings outlook and challenge assumptions behind the current fair value narrative.

Find out about the key risks to this NiSource narrative.

Another View: What Do Multiples Say?

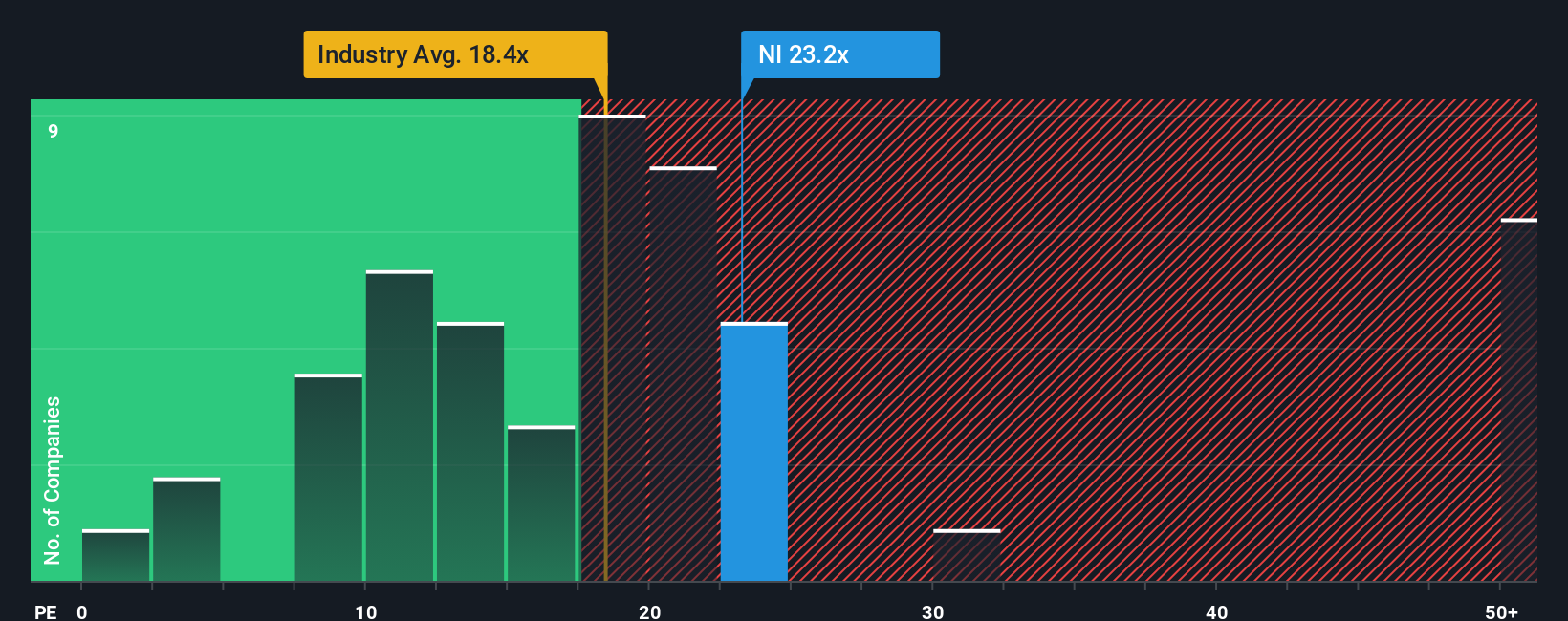

Looking from a different angle, NiSource trades at 23 times earnings. That is pricier than the global industry average of 18.4 times and even above the company’s own fair ratio of 21.1 times. While NiSource is cheaper than some peers, investors are still paying a premium compared to the broader sector. Does this extra cost reflect real opportunity or hidden risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NiSource Narrative

If you see the story unfolding differently or want your own view grounded in data, you can build your own custom narrative in just minutes. Do it your way

A great starting point for your NiSource research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors move ahead by tapping into unexpected opportunities. Gain your edge with powerful tools and fresh ideas right now. Do not let the next winner pass you by.

- Capture tomorrow’s growth by uncovering these 27 AI penny stocks and see how artificial intelligence leaders are transforming industries and generating serious returns.

- Boost your portfolio’s income with these 18 dividend stocks with yields > 3%, featuring companies paying yields above 3% and showing real financial strength.

- Take a leap into emerging technology with these 26 quantum computing stocks. Target the pioneers of quantum computing making breakthroughs set to reshape global markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com