A Look at Emerson Electric's Valuation Following Major Automation Wins in Energy and Mining

Emerson Electric (EMR) recently landed a series of high-profile automation contracts with Mitsui, South32, and Lithium Americas. The deals showcase how Emerson’s technology is underpinning projects that span the solar, mining, and battery materials sectors.

See our latest analysis for Emerson Electric.

Emerson Electric’s year so far reflects a battle between strong contract wins and a tougher market mood, with the stock’s 1.26% share price return year-to-date giving way to a recent cooling in momentum. However, long-term holders have still enjoyed a 36.9% total shareholder return over three years, which shows the benefits of staying patient during short-term swings.

Curious what other companies are gaining traction from industrial and energy trends? You might find your next opportunity by exploring fast growing stocks with high insider ownership.

With so many new projects and a substantial discount to analyst targets, the question is whether Emerson Electric is undervalued in light of its growth opportunities or if the current stock price already captures the company’s future potential.

Most Popular Narrative: 18% Undervalued

Emerson Electric's widely followed narrative sets its fair value noticeably above the latest closing price, implying the market is not fully recognizing its potential. This gap is anchored in a forward-looking view of robust automation demand and the company's evolving business mix.

The accelerating adoption of digital automation and artificial intelligence solutions in global industrial markets is fueling strong demand for Emerson's advanced software platforms and AI-enabled products, such as Ovation 4.0 and Nigel AI adviser. This is resulting in robust order growth and positions the company for sustained revenue expansion.

Want to know the secret to this upbeat valuation? The narrative hinges on a powerful combination of operational transformation, recurring revenue, and projected margin leaps. Dive in to uncover the bold financial leaps that back this price target. Some of the assumptions might just surprise you.

Result: Fair Value of $150.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges like global tariff uncertainty and foreign exchange swings could pressure Emerson's margins and potentially derail the upbeat outlook that analysts currently hold.

Find out about the key risks to this Emerson Electric narrative.

Another View: Looking at Market Ratios

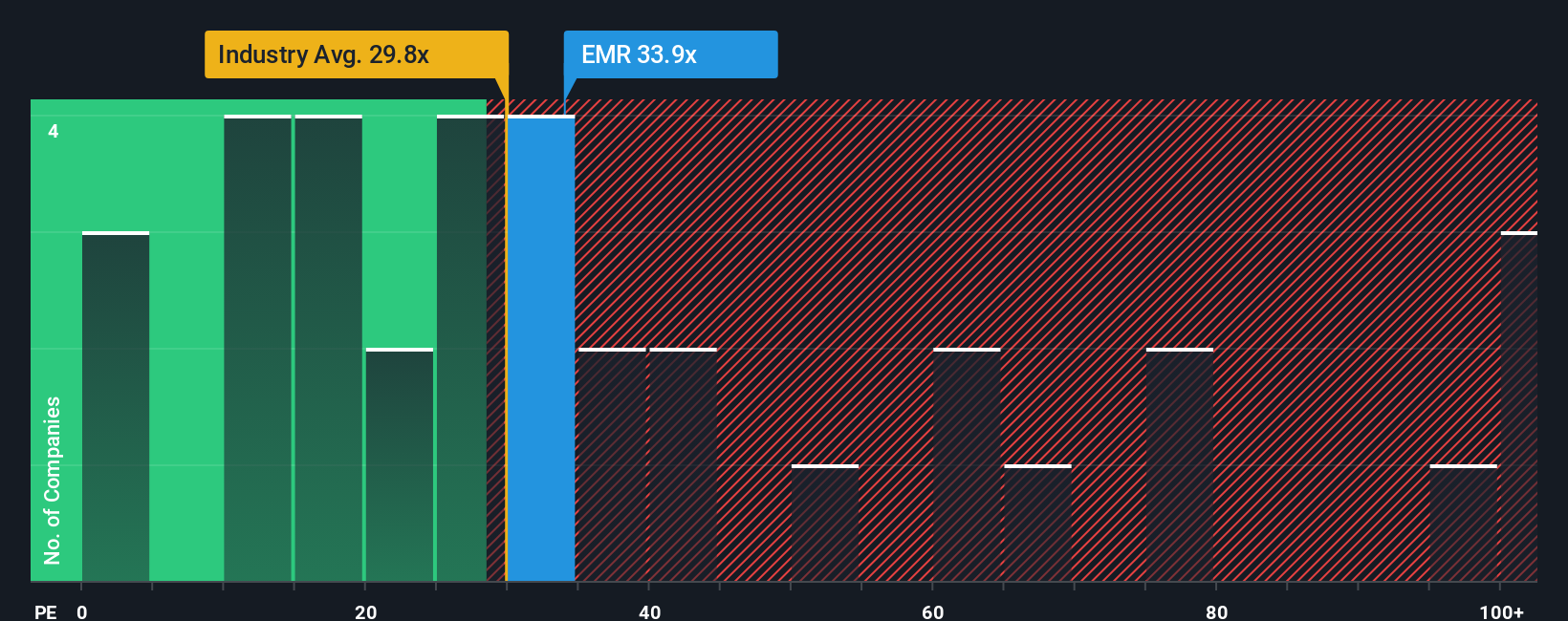

Beyond fair value models, Emerson Electric is currently trading at a price-to-earnings ratio of 30.4x. This is higher than the US Electrical industry average of 27.6x. It is also below peers at 42.3x and is quite close to its fair ratio of 31.4x. While this may suggest investors are paying a premium for quality and growth, it also means the stock could be sensitive to any slip in performance or industry sentiment. Does this risk offset the potential rewards, or is there more upside left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Emerson Electric Narrative

If you see the numbers differently or want to dig deeper on your own terms, it takes less than three minutes to craft a narrative that matches your research. So why not Do it your way?

A great starting point for your Emerson Electric research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

If you are ready to broaden your options, now is the time to take advantage of smarter stock picks that go beyond the obvious.

- Tap into long-term growth by scanning these 919 undervalued stocks based on cash flows that the market might be overlooking today.

- Unlock the latest trends in medical innovation by checking out these 30 healthcare AI stocks. This sector is driving advances in patient care and diagnostics.

- Supercharge your passive income strategy by targeting these 16 dividend stocks with yields > 3% that offer high yields and dependable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com