Will MDU Resources Group’s (MDU) $3.4 Billion Investment Plan and Transmission Deal Redefine Its Growth Path?

- Earlier this month, MDU Resources Group announced a US$3.4 billion capital investment plan for 2026–2030 targeting upgrades and growth in its regulated electric, natural gas, and pipeline segments, while affirming its quarterly dividend at 14 cents per share and signing a memorandum of understanding for a significant capacity share in the North Plains Connector HVDC transmission project.

- This capital plan reflects an increased commitment to energy infrastructure modernization, with anticipated equity issuance and a focus on sustainable, reliable service expansion across the company's core utility operations.

- We'll explore how the expanded multi-year investment strategy and new transmission partnership may reshape MDU Resources Group's future growth outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

MDU Resources Group Investment Narrative Recap

To be a shareholder in MDU Resources Group, you need to believe in the long-term value of regulated energy infrastructure and the company's ability to execute substantial capital investment plans while maintaining stable regulated returns. The latest US$3.4 billion investment plan and participation in the North Plains Connector support growth catalysts tied to utility modernization, yet they do not materially ease the most immediate risk, the need for external capital, which could mean shareholder dilution given upcoming equity issuances.

Among recent announcements, the memorandum of understanding for capacity in the North Plains Connector transmission project stands out for its relevance. Integrating 150 MW of transmission capacity, equivalent to over 15% of MDU’s recent peak load, supports the company’s focus on sustainable, reliable grid upgrades and aligns with anticipated regional growth in energy demand, acting as a practical catalyst for future utility earnings expansion.

However, in contrast to these developments, investors should also be mindful of the company’s funding strategy and the potential impact of additional equity offerings on existing shareholders…

Read the full narrative on MDU Resources Group (it's free!)

MDU Resources Group's outlook anticipates $2.0 billion in revenue and $233.0 million in earnings by 2028. This is based on an annual revenue growth rate of 3.0% and an increase in earnings of $50.3 million from the current level of $182.7 million.

Uncover how MDU Resources Group's forecasts yield a $20.60 fair value, in line with its current price.

Exploring Other Perspectives

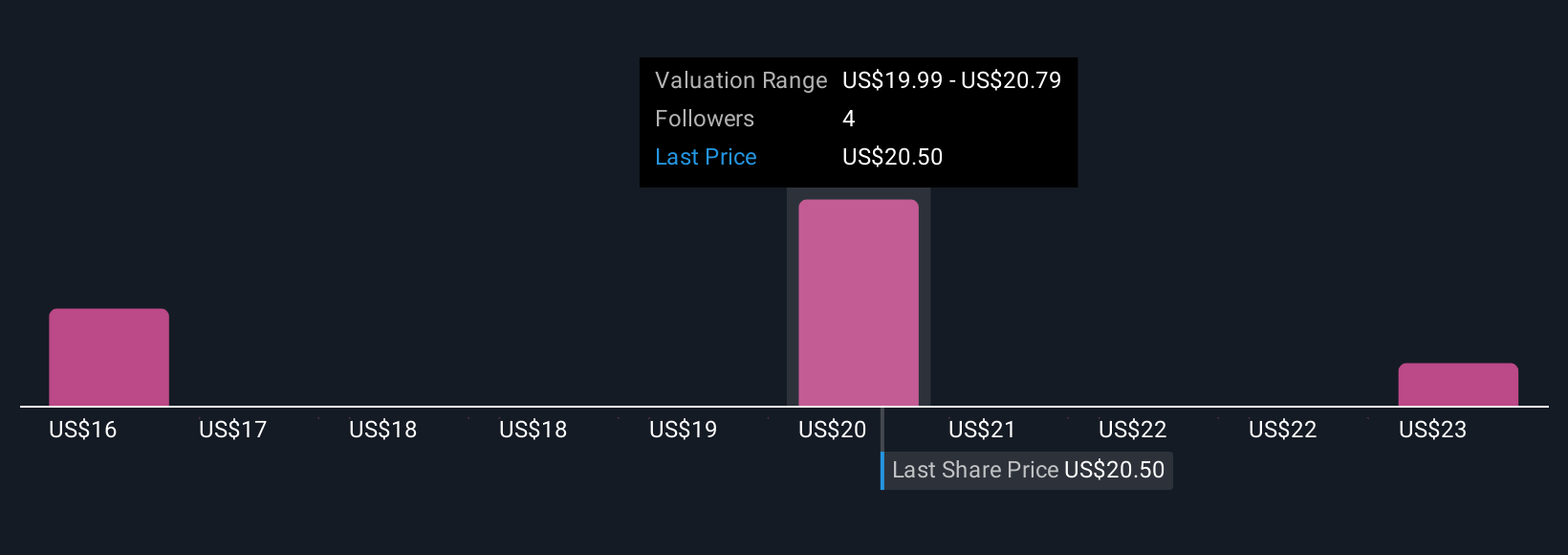

Simply Wall St Community members set fair values for MDU Resources Group between US$15.98 and US$24, with three perspectives represented. These views offer a wide range of expectations while the company’s larger capital plans raise questions about future returns and funding structure.

Explore 3 other fair value estimates on MDU Resources Group - why the stock might be worth 22% less than the current price!

Build Your Own MDU Resources Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MDU Resources Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MDU Resources Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MDU Resources Group's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com