Did Gentex’s (GNTX) Partnership With Genie Mark a Turning Point in Connected Home Vehicle Tech?

- In November 2025, Gentex Corporation and The Genie® Company announced an agreement to integrate Genie’s Aladdin Connect® platform into Gentex’s HomeLink®, allowing drivers to operate smart garage doors through their vehicle or the HomeLink app via the HomeLink cloud.

- This collaboration broadens Gentex’s connected car-to-home offering while enabling homeowners to retrofit nearly any garage door for secure, cloud-based control from inside or outside their vehicles.

- We’ll explore how Gentex’s new integration with Genie may boost its diversification strategy and strengthen its connected vehicle technology lineup.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Gentex Investment Narrative Recap

To believe in Gentex as a shareholder, you need to see value in its push for diversified connected vehicle technologies, especially as it looks beyond its core automotive mirror segment. The Genie partnership expands Gentex’s car-to-home offerings, but while this may support broader product integration, it does not fundamentally alter the immediate risk: ongoing decontenting and pricing pressure from Chinese OEMs, which continues to weigh on the company’s most critical growth region in the short term.

The recently extended U.S. Army contract for the Advanced Combat Helmet highlights another side of Gentex’s diversification efforts, complementing its automotive focus with a steady revenue stream from defense applications. However, this contract, while supportive, does not directly offset near-term risks tied to automotive sales in international markets, particularly in China.

By contrast, investors should be aware that as Gentex boosts its smart home integration, the company remains exposed to OEM-driven product decontenting in...

Read the full narrative on Gentex (it's free!)

Gentex's narrative projects $3.0 billion revenue and $529.5 million earnings by 2028. This requires 7.4% yearly revenue growth and a $134.7 million earnings increase from $394.8 million.

Uncover how Gentex's forecasts yield a $30.06 fair value, a 34% upside to its current price.

Exploring Other Perspectives

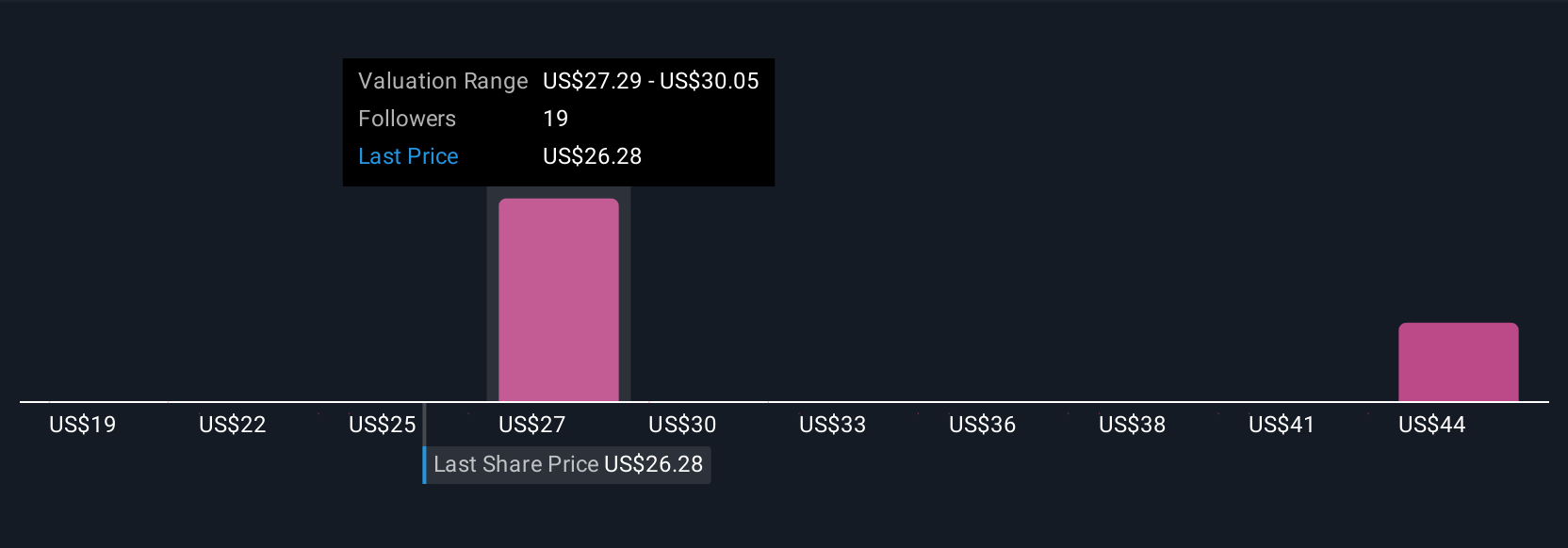

Fair value estimates on Gentex from the Simply Wall St Community range widely, from US$19 to US$31.59 across 4 perspectives. As you weigh these views, remember aggressive OEM cost cutting in China could continue to pressure both revenues and future margins, explore several opinions to understand the breadth of possible outcomes.

Explore 4 other fair value estimates on Gentex - why the stock might be worth as much as 41% more than the current price!

Build Your Own Gentex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gentex research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Gentex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gentex's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com