Dividend Boost and Raised EBITDA Guidance Might Change the Case for Investing in Martin Marietta Materials (MLM)

- Martin Marietta Materials recently declared a regular quarterly cash dividend of US$0.83 per share and filed a US$399.63 million shelf registration for an ESOP-related offering of 650,000 common shares, with the dividend payable on December 31, 2025, to shareholders of record as of December 1, 2025.

- Alongside these actions, the company raised its full-year adjusted EBITDA guidance and reported 8% aggregates shipment growth, reflecting ongoing demand resilience and robust pricing supported by infrastructure and data center construction activity.

- We'll explore how Martin Marietta's increased EBITDA outlook and sustained aggregates growth could reinforce its long-term earnings potential.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Martin Marietta Materials Investment Narrative Recap

Martin Marietta Materials appeals to shareholders who believe in the long-term demand for aggregates, underpinned by ongoing infrastructure and data center construction. The company's raised full-year EBITDA guidance and 8% aggregates shipment growth reinforce the story, but the recent news does not materially affect the near-term catalyst, continued strength in public infrastructure spending, or the significant risk of potential shifts in government funding and construction regulation.

Among recent announcements, the increase in quarterly cash dividend to US$0.83 per share stands out as the most relevant. This action reflects continued cash generation and management’s confidence, aligning with the core catalyst of anticipated revenue support from multi-year infrastructure investments that underpin Martin Marietta’s outlook, despite recent EPS and margin headwinds.

However, investors should be mindful that if government infrastructure funding wavers, the revenue foundation could face sudden pressure...

Read the full narrative on Martin Marietta Materials (it's free!)

Martin Marietta Materials is projected to reach $8.4 billion in revenue and $1.6 billion in earnings by 2028. This forecast assumes annual revenue growth of 7.9% and a $0.5 billion increase in earnings from the current $1.1 billion.

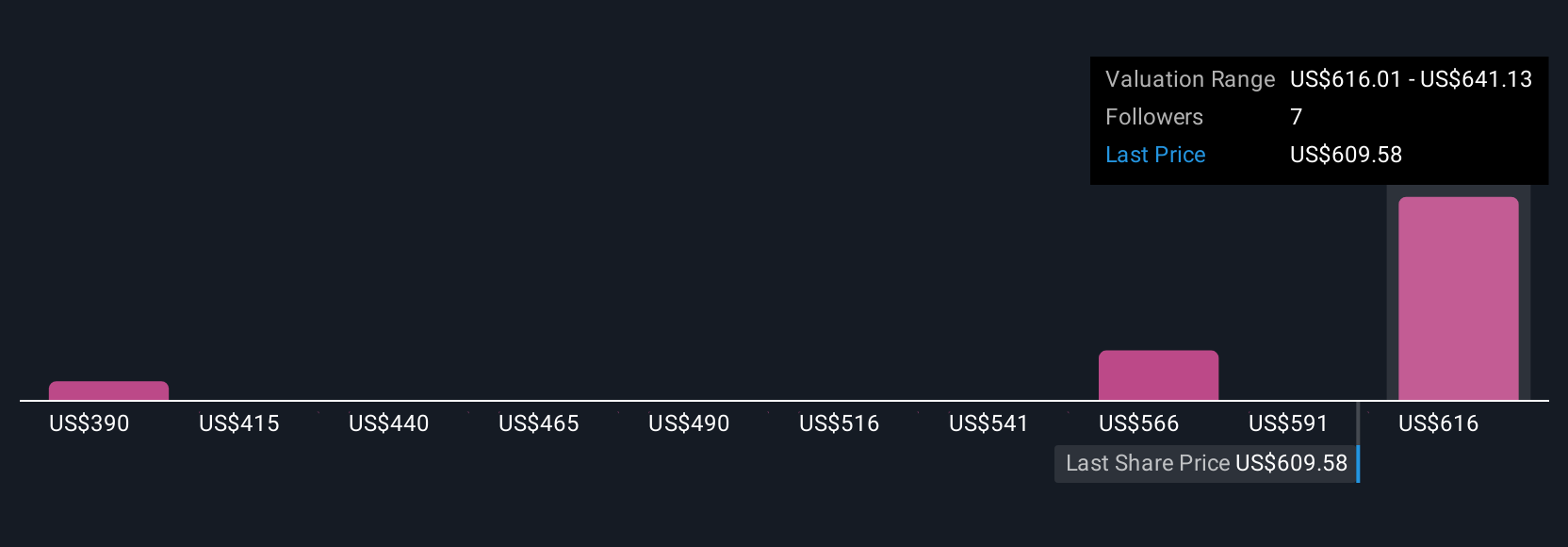

Uncover how Martin Marietta Materials' forecasts yield a $666.29 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Martin Marietta span from US$545.95 to US$700 per share. With ongoing federal infrastructure support still the key catalyst, you can see how opinions about future performance and value widely differ, explore several perspectives before deciding for yourself.

Explore 3 other fair value estimates on Martin Marietta Materials - why the stock might be worth as much as 16% more than the current price!

Build Your Own Martin Marietta Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Martin Marietta Materials research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Martin Marietta Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Martin Marietta Materials' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com