How the Cost of Capital Extension Could Shape California Water Service Group's (CWT) Regulatory Stability

- Earlier this month, the California Public Utilities Commission approved California Water Service Group’s request to postpone its Cost of Capital application to May 1, 2027, maintaining its current authorized rate of return, return on equity, and cost of debt for another year.

- This move provides regulatory clarity and stability for California Water Service Group, while also reducing the frequency of rate changes for its customers.

- We’ll now explore how the extension of the cost of capital timeline enhances visibility and reduces regulatory uncertainty in California Water’s investment outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

California Water Service Group Investment Narrative Recap

Investors in California Water Service Group typically look for stable, regulated returns supported by long-term infrastructure investment and regulatory clarity. The recent CPUC decision to extend the current cost of capital parameters to 2027 provides greater short-term stability and reduces immediate regulatory uncertainty, but does not materially change the key near-term catalyst, which remains progress on the California General Rate Case, nor does it fully resolve the ongoing risk of delayed or insufficient rate relief in the face of rising costs.

Among recent announcements, the company’s successful $370 million debt financing in October 2025 is particularly relevant in the context of the cost of capital extension. With rates now locked until 2027, this additional capital supports ongoing system improvements and PFAS-related investments at a predictable cost, helping California Water Service Group plan key projects while regulatory outcomes remain pending.

On the other hand, investors should be aware that if subsequent regulatory actions do not keep pace with the company’s capital expenditures, especially for emerging contaminants and water quality requirements...

Read the full narrative on California Water Service Group (it's free!)

California Water Service Group's narrative projects $1.1 billion revenue and $187.9 million earnings by 2028. This requires 3.9% yearly revenue growth and a $52.1 million earnings increase from $135.8 million.

Uncover how California Water Service Group's forecasts yield a $53.00 fair value, a 16% upside to its current price.

Exploring Other Perspectives

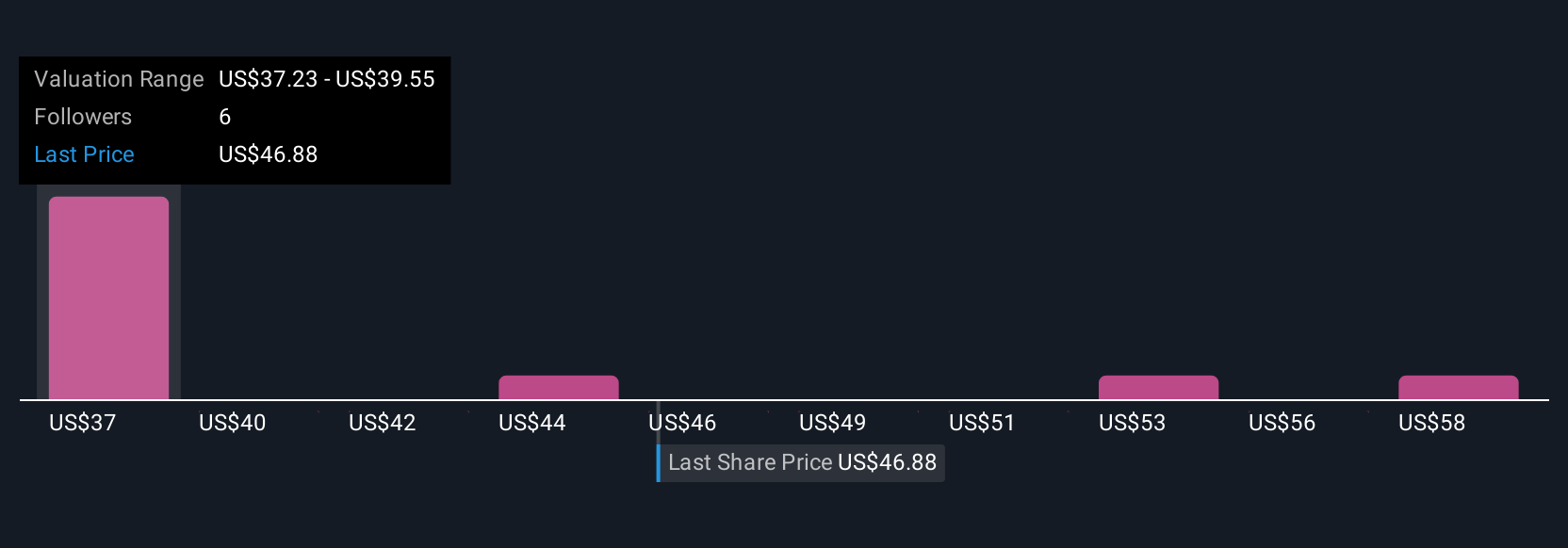

Four members of the Simply Wall St Community valued California Water Service Group between US$36.06 and US$60.39 per share. While opinions diverge, many continue to weigh regulatory risks and their ongoing impact on future financial performance.

Explore 4 other fair value estimates on California Water Service Group - why the stock might be worth 21% less than the current price!

Build Your Own California Water Service Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your California Water Service Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free California Water Service Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate California Water Service Group's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com