Could Eagle Materials' (EXP) Dividend and Buybacks Reveal a Strategic Shift in Capital Allocation?

- On November 10, 2025, the Board of Directors of Eagle Materials Inc. declared a quarterly cash dividend of US$0.25 per share, payable January 12, 2026, to shareholders of record as of December 15, 2025.

- Fund manager Madison Investments recently highlighted Eagle Materials as well positioned for a residential construction rebound, citing strong margins, market share gains, and prudent capital actions like share buybacks.

- We’ll explore how this institutional endorsement, combined with continued capital returns, shapes Eagle Materials’ investment narrative going forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Eagle Materials Investment Narrative Recap

To be an Eagle Materials shareholder, the core belief centers on a rebound in U.S. residential construction and resilient infrastructure spending supporting long-term growth, even as current market headwinds linger. While the latest quarterly dividend announcement adds reassurance about ongoing capital returns, it does not materially affect the most pressing near-term catalyst: a sustained pickup in new home demand, and the biggest risk remains continued weak wallboard volumes if housing affordability stays challenged.

Of the recent announcements, the quarterly dividend remains most relevant here, as it punctuates Eagle’s commitment to shareholder returns despite near-term earnings volatility. With operating earnings and profit margins recently under pressure from softer demand and higher costs, steady distributions could serve as a stabilizer during temporary sector weakness and reinforce investor confidence around the company’s financial discipline.

By contrast, investors should be aware that the company’s concentrated regional footprint means any localized market downturns or adverse weather events could quickly impact results...

Read the full narrative on Eagle Materials (it's free!)

Eagle Materials' outlook anticipates $2.6 billion in revenue and $524.5 million in earnings by 2028. This is based on a projected 3.8% annual revenue growth rate and a $71.6 million increase in earnings from the current $452.9 million.

Uncover how Eagle Materials' forecasts yield a $251.70 fair value, a 20% upside to its current price.

Exploring Other Perspectives

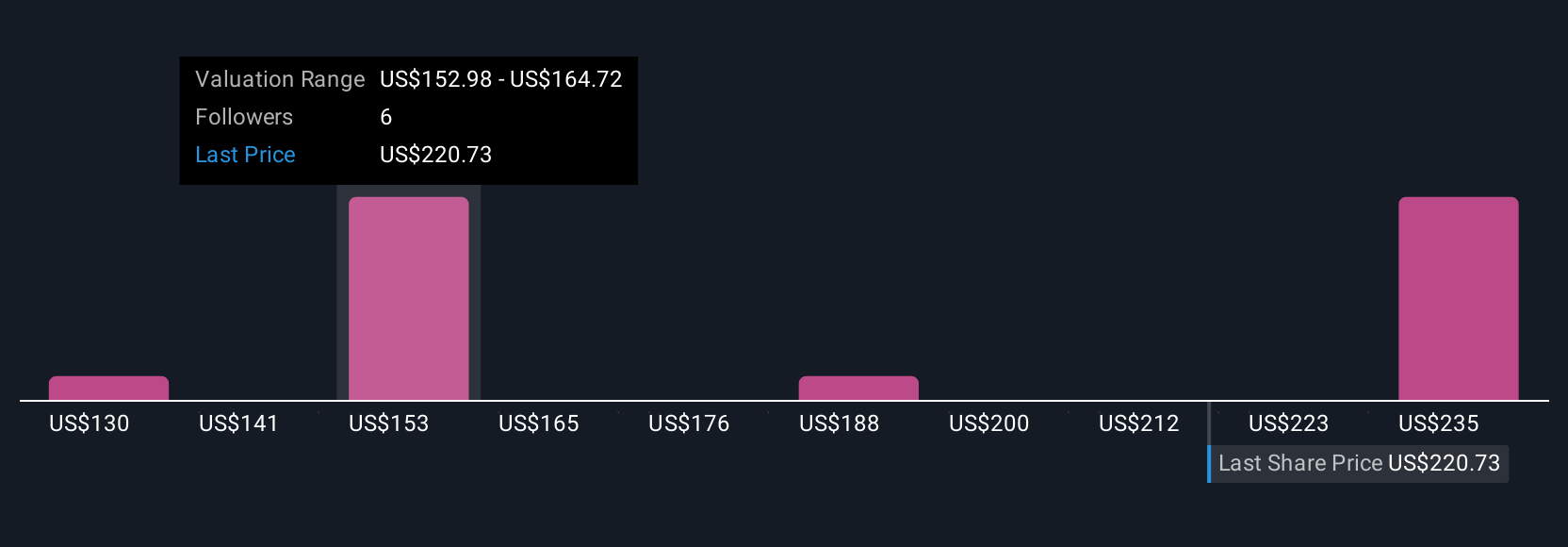

Simply Wall St Community members put forward four separate fair value estimates for Eagle Materials ranging from US$129.50 to US$450.25 per share. In the face of this wide spectrum, ongoing concerns about wallboard demand and housing affordability challenges highlight just how differently market participants view the company’s outlook.

Explore 4 other fair value estimates on Eagle Materials - why the stock might be worth 38% less than the current price!

Build Your Own Eagle Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eagle Materials research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Eagle Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eagle Materials' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com